Atlanta, Georgia-based Global Payments Inc. (GPN) provides payment technology and software solutions for card, check, and digital-based payments. With a market cap of $19.2 billion, Global Payments operates through the Merchant Solutions and Issuer Solutions segments.

The payments solutions provider has significantly underperformed the broader market over the past year. GPN stock prices have tanked 31.9% on a YTD basis and 33.6% over the past 52 weeks, notably lagging behind the S&P 500 Index’s ($SPX) 14.3% gains in 2025 and 13.4% returns over the past year.

Narrowing the focus, GPN has also underperformed the industry-focused Amplify Digital Payments ETF’s (IPAY) 9.1% decline on a YTD basis and 7.8% dip over the past year.

Global Payments’ stock prices gained 3.7% in the trading session following the release of its better-than-expected Q3 results on Nov. 4. The company’s transformation plan to improve margins and boost growth has delivered the expected results. Along with notable sequential growth, its topline for the quarter inched up 50 bps year-over-year to $2 billion, surpassing the Street’s expectations by 90 bps. Further, its adjusted EPS soared 11.8% year-over-year to $3.26, beating the consensus estimates by 6.9%. Moreover, GPN generated a strong free cash flow of $784 million, allowing it to reduce leverage and risk in the company.

For the full fiscal 2025, ending in December, analysts expect GPN to deliver an adjusted EPS of $11.64, up 5.3% year-over-year. On a positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

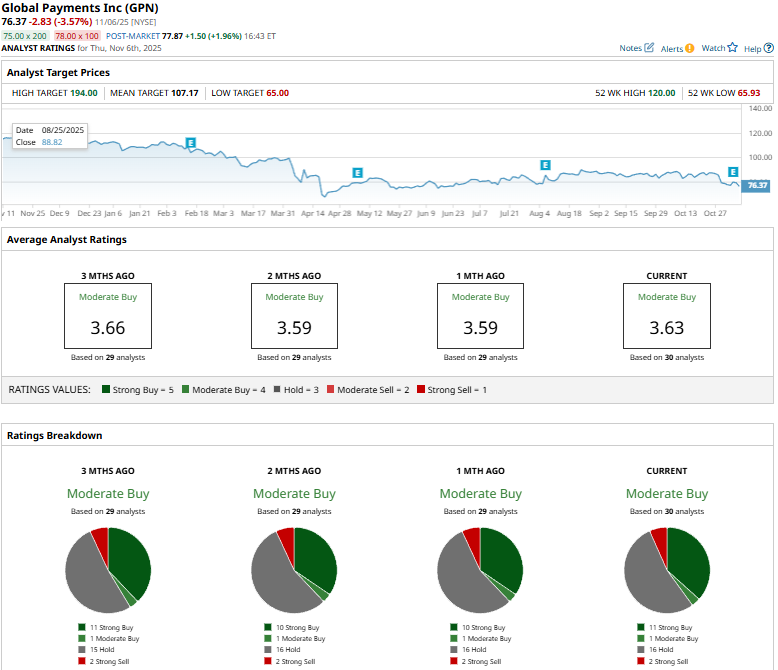

Among the 30 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buys,” one “Moderate Buy,” 16 “Holds,” and two “Strong Sells.”

This configuration is slightly more optimistic than a month ago, when 10 analysts gave “Strong Buy” recommendations.

On Nov. 5, TD Cowen analyst Bryan Bergin maintained a “Hold” rating on GPN and raised the price target from $92 to $95.

GPN’s mean price target of $107.17 represents a notable 40.3% premium to current price levels. Meanwhile, the street-high target of $194 suggests a staggering 154% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?