Sinclair currently trades at $14.15 per share and has shown little upside over the past six months, posting a middling return of 4.4%. The stock also fell short of the S&P 500’s 11.6% gain during that period.

Is now the time to buy Sinclair, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Sinclair Will Underperform?

We don't have much confidence in Sinclair. Here are three reasons there are better opportunities than SBGI and a stock we'd rather own.

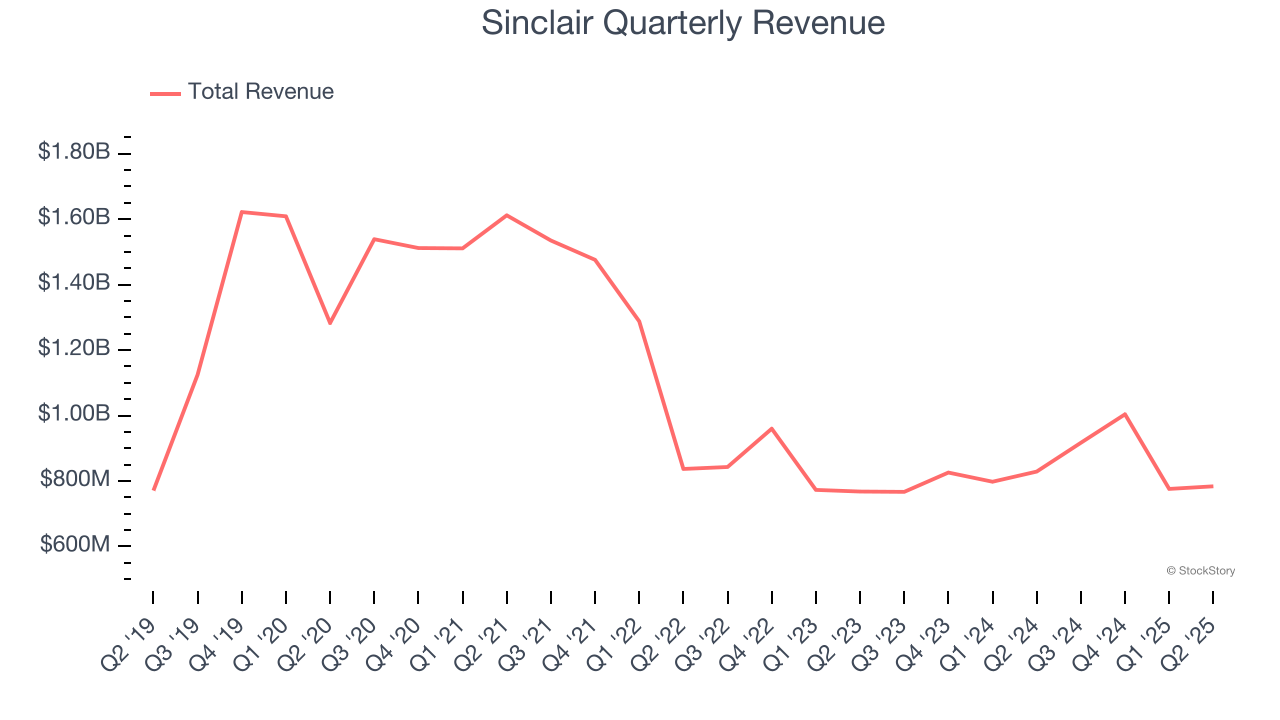

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Sinclair’s demand was weak and its revenue declined by 9.2% per year. This wasn’t a great result and signals it’s a low quality business.

