Packaged foods company Hormel (NYSE:HRL) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 4.6% year on year to $3.03 billion. On the other hand, next quarter’s revenue guidance of $3.2 billion was less impressive, coming in 1.4% below analysts’ estimates. Its non-GAAP profit of $0.35 per share was 15% below analysts’ consensus estimates.

Is now the time to buy Hormel Foods? Find out by accessing our full research report, it’s free.

Hormel Foods (HRL) Q2 CY2025 Highlights:

- Revenue: $3.03 billion vs analyst estimates of $2.98 billion (4.6% year-on-year growth, 1.7% beat)

- Adjusted EPS: $0.35 vs analyst expectations of $0.41 (15% miss)

- Adjusted EBITDA: $304.4 million vs analyst estimates of $367 million (10% margin, 17.1% miss)

- Revenue Guidance for Q3 CY2025 is $3.2 billion at the midpoint, below analyst estimates of $3.25 billion

- Management lowered its full-year Adjusted EPS guidance to $1.44 at the midpoint, a 11.7% decrease

- Operating Margin: 7.9%, in line with the same quarter last year

- Free Cash Flow Margin: 2.8%, down from 5.3% in the same quarter last year

- Sales Volumes rose 2.7% year on year (-6.9% in the same quarter last year)

- Market Capitalization: $15.96 billion

"I am honored to rejoin this great company and partner with John Ghingo and the entire leadership team to focus on restoring profitable growth," said Jeff Ettinger, interim chief executive officer.

Company Overview

Best known for its SPAM brand, Hormel (NYSE:HRL) is a packaged foods company with products that span meat, poultry, shelf-stable foods, and spreads.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $12.06 billion in revenue over the past 12 months, Hormel Foods is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To expand meaningfully, Hormel Foods likely needs to tweak its prices, innovate with new products, or enter new markets.

