Viatris Inc. (VTRS), valued at a market cap of $14.6 billion, is a global pharmaceutical and healthcare company formed in November 2020. Headquartered in Canonsburg, Pennsylvania, it develops, manufactures and distributes a broad portfolio of generic, branded, complex generic and biosimilar medicines across more than 165 countries and territories, supplying high-quality medicines to roughly 1 billion patients globally each year.

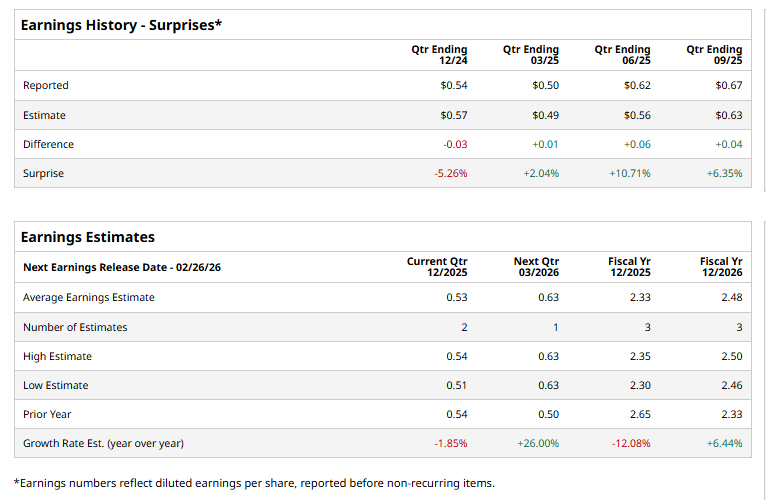

The global healthcare giant is expected to announce its fiscal 2025 fourth-quarter earnings soon. Ahead of the event, analysts expect VTRS to report a profit of $0.53 per share on a diluted basis, down 1.9% from $0.54 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For FY2025, analysts expect VTRS to report EPS of $2.33, down 12.1% from $2.65 in fiscal 2024. However, its EPS is expected to rise 6.4% year over year to $2.48 in fiscal 2026.

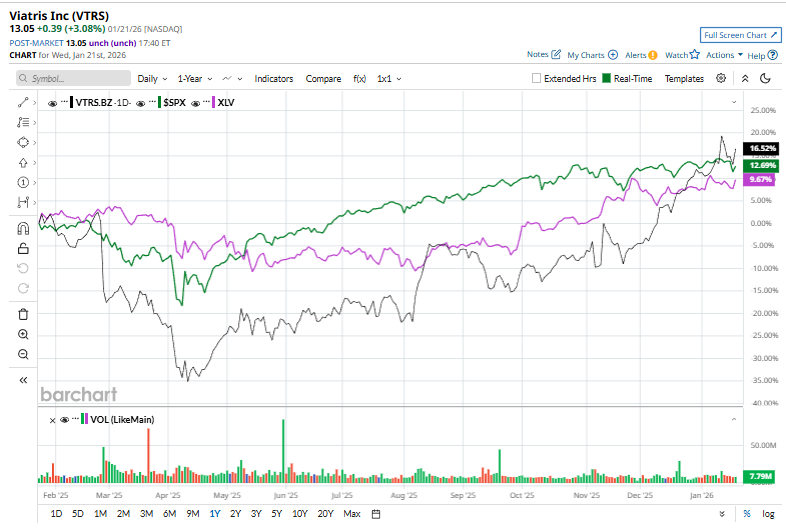

VTRS stock has surged 15.2% over the past year, outperforming both the S&P 500 Index’s ($SPX) 13.7% gains and the sector-specific Health Care Select Sector SPDR Fund’s (XLV) 11.1% rally over the same time frame.

On Jan. 20, Viatris announced the launch of its heart failure treatment, Inpefa (sotagliflozin), in the United Arab Emirates, marking the first commercial launch of the drug in its international territories. Inpefa, the first dual SGLT1/2 inhibitor approved for heart failure, is designed to reduce the risk of cardiovascular death and related hospitalizations, strengthening Viatris’ cardiovascular portfolio and supporting its growing innovative pipeline. VTRS shares rose 3.1% in the following trading session.

Analysts’ consensus opinion on VTRS stock is cautious, with a “Moderate Buy” rating overall. Out of ten analysts covering the stock, four advise a “Strong Buy” rating, five give a “Hold,” and one recommends a “Moderate Sell.” VTRS currently trades above its average analyst price target of $13.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart