Conveyorized car wash service company Mister Car Wash (NYSE:MCW) fell short of the market’s revenue expectations in Q2 CY2025 as sales rose 4.1% year on year to $265.4 million. The company’s full-year revenue guidance of $1.05 billion at the midpoint came in 0.9% below analysts’ estimates. Its non-GAAP profit of $0.11 per share was 12.3% below analysts’ consensus estimates.

Is now the time to buy Mister Car Wash? Find out by accessing our full research report, it’s free.

Mister Car Wash (MCW) Q2 CY2025 Highlights:

- Revenue: $265.4 million vs analyst estimates of $271.7 million (4.1% year-on-year growth, 2.3% miss)

- Adjusted EPS: $0.11 vs analyst expectations of $0.13 (12.3% miss)

- Adjusted EBITDA: $87.05 million vs analyst estimates of $92.96 million (32.8% margin, 6.4% miss)

- The company reconfirmed its revenue guidance for the full year of $1.05 billion at the midpoint

- EBITDA guidance for the full year is $340 million at the midpoint, below analyst estimates of $342.9 million

- Operating Margin: 20.4%, down from 21.6% in the same quarter last year

- Free Cash Flow was -$11.2 million compared to -$20.36 million in the same quarter last year

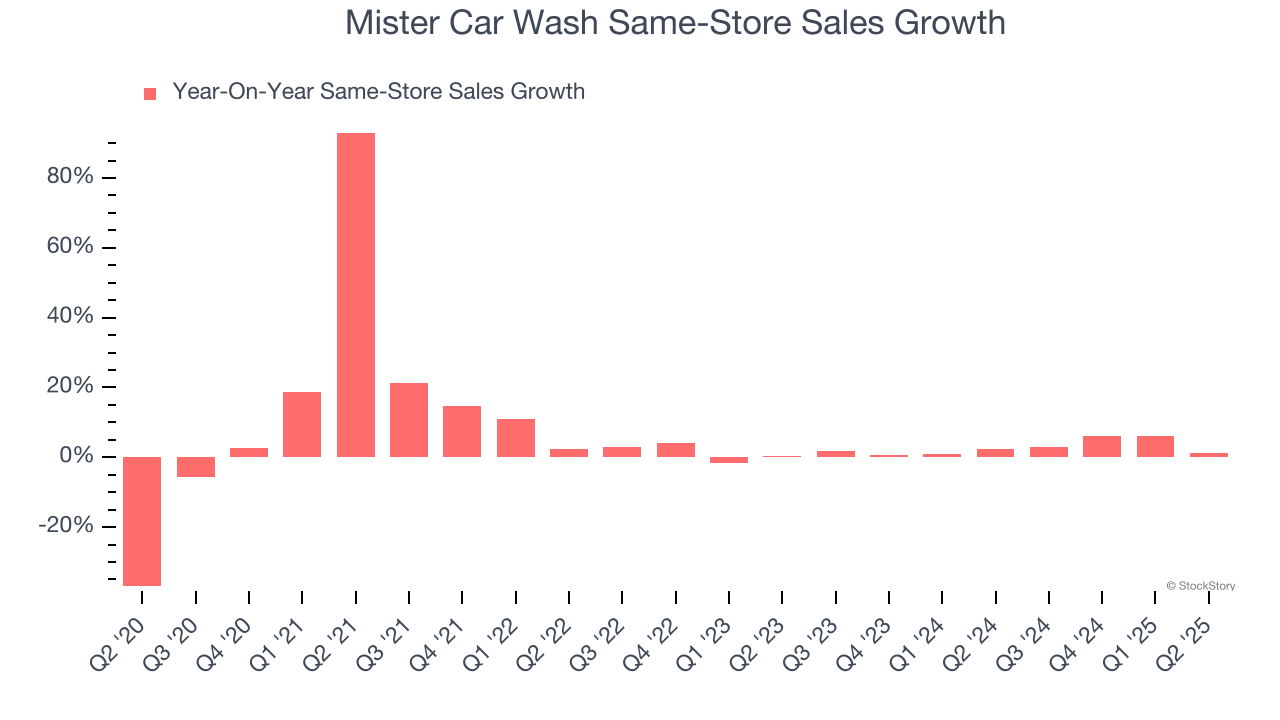

- Same-Store Sales rose 1.2% year on year (2.4% in the same quarter last year)

- Market Capitalization: $2.03 billion

“Fueled by the strength of our UWC subscription model and the solid execution of our teams, we delivered our ninth consecutive quarter of positive comp-store sales growth in the second quarter—even amidst a challenging retail environment. Our membership base grew 5% year-over-year, underscoring the effectiveness of our model in converting retail traffic into a robust stream of recurring revenue,” commented John Lai, Chairperson, President and CEO of

Company Overview

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE:MCW) offers car washes across the United States through its conveyorized service.

