Latest News

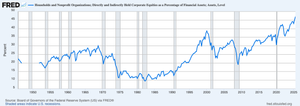

Madness and mayhem are the order of the day, while consumer and business sentiment are dour, and for-sale signs are popping up like measles.

Via Talk Markets · January 22, 2026

Amalgamated Financial Corp (NASDAQ:AMAL) Reports Mixed Q4 2025 Results with Earnings Beat and Revenue Misschartmill.com

Via Chartmill · January 22, 2026

LSI Industries Inc (NASDAQ:LYTS) Reports Mixed Q2 FY2026 Results with Revenue Beat and Strong Cash Flowchartmill.com

Via Chartmill · January 22, 2026

Via MarketBeat · January 22, 2026

Huntington Bancshares Inc (NASDAQ:HBAN) Stock Falls After Q4 2025 Revenue and EPS Miss Estimateschartmill.com

Via Chartmill · January 22, 2026

OLD REPUBLIC INTL CORP (NYSE:ORI) Stock Falls 4% After Q4 Earnings Misschartmill.com

Via Chartmill · January 22, 2026

OFG Bancorp (NYSE:OFG) Q4 2025 Earnings Beat Estimates, Shares Risechartmill.com

Via Chartmill · January 22, 2026

Procter & Gamble Co. (NYSE:PG) Q2 2026 Earnings: Revenue Misses, EPS Meets Targetschartmill.com

Via Chartmill · January 22, 2026

QUALCOMM INC (NASDAQ:QCOM) Stands Out as a Quality Dividend Stock for Income Investorschartmill.com

Via Chartmill · January 22, 2026

S&T Bancorp Inc (NASDAQ:STBA) Stock Falls After Q4 2025 Earnings Misschartmill.com

Via Chartmill · January 22, 2026

Abbott Laboratories (NYSE:ABT) Shares Slump on Q4 Revenue Miss and Nutrition Segment Weaknesschartmill.com

Via Chartmill · January 22, 2026

Hallador Energy Co (NASDAQ:HNRG) Presents a High-Growth Momentum and Technical Breakout Opportunitychartmill.com

Via Chartmill · January 22, 2026

BigBear.ai is riding the AI boom, but how the company manages these two key risks will decide whether this stock soars or stalls.

Via The Motley Fool · January 22, 2026

Nike investors have been losing big for the past few years. Is this former champion becoming a permanent underdog?

Via The Motley Fool · January 22, 2026

Cycurion, Inc. (CYCU) to acquire video-solutions division of Kustom Entertainment, Inc. (KUST) for $6.0-8.4 million in cash and preferred stock. The addition could increase revenues by $5.1 million and strengthen customer reach. Subject to customary closing conditions.

Via Benzinga · January 22, 2026

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans struggling with debt.

Via Talk Markets · January 22, 2026

SLB (NYSE: SLB) to release Q4 earnings before Jan. 23 opening bell. Analysts expect 74 cents/share. Dividend yield of 2.35% or $1.14/year.

Via Benzinga · January 22, 2026

Morningstar Inc. (NASDAQ:MORN) Passes Key Quality Investing Filterchartmill.com

Via Chartmill · January 22, 2026

Via Benzinga · January 22, 2026

Analysts predict good earnings for IBM on Jan. 28. Alibaba forms nuclear power partnership for AI, while iShares and Nu are expected to do well.

Via Benzinga · January 22, 2026

Netflix's ad revenue is soaring, but it's leaving money on the table.

Via The Motley Fool · January 22, 2026

Teradyne (TER) is overpriced: Value score sinks to 9.55 amid a 12% rally. See why Cathie Wood's top tech pick is flashing warning signs.

Via Benzinga · January 22, 2026

With Sweetgreen shares 85% off their record, it's difficult to be bullish.

Via The Motley Fool · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Daily trading volume for US gas futures on the CME exchange broke an all-time record yesterday.

Via Talk Markets · January 22, 2026

GE Aerospace (NYSE: GE) reported strong Q4 results, with revenue up 18%, EPS up 19%, and free cash flow up 15%.

Via Benzinga · January 22, 2026

This AI power chip stock looks risky today but one NVIDIA driven catalyst could completely change its future.

Via The Motley Fool · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Tesla reports Q4 earnings next week and the top voted retail question for Elon Musk is about the upcoming SpaceX IPO.

Via Investor's Business Daily · January 22, 2026

Janux Stock Is Rising Pre-Market After A New Oncology Deal With Bristol Myers Squibbstocktwits.com

Via Stocktwits · January 22, 2026

It's a critical date to put on your calendar.

Via The Motley Fool · January 22, 2026

EXLSERVICE HOLDINGS INC (NASDAQ:EXLS) Shows Strong Fundamentals and Technical Breakout Potentialchartmill.com

Via Chartmill · January 22, 2026

Trump Reportedly Says A Piece Of Golden Dome Will Be On Greenland — Dow Futures Rise Over 100 Pointsstocktwits.com

Via Stocktwits · January 22, 2026

DRDGOLD LTD-SPONSORED ADR (NYSE:DRD) Stands Out as a CAN SLIM Candidatechartmill.com

Via Chartmill · January 22, 2026

Regional banking company S&T Bancorp (NASDAQ:STBA) announced better-than-expected revenue in Q4 CY2025, with sales up 10.8% year on year to $105.3 million. Its GAAP profit of $0.89 per share was 1.7% above analysts’ consensus estimates.

Via StockStory · January 22, 2026

The Pound Sterling rises against its peers as UK inflation rises faster than projected in December.

Via Talk Markets · January 22, 2026

Regional banking company Cadence Bank (NYSE:CADE) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 17.1% year on year to $528.4 million. Its non-GAAP profit of $0.85 per share was 6.4% above analysts’ consensus estimates.

Via StockStory · January 22, 2026

Investors should look at these three options as swing-for-the-fences stock picks.

Via The Motley Fool · January 22, 2026

Healthcare product and device company Abbott Laboratories (NYSE:ABT) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 4.4% year on year to $11.46 billion. Its non-GAAP profit of $1.50 per share was in line with analysts’ consensus estimates.

Via StockStory · January 22, 2026

Financial services company Northern Trust (NASDAQ:NTRS) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 8.4% year on year to $2.14 billion. Its GAAP profit of $2.42 per share was 2.8% above analysts’ consensus estimates.

Via StockStory · January 22, 2026

Donald Trump shook the markets once again by reversing his decision to use force to acquire Greenland.

Via Talk Markets · January 22, 2026