Experiential tourism company Pursuit Attractions and Hospitality (NYSE:PRSU) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, but sales fell by 84.3% year on year to $45.8 million. Its non-GAAP loss of $0.82 per share was 52% above analysts’ consensus estimates.

Is now the time to buy Pursuit? Find out by accessing our full research report, it’s free.

Pursuit (PRSU) Q4 CY2024 Highlights:

- Revenue: $45.8 million vs analyst estimates of $41.36 million (84.3% year-on-year decline, 10.7% beat)

- Adjusted EPS: -$0.82 vs analyst estimates of -$1.71 (52% beat)

- Adjusted EBITDA: -$11.18 million vs analyst estimates of -$14.26 million (-24.4% margin, 21.6% beat)

- EBITDA guidance for the upcoming financial year 2025 is $103 million at the midpoint, above analyst estimates of $94.97 million

- Operating Margin: -52.9%, down from 0.2% in the same quarter last year

- Market Capitalization: $1.06 billion

Company Overview

With attractions ranging from glacier tours in the Canadian Rockies to an oceanfront geothermal lagoon in Iceland, Pursuit Attractions and Hospitality (NYSE:PRSU) operates iconic travel experiences, experiential marketing services, and exhibition management across North America and Europe.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

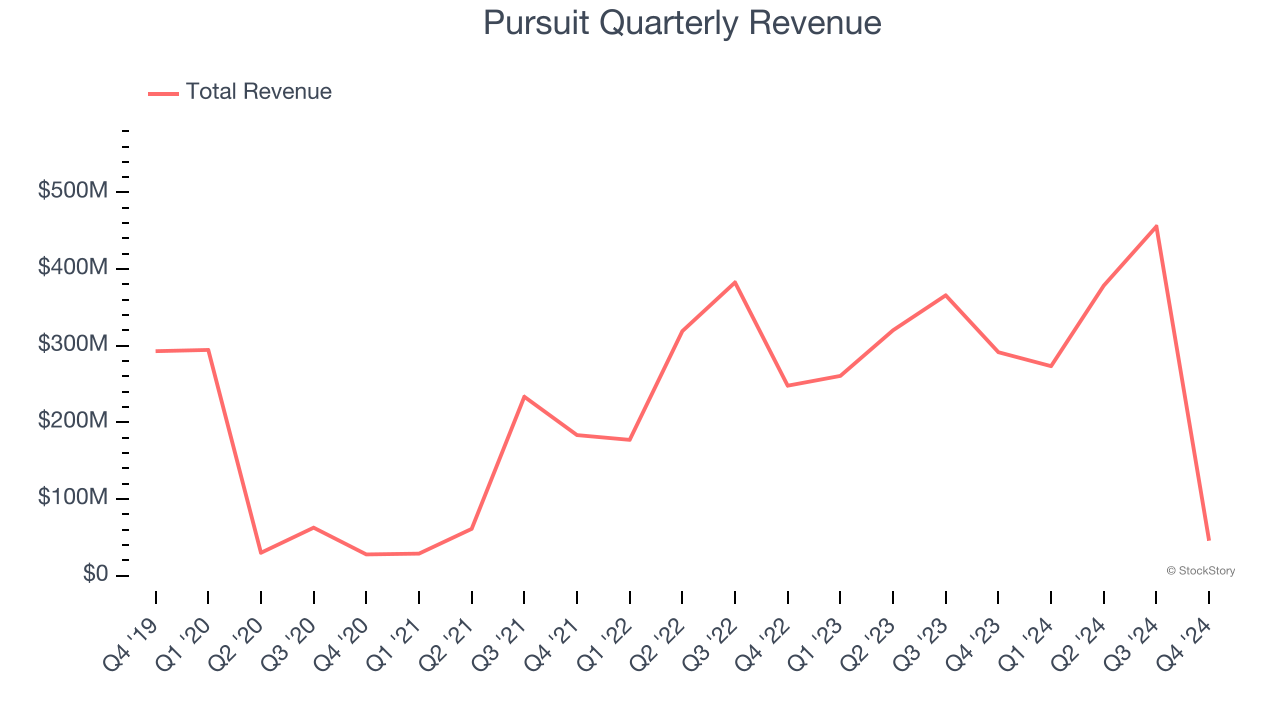

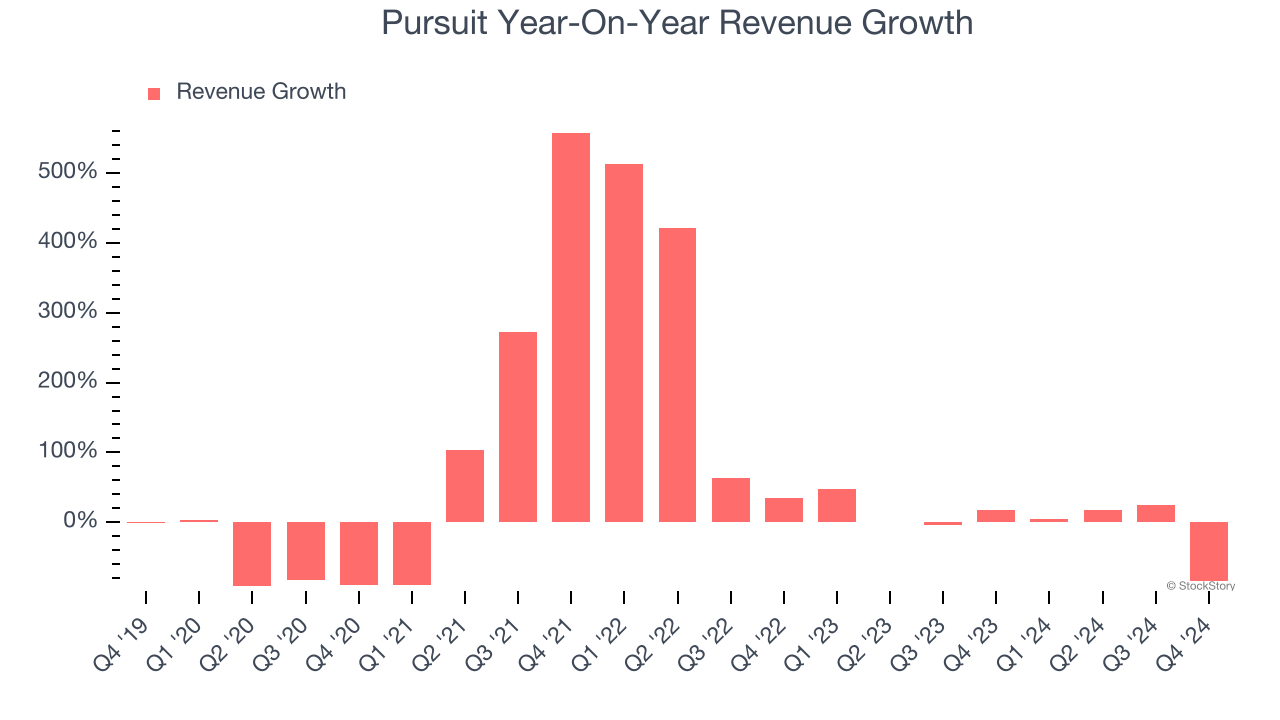

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Pursuit struggled to consistently generate demand over the last five years as its sales dropped at a 2.4% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Pursuit’s annualized revenue growth of 1.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Pursuit’s revenue fell by 84.3% year on year to $45.8 million but beat Wall Street’s estimates by 10.7%.

Looking ahead, sell-side analysts expect revenue to decline by 67.1% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

