Micron Technology (MU) is a leading global provider of memory and storage solutions, specializing in DRAM, NAND, and NOR technologies that power data centers, PCs, smartphones, automotive systems, and industrial applications. The company excels in high-bandwidth memory (HBM) for artificial intelligence (AI) accelerators, advanced nodes for cloud computing, and consumer SSDs under the Crucial brand.

Founded in 1978, Micron is headquartered in Boise, Idaho. It operates manufacturing fabs, R&D centers, and sales offices across North America, Asia, and Europe.

Micron Stock Surges

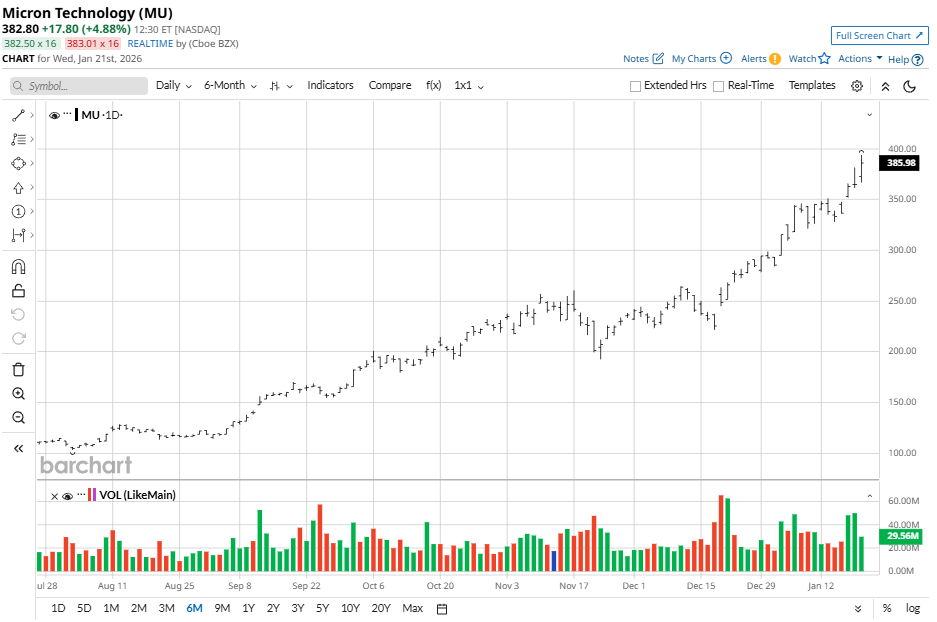

MU stock is up 527% from its 52-week low of roughly $62 after smashing a fresh yearly high of $394 on HBM and AI memory demand. Shares have rocketed 15% over the past five days, 46% in one month, and 244% over six months amid record first-quarter fiscal 2026 earnings and dividend initiation.

Micron obliterates the Philadelphia Semiconductor Index ($SOX), which has gained 50% over 52 weeks versus MU stock's explosive 256% surge fueled by data center dominance. Trading well above the 50-day moving average of $271 and the 200-day moving average of $164, with high beta volatility, MU suits aggressive portfolios chasing the memory cycle upswing.

Micron Tops Results

Micron Technology posted record Q1 fiscal 2026 revenue of $13.64 billion, up 57% year-over-year (YOY) from $8.71 billion and beating analyst estimates of around $13.2 billion. GAAP EPS reached $4.60 on $5.24 billion net income, crushing consensus forecasts amid explosive AI-driven HBM and DRAM demand.

Gross margin soared to 56% GAAP, with operating income at $6.14 billion, with 45% margin against 25% YOY. Operating cash flow hit $8.41 billion while free cash flow reached a quarterly record $3.9 billion after capex, as cash reserves swelled on record profitability.

Micron guided for Q2 revenue of $18.7 billion, implying a 37% sequential growth rate and well above the Street's $17.75 billion expectations. Non-GAAP gross margin is expected at 68% with EPS of $8.42.

What Do Analysts Think of MU Stock?

Micron recently earned a reiterated “Buy” rating from Stifel, which raised its price target to $360 from $300 — reflecting a potential downside of 7% from the market rate — following the company's $1.8 billion all-cash acquisition of a Taiwan chip fab from Powerchip Semiconductor Manufacturing. Analyst Brian Chin called the Tongluo fab, which is located near Micron's Taichung facilities, “geographically synergistic.”

The chip fab is poised to help enable faster DRAM wafer output by the second half of 2027 to address AI-driven shortages. Micron shifts supply from China/retail toward cloud/enterprise, leapfrogging rivals amid infrastructure growth. The deal, closing in the second half of 2026, also complements Micron's $100 billion megafab groundbreaking in New York.

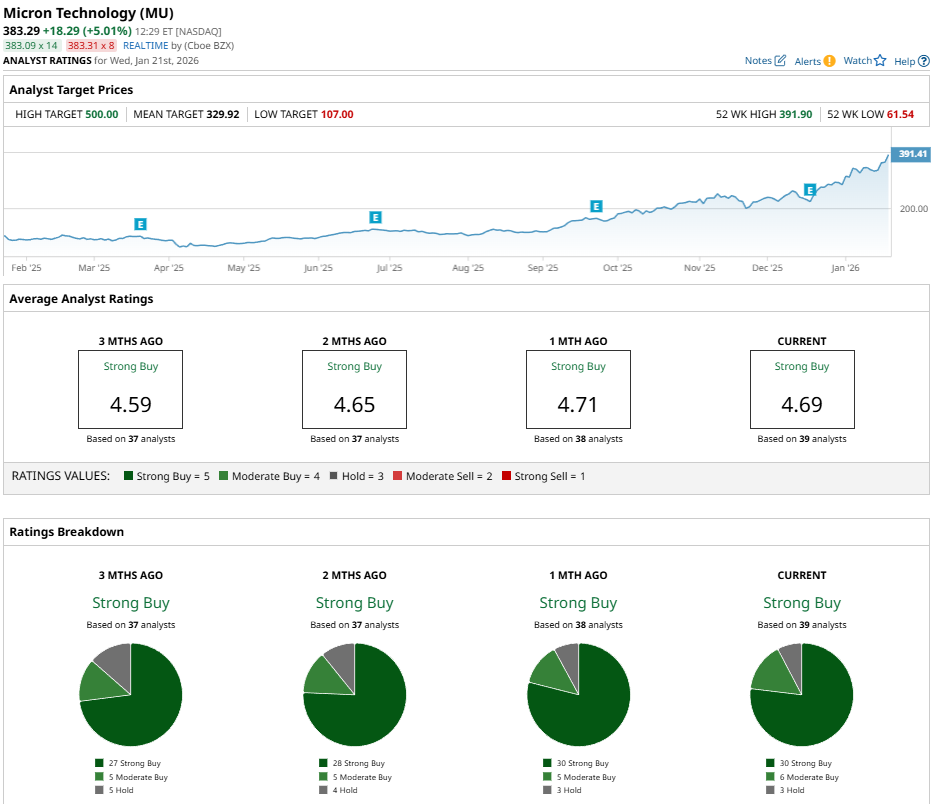

As MU stock races past market expectations, leaving estimates behind, it proceeds with a bullish “Strong Buy” consensus rating from analysts alongside a mean price target of $330.46. That mean price target signals 15% potential downside from current price levels.

MU stock has been rated by 40 analysts so far as tracked by Barchart. Micron has 31 “Strong Buy” ratings, six “Moderate Buy” ratings, and three “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart