Latest News

A lot can happen in five years.

Via The Motley Fool · January 31, 2026

Blue skies appear to be ahead for Apple -- with one pesky dark cloud.

Via The Motley Fool · January 31, 2026

It remains a compelling investment.

Via The Motley Fool · January 31, 2026

While everyone is different, here's a snapshot of what to expect if you've saved roughly what the average boomer has.

Via The Motley Fool · January 31, 2026

In this video, Jordan argues that the recent

Via Talk Markets · January 31, 2026

If you're seeking exposure to the nuclear energy buildout without investing in uranium miners, this construction company is worth a look.

Via The Motley Fool · January 31, 2026

Rivian is making progress toward its big 2026 goal, but is it worth buying before that goal is hit?

Via The Motley Fool · January 31, 2026

The CEO of a top mortgage lender sold over a million insider shares within a span of five days, but there's a catch to the sale.

Via The Motley Fool · January 31, 2026

In January 2026, economists find that tariffs contributed ~1.1–1.4% to annual inflation. While median households face $1,400 in extra annual costs, the impact is less than feared due to implementation lags and exceptions.

Via Talk Markets · January 31, 2026

Mag 7 earnings for Q4 2025 show a

Via Talk Markets · January 30, 2026

Lukoil has agreed to sell most of its international assets to Carlyle amid Western sanctions and competing bids.

Via Benzinga · January 31, 2026

The electric vertical takeoff and landing (eVTOL) market offers huge upside potential, but also downside risk.

Via The Motley Fool · January 31, 2026

Amazon.com is asking the FCC for a two-year extension on its 1,600-satellite deployment deadline for its $10 billion Amazon Leo internet network, citing rocket shortages and launch delays, as it aims to catch up with SpaceX's Starlink while warning that denying the extension could slow U.S. broadband expansion.

Via Benzinga · January 31, 2026

The Vanguard Information Technology ETF is missing some key long-term pieces.

Via The Motley Fool · January 31, 2026

Nvidia's proposed $100 billion investment in OpenAI has reportedly stalled as CEO Jensen Huang raises concerns over the AI startup's spending discipline and intensifying competition, prompting both companies to reconsider a smaller, nonbinding equity deal even as OpenAI attracts heavy Big Tech interest and posts surging revenue.

Via Benzinga · January 31, 2026

LinkedIn co-founder Reid Hoffman urges Silicon Valley leaders to speak out against ICE killings, calling inaction unacceptable.

Via Benzinga · January 31, 2026

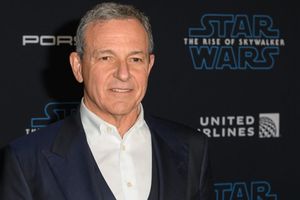

Walt Disney (NYSE: DIS) CEO Bob Iger has reportedly told associates he plans to step down and pull back from daily management before his contract expires on Dec. 31, and the entertainment giant's board is set to meet next week to vote on a successor.

Via Benzinga · January 31, 2026

SaaS stocks have plunged on AI fears.

Via The Motley Fool · January 31, 2026

Deckers continues to deliver solid growth even as Wall Street remains skeptical.

Via The Motley Fool · January 30, 2026

Eli Lilly CEO Dave Ricks said upcoming Medicare coverage of obesity drugs could be a game-changer for the launch of its experimental weight-loss pill orforglipron, potentially expanding access to millions of patients even as competition with Novo Nordisk intensifies ahead of both companies' earnings.

Via Benzinga · January 31, 2026

Trump taps veteran economist Brett Matsumoto to lead the Bureau of Labor Statistics (BLS) after abruptly firing the agency's commissioner in August.

Via Benzinga · January 31, 2026

Johnson & Johnson is a picture of stability.

Via The Motley Fool · January 30, 2026

Blue Origin pauses New Shepard suborbital flights to focus on lunar lander development for NASA's Artemis program.

Via Benzinga · January 30, 2026

Today’s silver crash is a reminder that the market can remain irrational longer than you can remain solvent. Whether this is a temporary shock or the start of a deeper correction remains to be seen.

Via Talk Markets · January 30, 2026