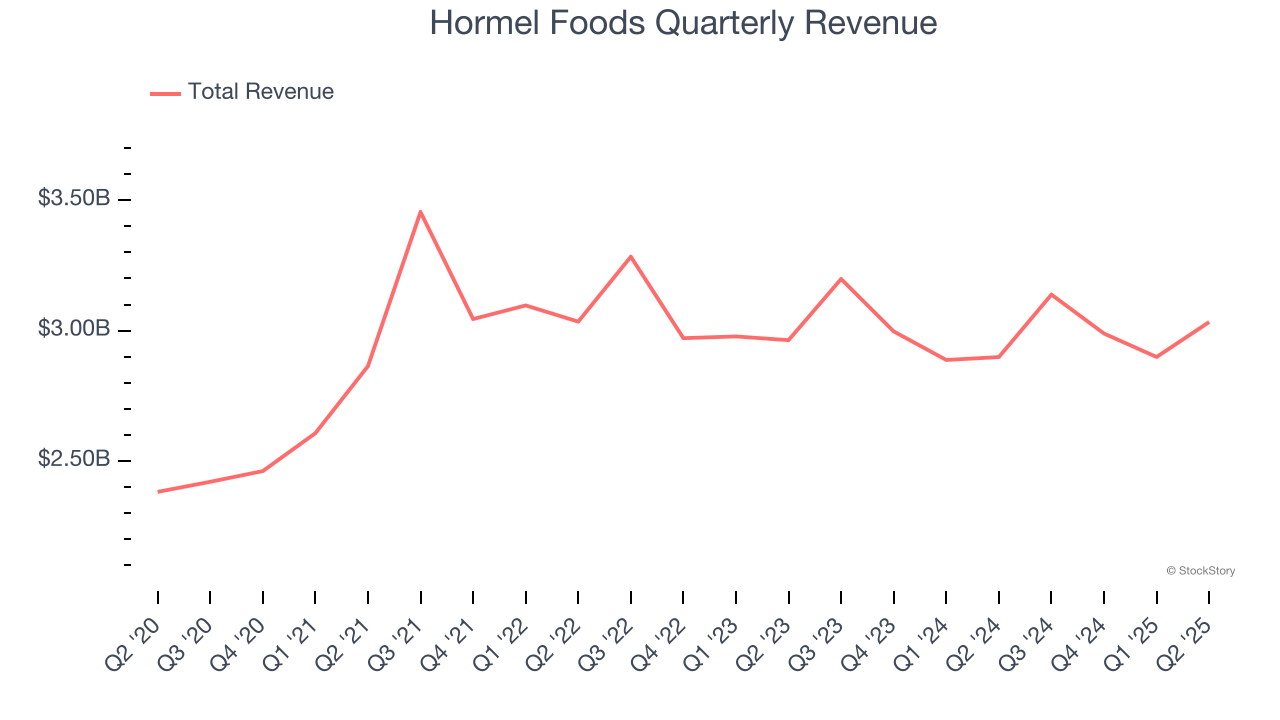

As you can see below, Hormel Foods’s demand was weak over the last three years. Its sales fell by 1.5% annually as consumers bought less of its products.

This quarter, Hormel Foods reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 1.7%. Company management is currently guiding for a 2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months. Although this projection suggests its newer products will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

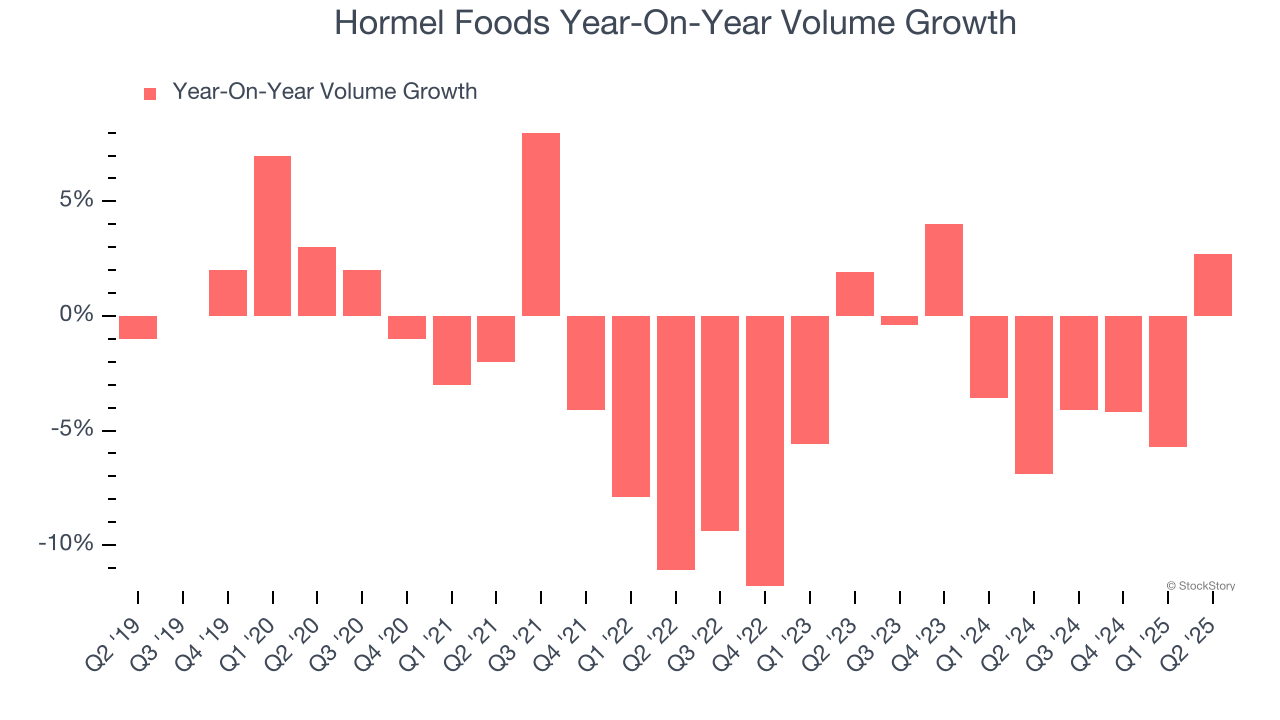

Hormel Foods’s average quarterly sales volumes have shrunk by 2.3% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Hormel Foods’s Q2 2025, sales volumes jumped 2.7% year on year. This result was a well-appreciated turnaround from its historical levels, showing the company is heading in the right direction.

Key Takeaways from Hormel Foods’s Q2 Results

It was encouraging to see Hormel Foods beat analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7% to $26.97 immediately after reporting.

Hormel Foods’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.