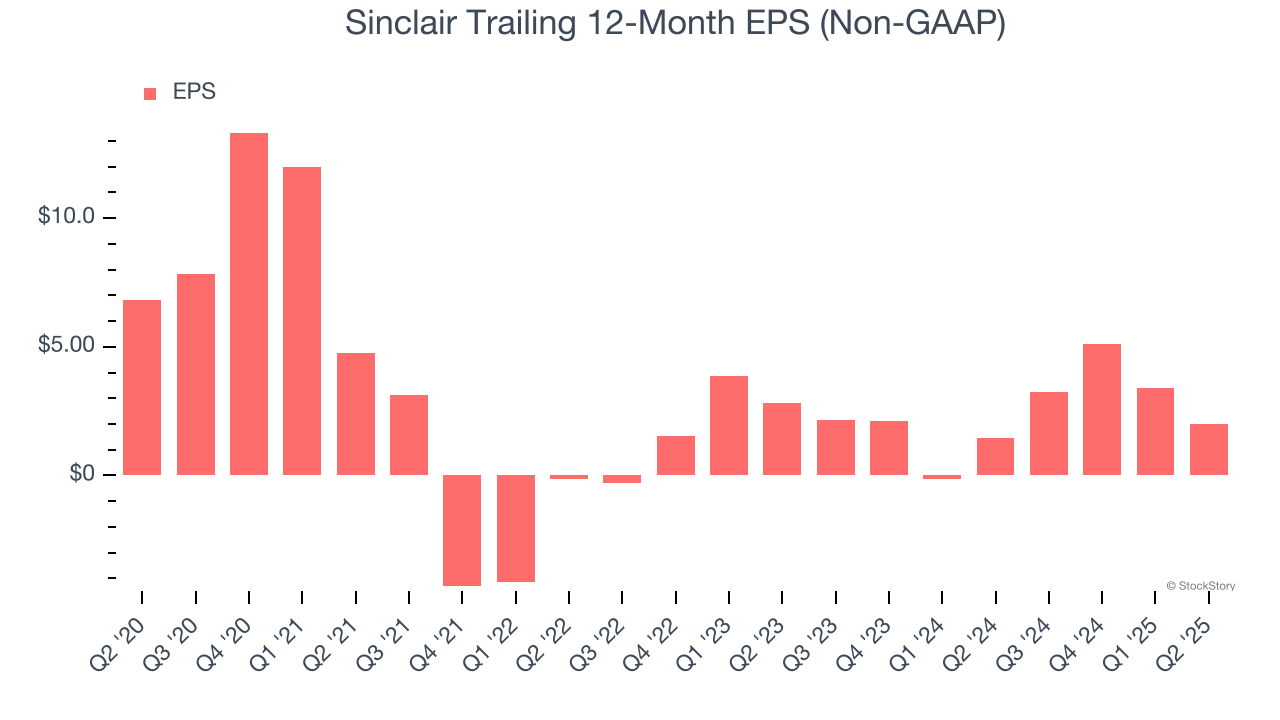

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Sinclair, its EPS declined by 21.9% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

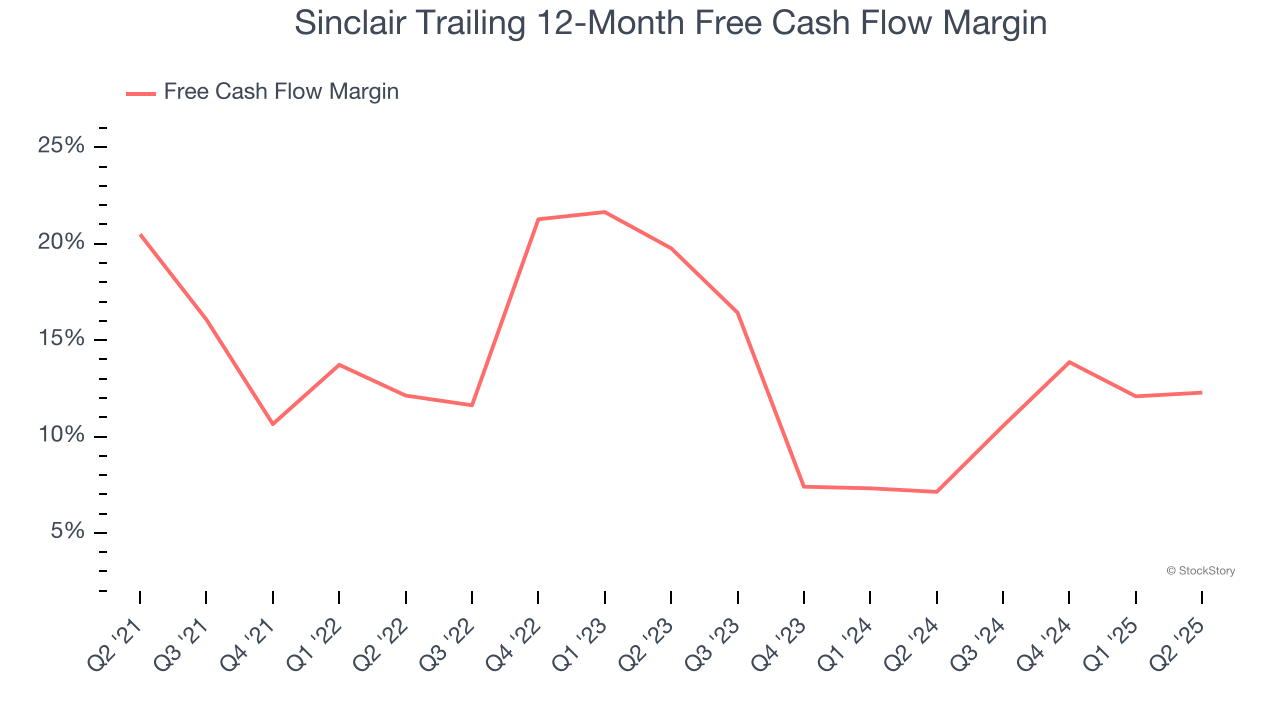

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Sinclair’s margin dropped by 8.2 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Sinclair’s free cash flow margin for the trailing 12 months was 12.3%.

Final Judgment

Sinclair doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 1.9× forward EV-to-EBITDA (or $14.15 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. Let us point you toward the most dominant software business in the world.

Stocks We Like More Than Sinclair

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.