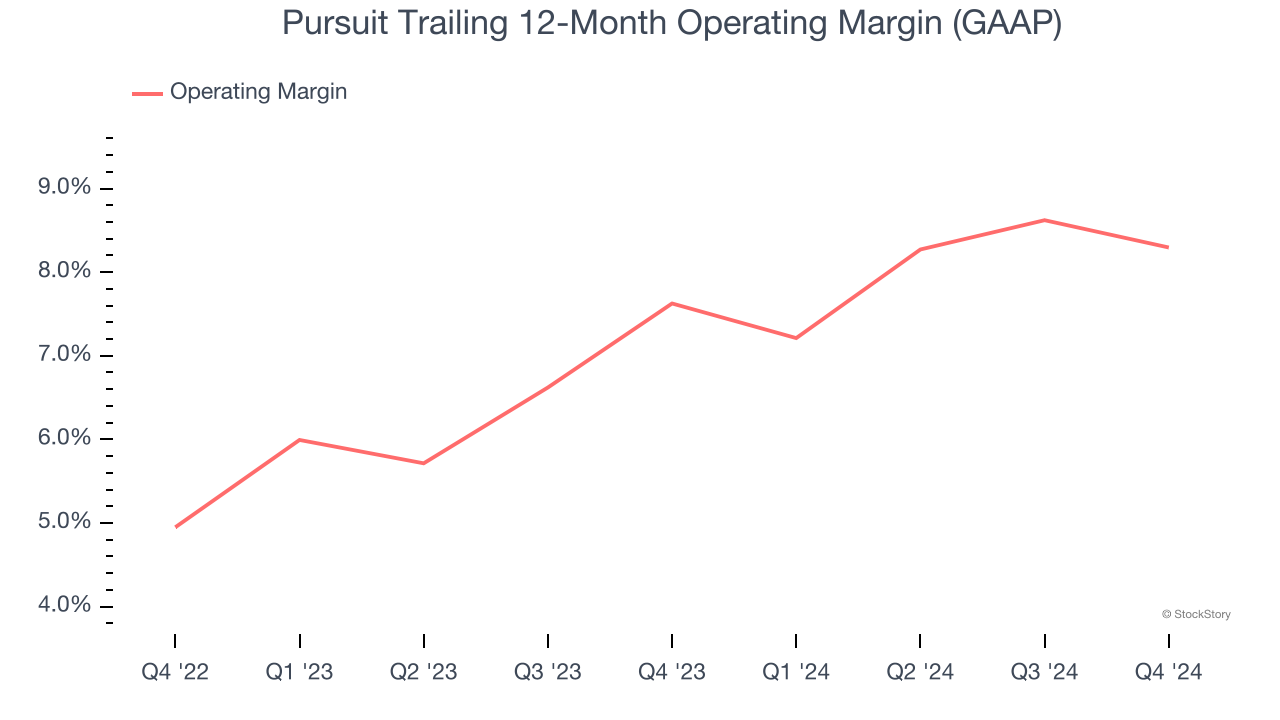

Operating Margin

Pursuit’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 7.9% over the last two years. This profitability was paltry for a consumer discretionary business and caused by its suboptimal cost structure.

In Q4, Pursuit generated an operating profit margin of negative 52.9%, down 53.2 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

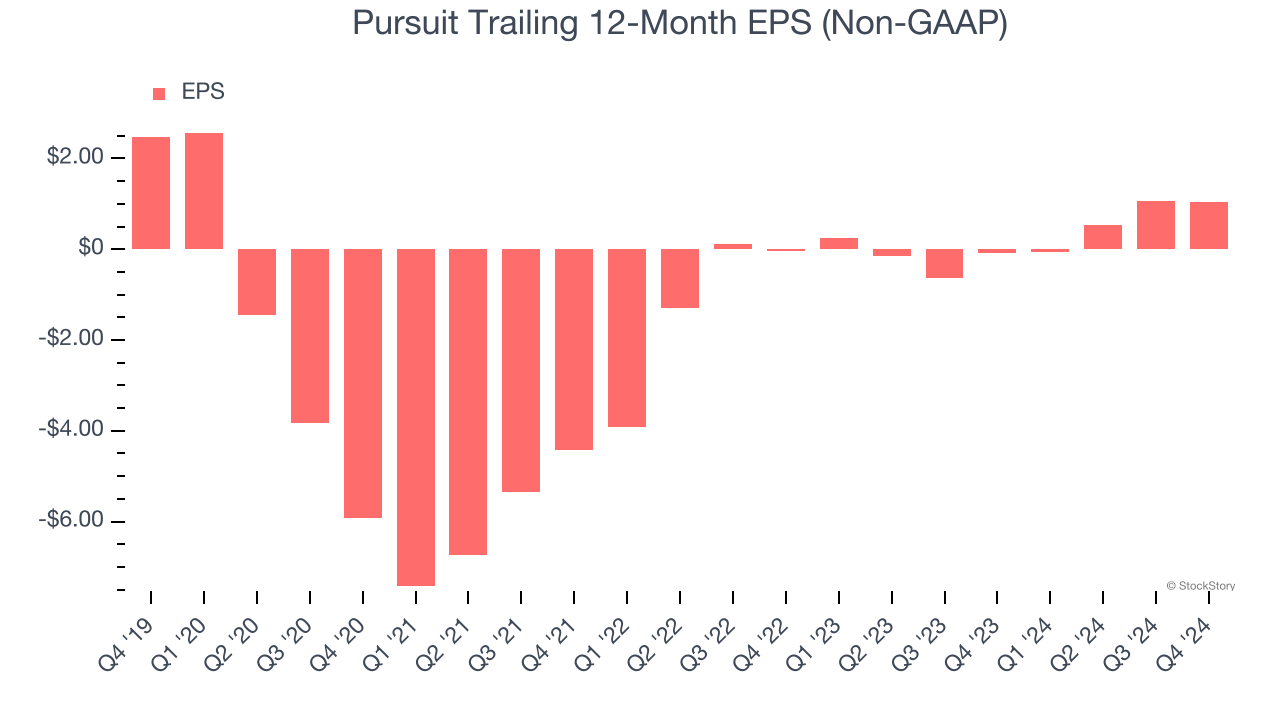

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Pursuit, its EPS declined by 16.1% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, Pursuit reported EPS at negative $0.82, down from negative $0.79 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Pursuit to perform poorly. Analysts forecast its full-year EPS of $1.03 will hit $0.25.

Key Takeaways from Pursuit’s Q4 Results

We were impressed by how significantly Pursuit blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited its full-year EBITDA guidance outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid quarter. The stock traded up 3.7% to $38.50 immediately after reporting.

Sure, Pursuit had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.