Department store chain Kohl’s (NYSE:KSS) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 9.4% year on year to $5.40 billion. Its GAAP profit of $0.43 per share was 43.9% below analysts’ consensus estimates.

Is now the time to buy Kohl's? Find out by accessing our full research report, it’s free.

Kohl's (KSS) Q4 CY2024 Highlights:

- Revenue: $5.40 billion vs analyst estimates of $5.38 billion (9.4% year-on-year decline, in line)

- EPS (GAAP): $0.43 vs analyst expectations of $0.77 (43.9% miss)

- Adjusted EBITDA: $284 million vs analyst estimates of $371.7 million (5.3% margin, 23.6% miss)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $0.35 at the midpoint, missing analyst estimates by 72.4%

- Operating Margin: 2.3%, down from 5% in the same quarter last year

- Free Cash Flow Margin: 9.2%, down from 11.9% in the same quarter last year

- Same-Store Sales fell 6.7% year on year (-4.3% in the same quarter last year)

- Market Capitalization: $1.34 billion

Ashley Buchanan, Kohl’s Chief Executive Officer, said “Kohl’s is built on a strong foundation that includes operating more than 1,100 conveniently located stores nationwide, serving over 60 million customers, with 30 million of those customers being Kohl’s Loyalty Members. Kohl’s has a tremendous opportunity to build on our strengths, address key areas of opportunity and better serve our customers every day. “

Company Overview

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE:KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $16.22 billion in revenue over the past 12 months, Kohl's is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To accelerate sales, Kohl's likely needs to optimize its pricing or lean into international expansion.

