Spotify (SPOT) is one of the key growth tales in worldwide media that investors are watching. But this one is worth keeping an eye on again as its next earnings release approaches. The equity in Spotify has actually doubled over the past twelve months as investors reward this streaming media player for its continued growth in premium subscriptions, its improvement in bottom-line margin performance, and its initiatives in content offerings. The key question that its soon-to-be-released earnings will address is whether this growth continues.

The broader tech and entertainment industry has actually remained quite stable in 2025. The growing demand for digital content and AI-powered personalization has helped. As music, podcasts, and audiobooks are integrated into one streaming platform, Spotify's advantage in size and its first-party data continue to give it a distinct edge. Earnings are due on Nov. 4. Shares are currently looking to sustain their positive gains and seize even more market share in 2026.

About Spotify Stock

Spotify, based in Stockholm, Sweden, is the world’s leading audio streaming service with more than 700 million users in 180 countries. The company has a market value of approximately $130 billion and offers its services through a premium subscription service and a freemium model that altogether have one of the largest installed bases in digital media.

SPOT stock has grown about 70% in the last year as its share price moved from a 52-week low of $376.04 to a peak of $785.00. Although it is trading lower at about $664.26 currently, this level is still an impressive outperformance in comparison to a 25% growth in the S&P 500 Index ($SPX) over the same period.

As a valuation metric, Spotify is currently trading at a forward price-earnings ratio of 119.6 and a price-to-sales (P/S) ratio of 7.89. However, it is important to note that Spotify is a business in a growth cycle that is shifting toward execution. Spotify can still achieve a return on equity and a profit margin of 13.7% and 7.3%, respectively. As a matter of fact, Spotify's balance sheet is debt-free.

As such, it is poised to either acquire content and/or reward shareholders in the coming years.

Spotify Beats Analysts’ Q2 2025 Projections

The second quarter performance in 2025 demonstrated Spotify’s strength and user retention. The total revenues grew 10% to €4.2 billion from last year, and MAUs grew 11% to reach 696 million. Spotify Premium users grew 12% to 276 million, which is one of its biggest addition periods in history. The growth in this period is evident when considering its historical context.

Profitability also achieved a historic milestone. The gross margin increased by 227 basis points to 31.5%, mainly due to lower content costs and better pricing rigor. Operating profits were recorded at €406 million, a substantial jump over the past year. The CEO of Spotify, Daniel Ek, stated that “people come to Spotify and they stay on Spotify” and that this is because Spotify has always continued to innovate.

The key takeaways were reflective of Spotify’s strength in growing while simultaneously growing its bottom line. Projects including optimizing licensing agreements, growing its AI-driven and personalized features, and conducting podcast and audiobook integration have helped diversify its sources of revenue without diluting engagement. Spotify’s key strength has remained its commitment to cost efficiency and product development initiatives that have converted a cash-intensive business into a margin-accretive one.

Q3 2025 Earnings Preview: Can the Momentum Continue?

As earnings are drawing near with a closing date of Nov. 4, market anticipation is still running high. Analysts have forecast that Spotify will post better top-line growth for this quarter through solid Premium user acquisition and enhanced advertisement monetization. EPS is forecast near $1.89 and revenue near $4.93 billion.

The key question is whether Spotify can sustain its heightened profitability path. The fate of advertisements is one key area that remains in focus as advertisers come back to digital and AI-powered targeted marketing increases returns for all advertisers on the platform. Secondly, including audiobooks in the premium offerings is set to increase ARPU in more developed markets like the U.S. and UK.

Investors will also want to hear more about management’s attitude regarding pricing power and engagement. There isn't much margin for error given Spotify's premium valuation. However, fundamentals are looking solid as free cash flows are rising, subscriber numbers are growing positively, and its size is unmatched in its industry. Going forward is all a matter of execution. However, Spotify is well-positioned to beat estimates once again.

What Do Analysts Expect for SPOT Stock?

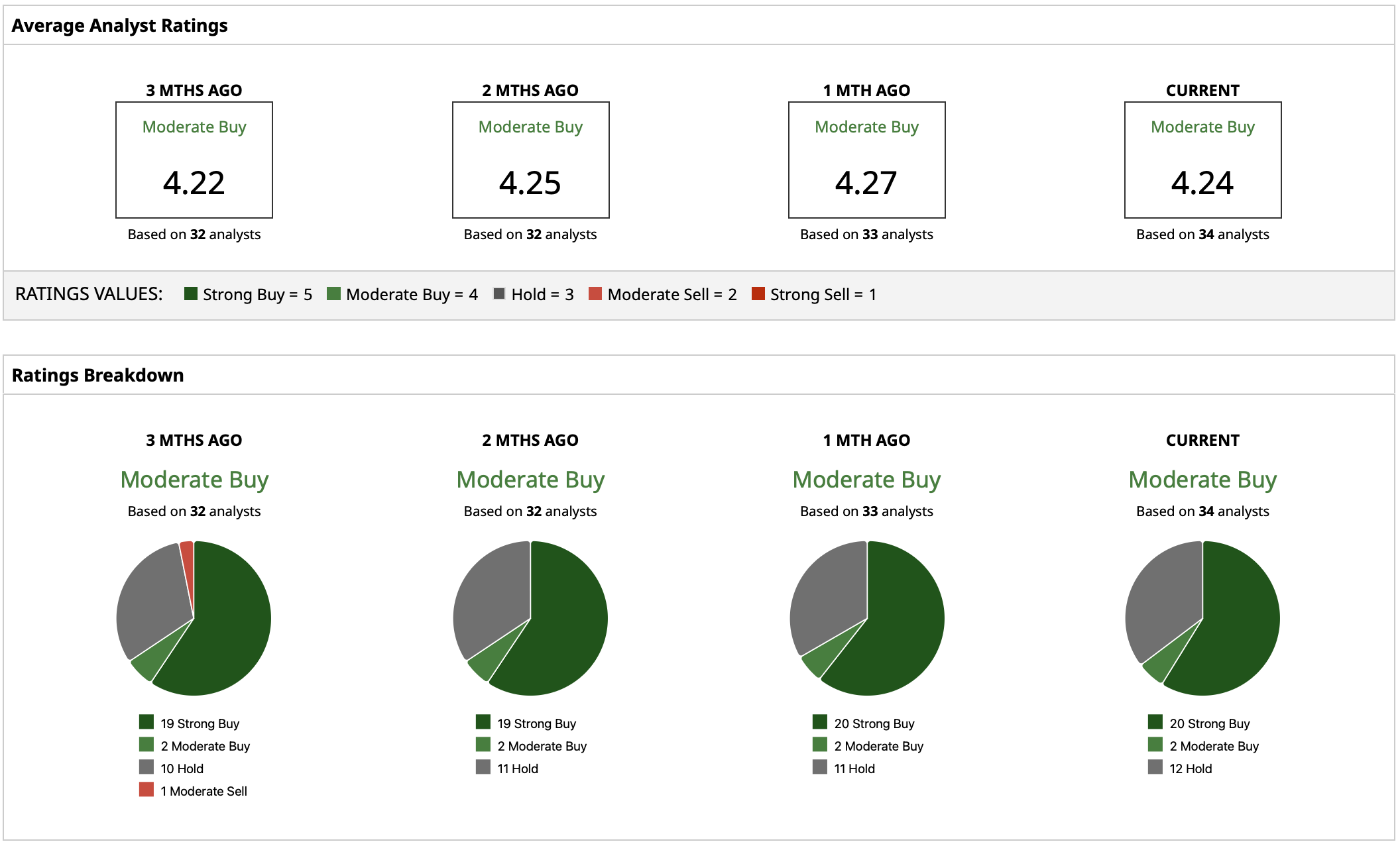

SPOT has a “Moderate Buy” consensus among over 34 analysts that cover this stock. The average target price is set at $758.79, indicating a potential gain of 13% from its current market price. The Street-high target is placed at a much higher price of $900. The lowest target is placed at $484.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever

- 'Our GPUs Are Everywhere’ According to CEO Jensen Huang as Nvidia Doubles Down on AI, Quantum, and 6G

- Chipotle Stock Is Plunging. Should You Buy the Dip Today?