Cloud data platform provider Snowflake (NYSE:SNOW) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 31.8% year on year to $1.14 billion. Its non-GAAP profit of $0.38 per share was 42.6% above analysts’ consensus estimates.

Is now the time to buy Snowflake? Find out by accessing our full research report, it’s free.

Snowflake (SNOW) Q2 CY2025 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.09 billion (31.8% year-on-year growth, 5.1% beat)

- Adjusted EPS: $0.38 vs analyst estimates of $0.27 (42.6% beat)

- Adjusted Operating Income: $127.6 million vs analyst estimates of $88.39 million (11.1% margin, 44.3% beat)

- Product Revenue Guidance for Q3 CY2025 is $1.13 billion at the midpoint

- Operating Margin: -29.7%, up from -40.9% in the same quarter last year

- Free Cash Flow Margin: 5.1%, down from 17.6% in the previous quarter

- Customers: 654 customers paying more than $1 million annually

- Net Revenue Retention Rate: 125%, up from 124% in the previous quarter

- Billings: $1.09 billion at quarter end, up 40.2% year on year

- Market Capitalization: $64.85 billion

Company Overview

Named after the unique architecture of its data warehouse which resembles a snowflake pattern, Snowflake (NYSE:SNOW) provides a cloud-based data platform that enables organizations to consolidate, analyze, and share data across multiple cloud providers.

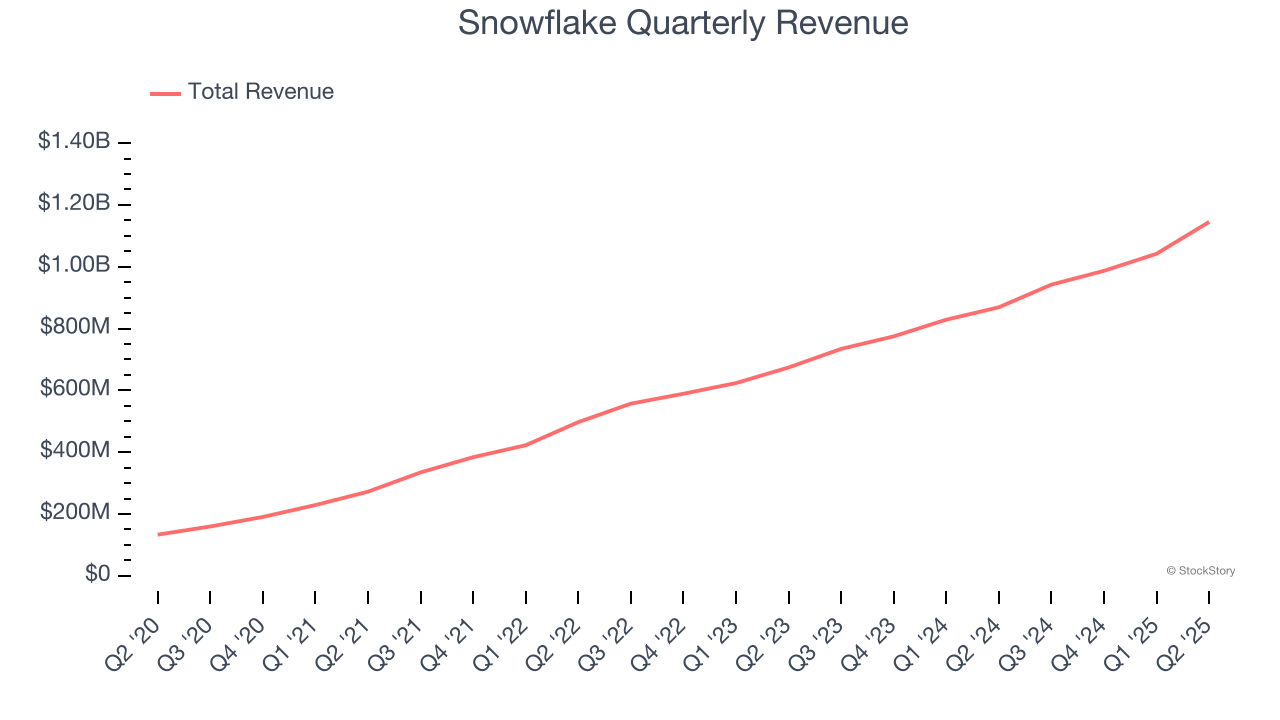

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Snowflake’s 36% annualized revenue growth over the last three years was excellent. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Snowflake reported wonderful year-on-year revenue growth of 31.8%, and its $1.14 billion of revenue exceeded Wall Street’s estimates by 5.1%.

Looking ahead, sell-side analysts expect revenue to grow 22.3% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and indicates the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