Revenue Growth

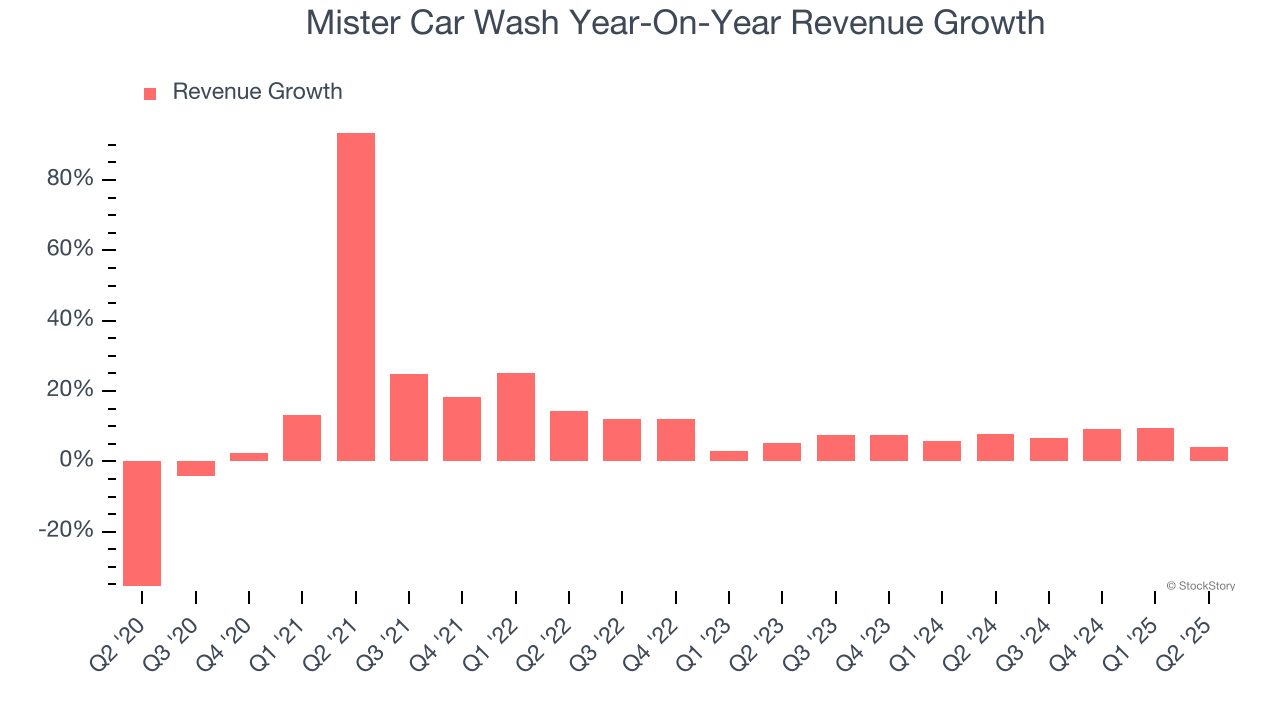

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Mister Car Wash grew its sales at a 12.2% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Mister Car Wash’s recent performance shows its demand has slowed as its annualized revenue growth of 7.2% over the last two years was below its five-year trend.

Mister Car Wash also reports same-store sales, which show how much revenue its established locations generate. Over the last two years, Mister Car Wash’s same-store sales averaged 2.7% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Mister Car Wash’s revenue grew by 4.1% year on year to $265.4 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