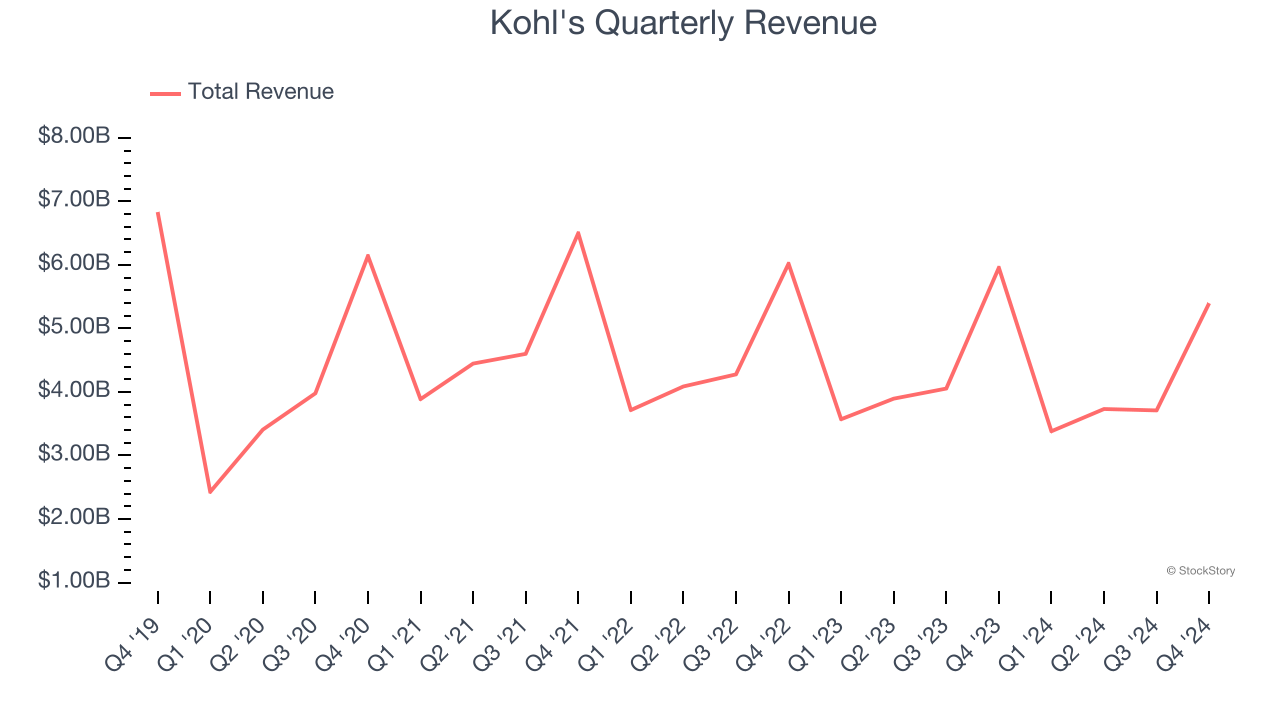

As you can see below, Kohl’s demand was weak over the last five years (we compare to 2019 to normalize for COVID-19 impacts). Its sales fell by 4.1% annually as it didn’t open many new stores and observed lower sales at existing, established locations.

This quarter, Kohl's reported a rather uninspiring 9.4% year-on-year revenue decline to $5.40 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 2% over the next 12 months. Although this projection is better than its five-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

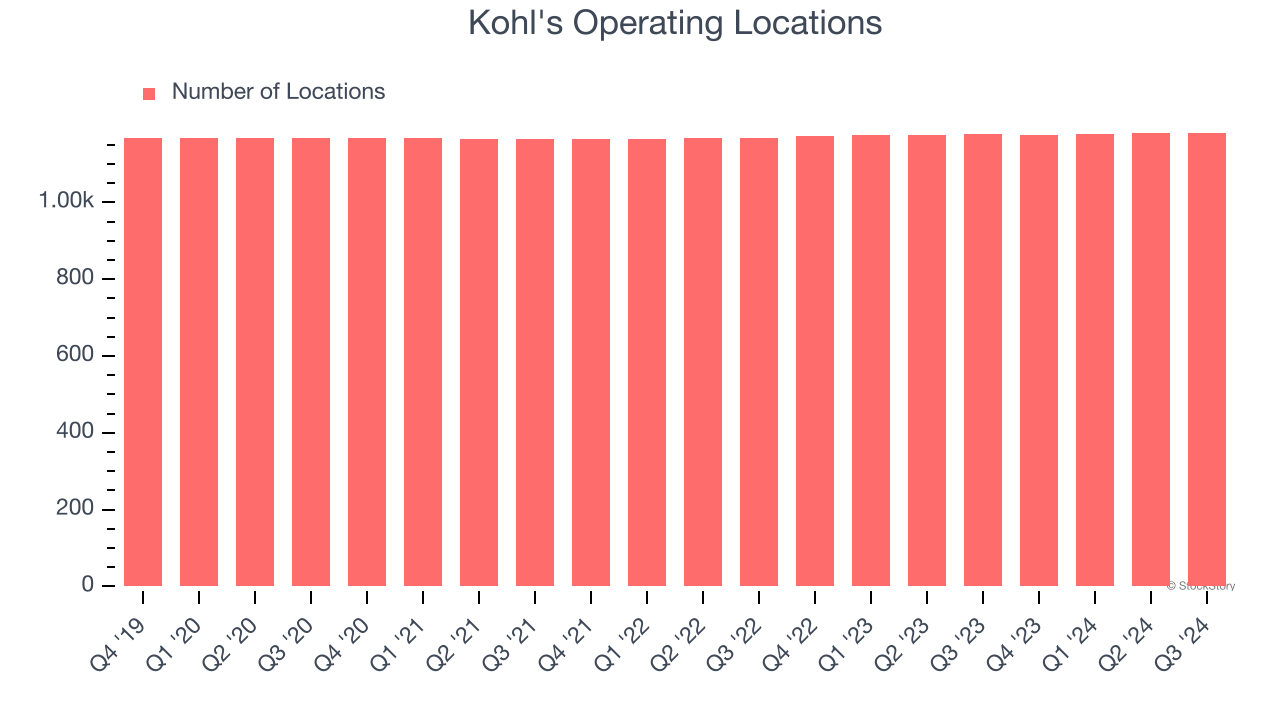

Over the last two years, Kohl's has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Note that Kohl's reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

