Online payroll and human resource software provider Paycom (NYSE:PAYC) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 10.5% year on year to $483.6 million. The company’s full-year revenue guidance of $2.05 billion at the midpoint came in 1% above analysts’ estimates. Its non-GAAP profit of $2.06 per share was 15.6% above analysts’ consensus estimates.

Is now the time to buy Paycom? Find out by accessing our full research report, it’s free.

Paycom (PAYC) Q2 CY2025 Highlights:

- Revenue: $483.6 million vs analyst estimates of $472 million (10.5% year-on-year growth, 2.5% beat)

- Adjusted EPS: $2.06 vs analyst estimates of $1.78 (15.6% beat)

- Adjusted EBITDA: $198.3 million vs analyst estimates of $177.8 million (41% margin, 11.5% beat)

- The company slightly lifted its revenue guidance for the full year to $2.05 billion at the midpoint from $2.03 billion

- EBITDA guidance for the full year is $877 million at the midpoint, above analyst estimates of $852.8 million

- Operating Margin: 23.2%, up from 21.7% in the same quarter last year

- Free Cash Flow was -$144.6 million, down from $144.8 million in the previous quarter

- Market Capitalization: $12.51 billion

Company Overview

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE:PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

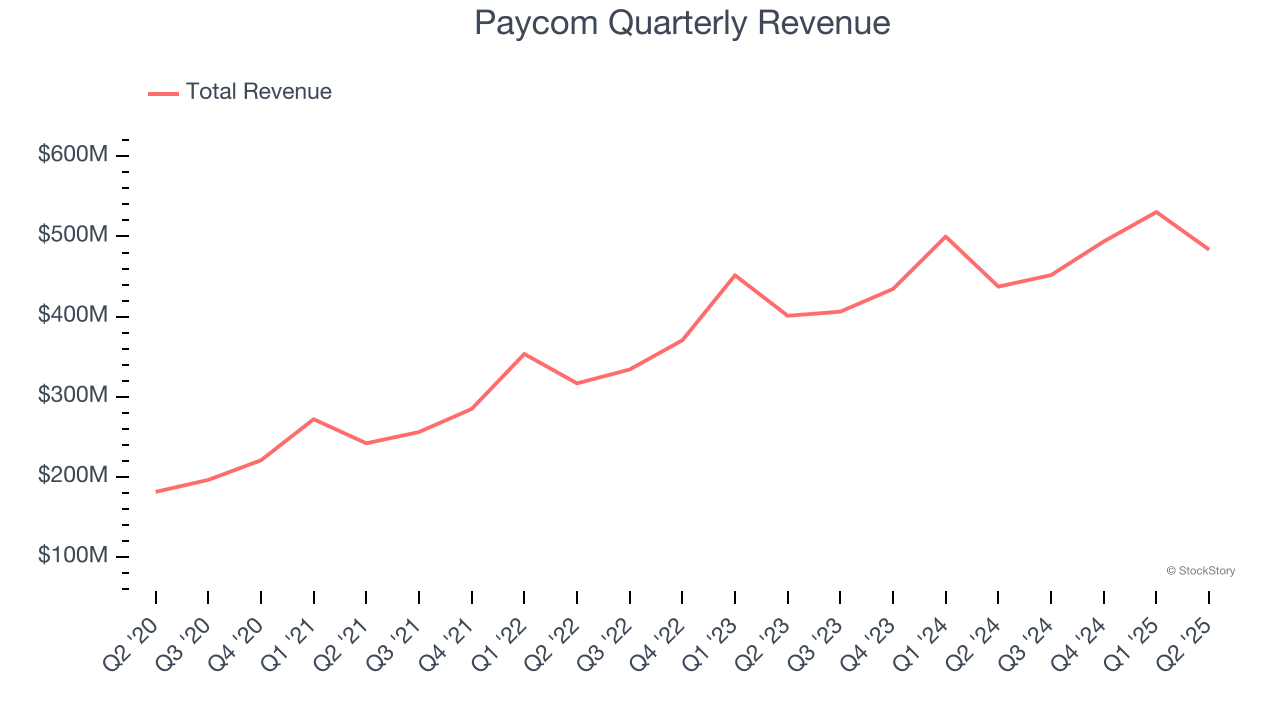

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Paycom grew its sales at a 17.4% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Paycom.