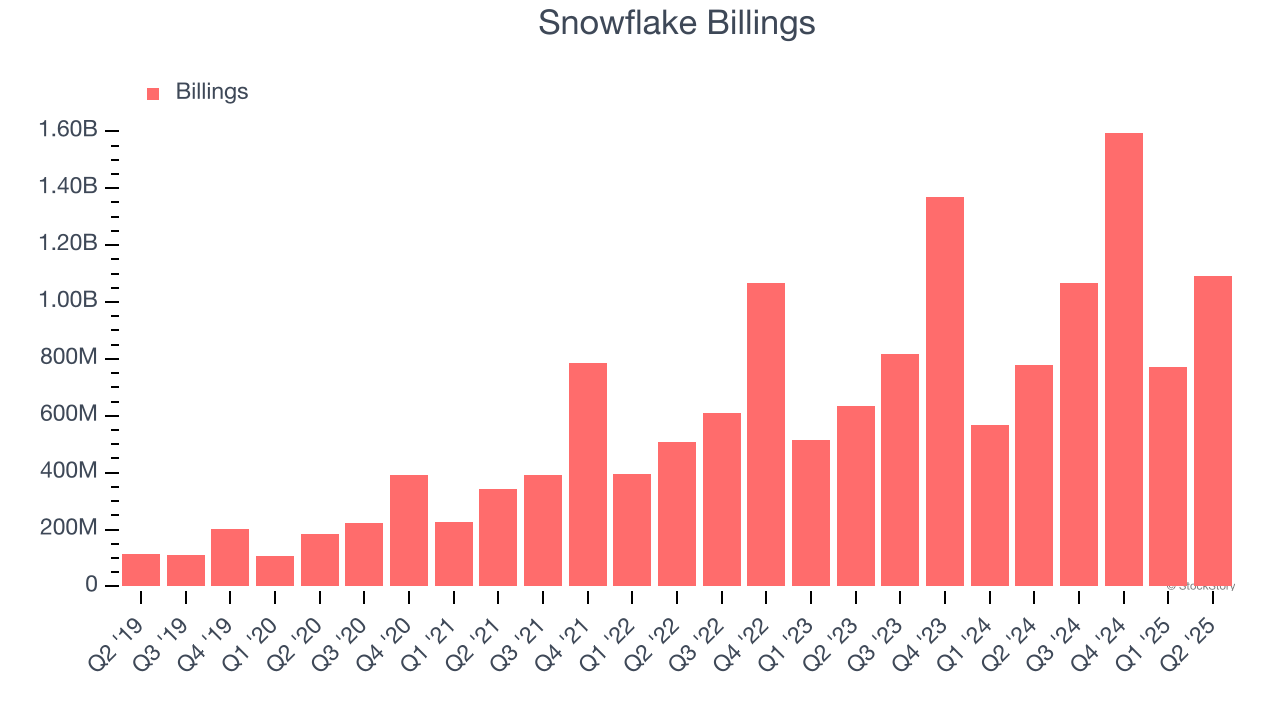

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Snowflake’s billings punched in at $1.09 billion in Q2, and over the last four quarters, its growth was fantastic as it averaged 30.9% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

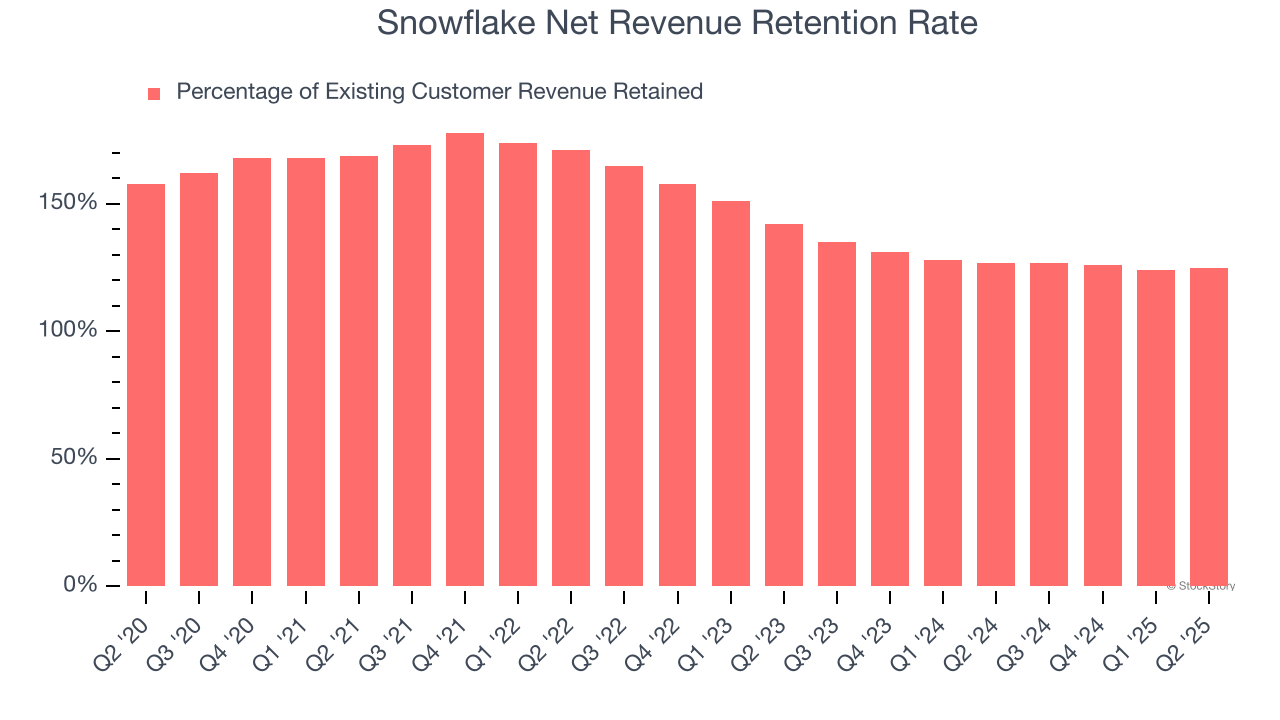

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Snowflake’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 126% in Q2. This means Snowflake would’ve grown its revenue by 25.5% even if it didn’t win any new customers over the last 12 months.

Snowflake has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing their usage over time.

Key Takeaways from Snowflake’s Q2 Results

We enjoyed seeing Snowflake beat analysts’ billings and revenue expectations this quarter. On top of that, net revenue retention improved sequentially, which is not an easy accomplishment for software companies. Lastly, the growth was not just stronger than expected but more profitable as well, with adjusted operating profit smashing expectations this quarter. Overall, we think this was a very good quarter with many key metrics above expectations. The stock traded up 12.5% to $225.58 immediately after reporting.

Snowflake had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.