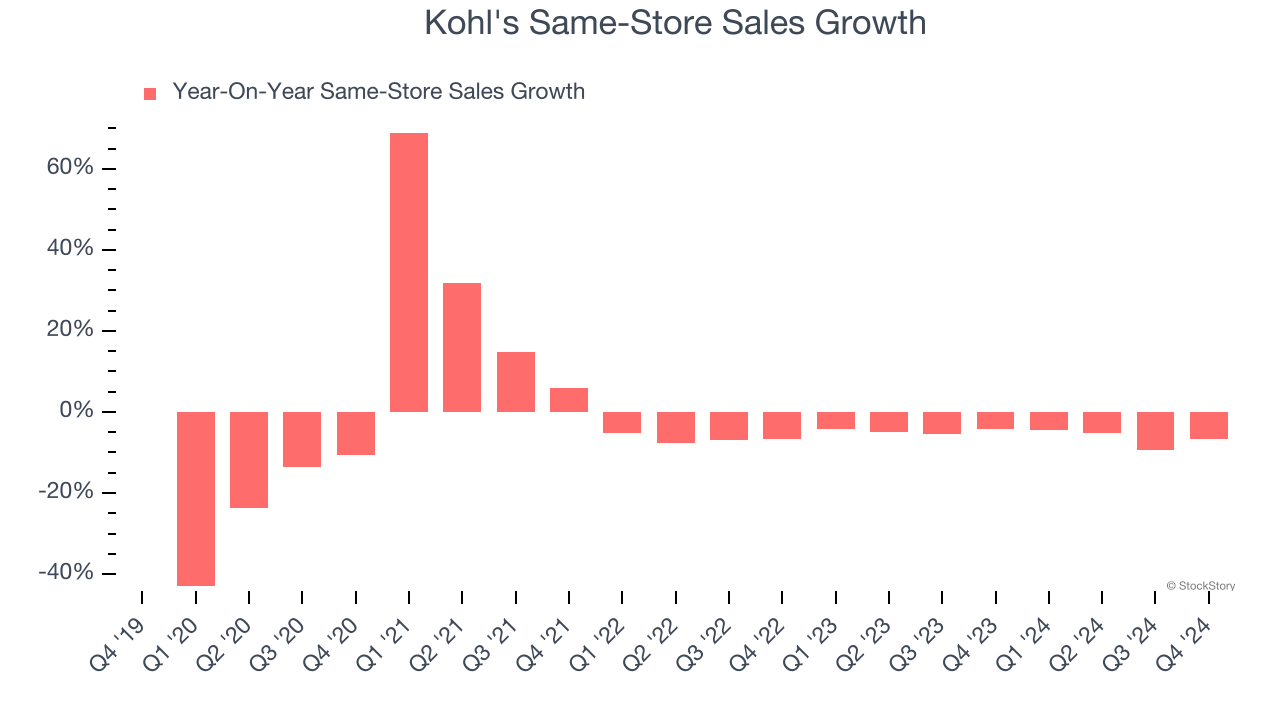

Kohl’s demand has been shrinking over the last two years as its same-store sales have averaged 5.6% annual declines. This performance isn’t ideal, and we’d be concerned if Kohl's starts opening new stores to artificially boost revenue growth.

In the latest quarter, Kohl’s same-store sales fell by 6.7% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Kohl’s Q4 Results

Kohl's EPS missed by a meaningful amount this quarter, and its full-year EPS guidance missed significantly as well. Overall, this quarter was quite bad. The stock traded down 15.4% to $10.20 immediately after reporting.

Kohl's didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.