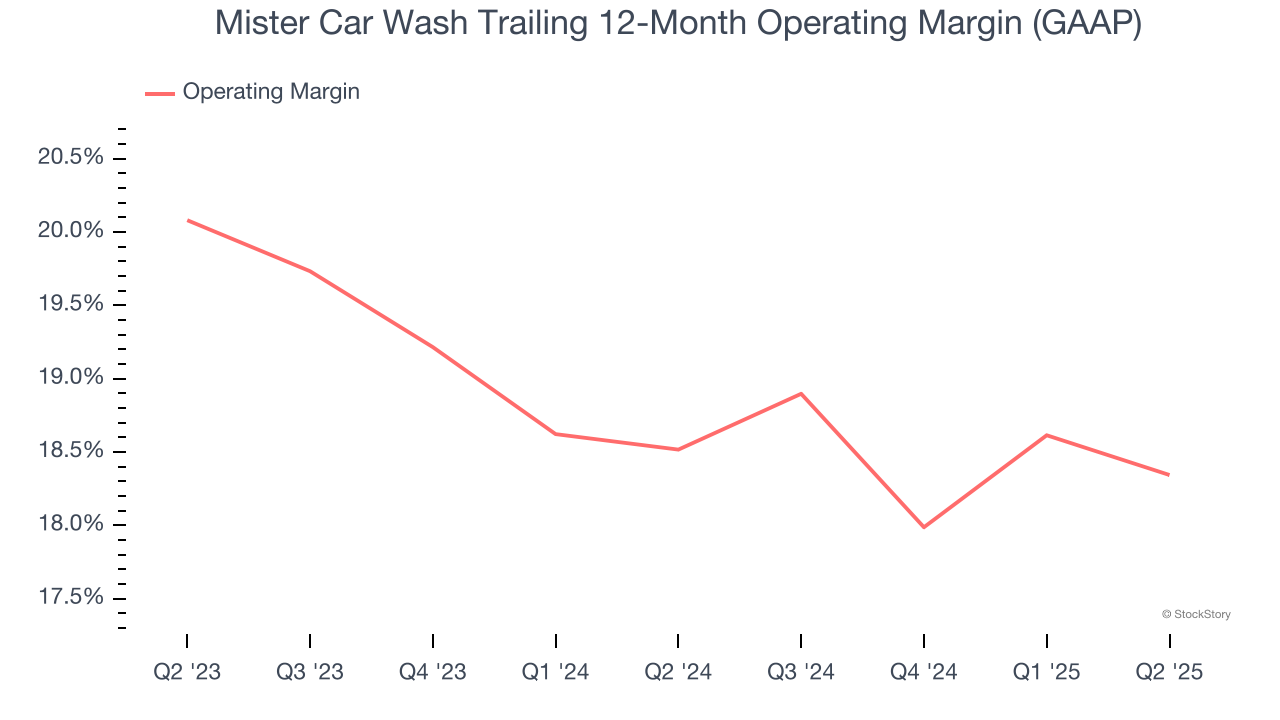

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Mister Car Wash’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 18.4% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, Mister Car Wash generated an operating margin profit margin of 20.4%, down 1.2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

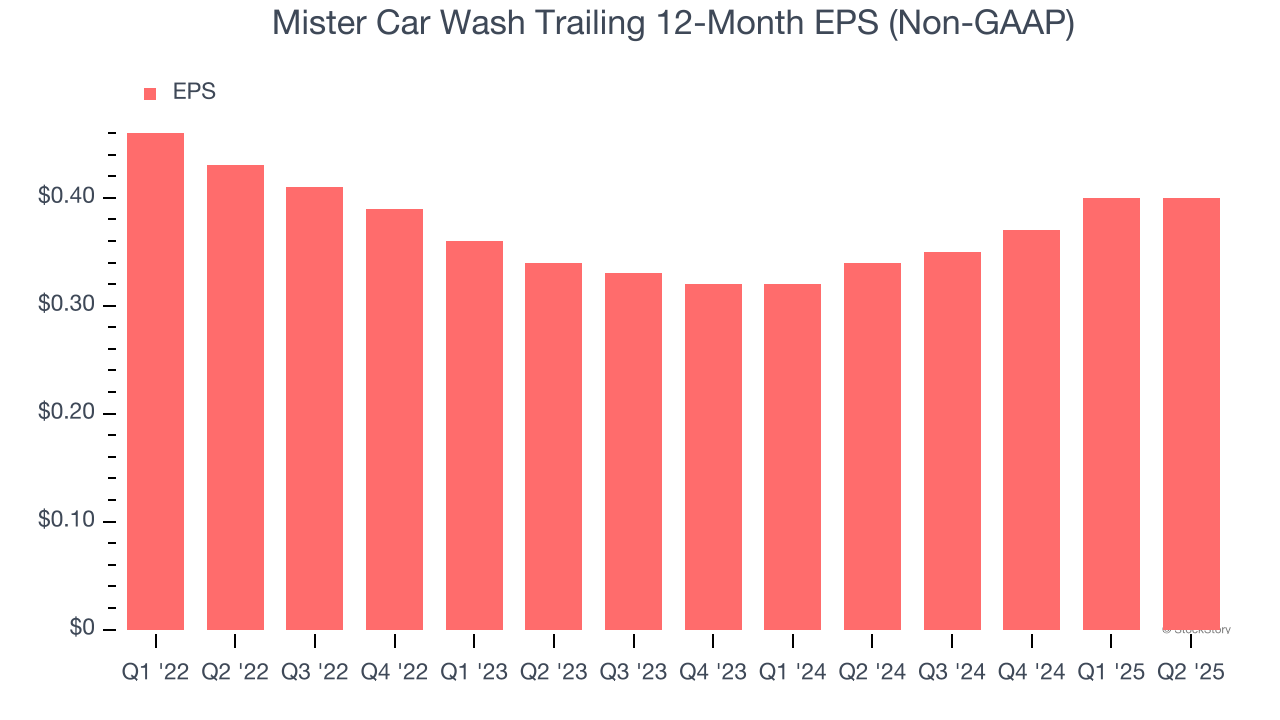

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q2, Mister Car Wash reported adjusted EPS at $0.11, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Mister Car Wash to perform poorly. Analysts forecast its full-year EPS of $0.40 will hit $0.47.

Key Takeaways from Mister Car Wash’s Q2 Results

We struggled to find many positives in these results. Its EPS missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.8% to $5.91 immediately following the results.

Mister Car Wash’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.