This quarter, Paycom reported year-on-year revenue growth of 10.5%, and its $483.6 million of revenue exceeded Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

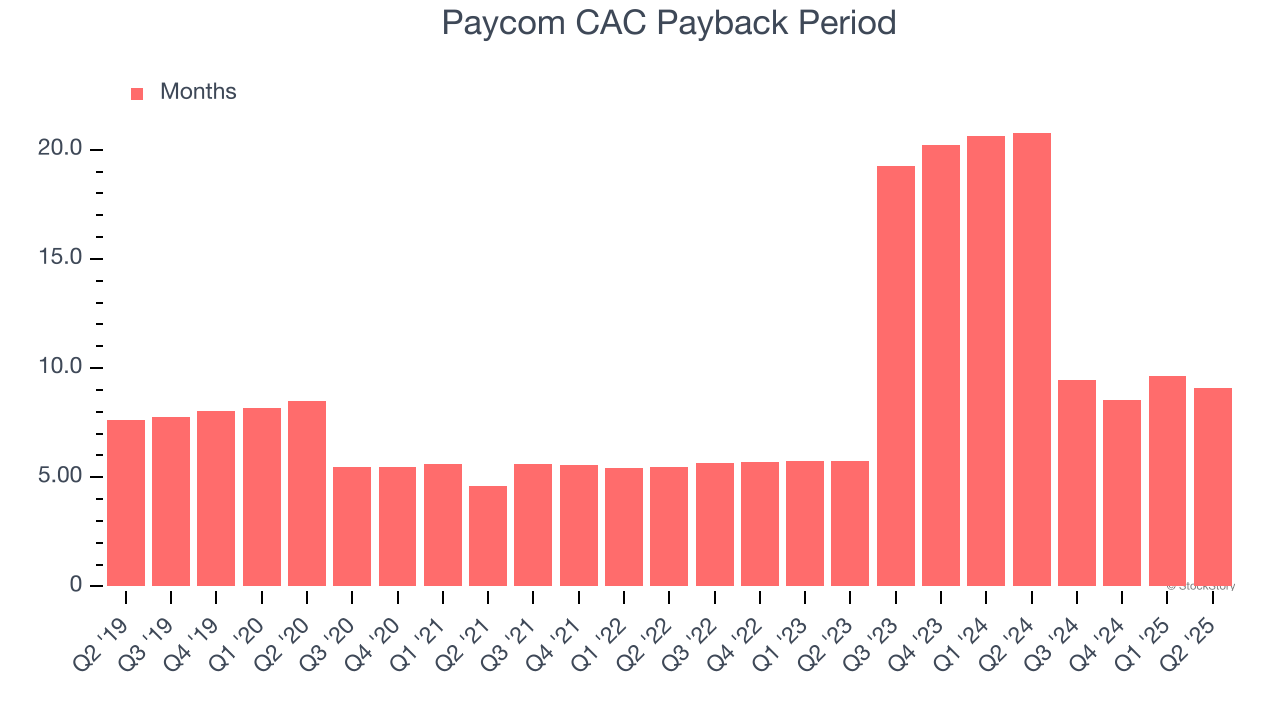

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Paycom is extremely efficient at acquiring new customers, and its CAC payback period checked in at 9.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Paycom’s Q2 Results

We were impressed that Paycom beat analysts’ revenue and EBITDA expectations this quarter. We were also glad its full-year revenue guidance was raised and full-year EBITDA guidance exceeded Wall Street’s estimates. Zooming out, we think this was a very good print with some key areas of upside. The stock traded up 10.4% to $246 immediately following the results.

Paycom had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.