Arthur J. Gallagher & Co. (AJG), headquartered in Rolling Meadows, Illinois, provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services. Valued at $63.5 billion by market cap, the company's principal activity is the negotiation and placement of insurance for its clients. Gallagher also specializes in furnishing risk management services.

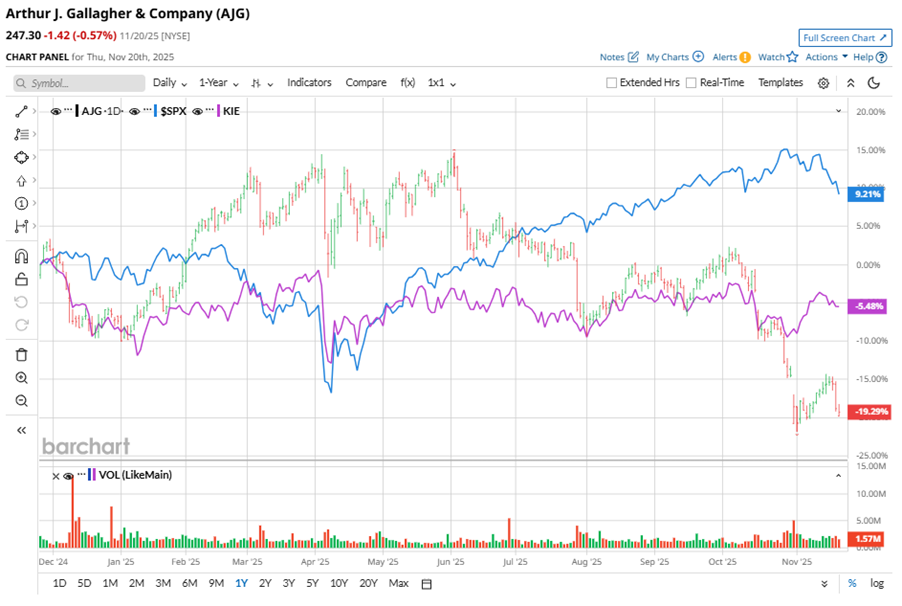

Shares of this insurance giant have considerably underperformed the broader market over the past year. AJG has declined 16.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 10.5%. In 2025, AJG stock is down 12.9%, compared to SPX’s 11.2% rise on a YTD basis.

Narrowing the focus, AJG’s underperformance is also apparent compared to the SPDR S&P Insurance ETF (KIE). The exchange-traded fund has declined about 2.2% over the past year. Moreover, the ETF’s 2.9% returns on a YTD basis outshine the stock’s double-digit losses over the same time frame.

On Oct. 30, AJG reported its Q3 results, and its shares closed down by 4.8% in the following trading session. Its adjusted EPS of $2.32 missed Wall Street expectations of $2.51. The company’s adjusted revenue was $3.3 billion, missing Wall Street's $3.5 billion forecast.

For the current fiscal year, ending in December, analysts expect AJG’s EPS to grow 7% to $10.80 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

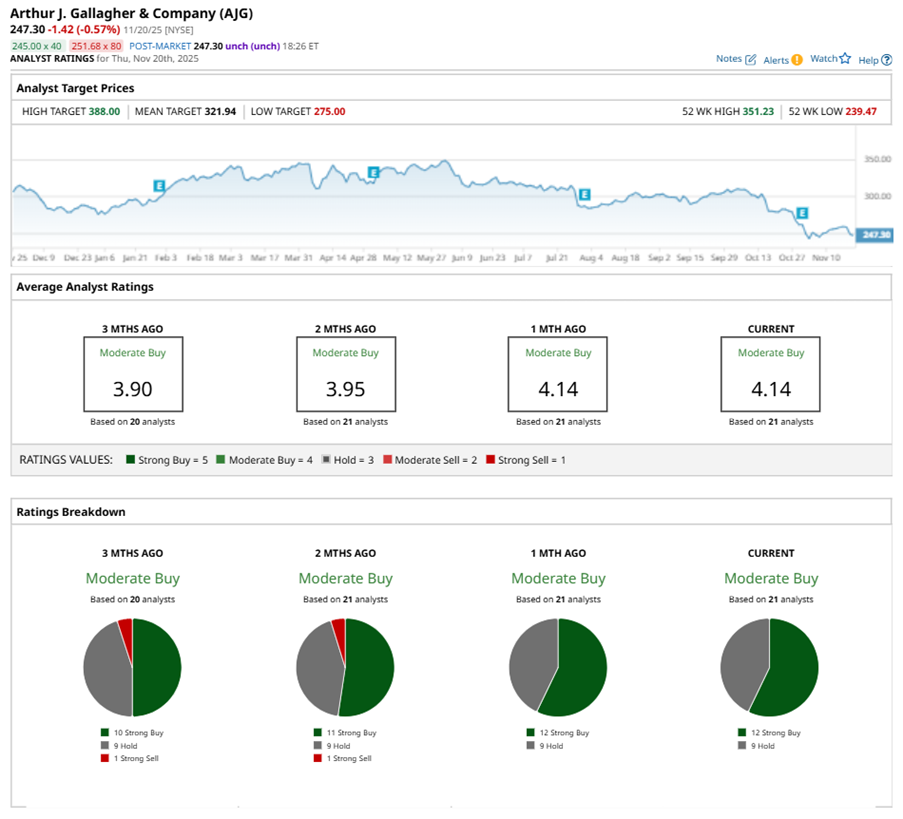

Among the 21 analysts covering AJG stock, the consensus is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, and nine “Holds.”

This configuration is more bullish than two months ago, with 11 analysts suggesting a “Strong Buy,” and one analyst advising a “Strong Sell.”

On Nov. 20, Barclays PLC (BCS) downgraded AJG to an “Underweight” rating with a price target of $250, implying a potential upside of 1.1% from current levels.

The mean price target of $321.94 represents a 30.2% premium to AJG’s current price levels. The Street-high price target of $388 suggests a notable upside potential of 56.9%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Stock Breaks 100-Day Moving Average on Q3 Earnings Selloff. Should You Buy the NVDA Dip?

- Nvidia Is a Leader in AI Computing, But Is NVDA Stock a Buy Now?

- Buy DoorDash Stock Now for a ‘Banner’ 2026, According to Analysts

- Dan Ives Is Pounding the Table on Meta Platforms Despite a ‘Capex Super Cycle.’ Should You Buy META Stock Here?