Nova has been on fire lately. In the past six months alone, the company’s stock price has rocketed 43.5%, reaching $404.50 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy NVMI? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Are We Positive On NVMI?

Headquartered in Israel, Nova (NASDAQ:NVMI) is a provider of quality control systems used in semiconductor manufacturing.

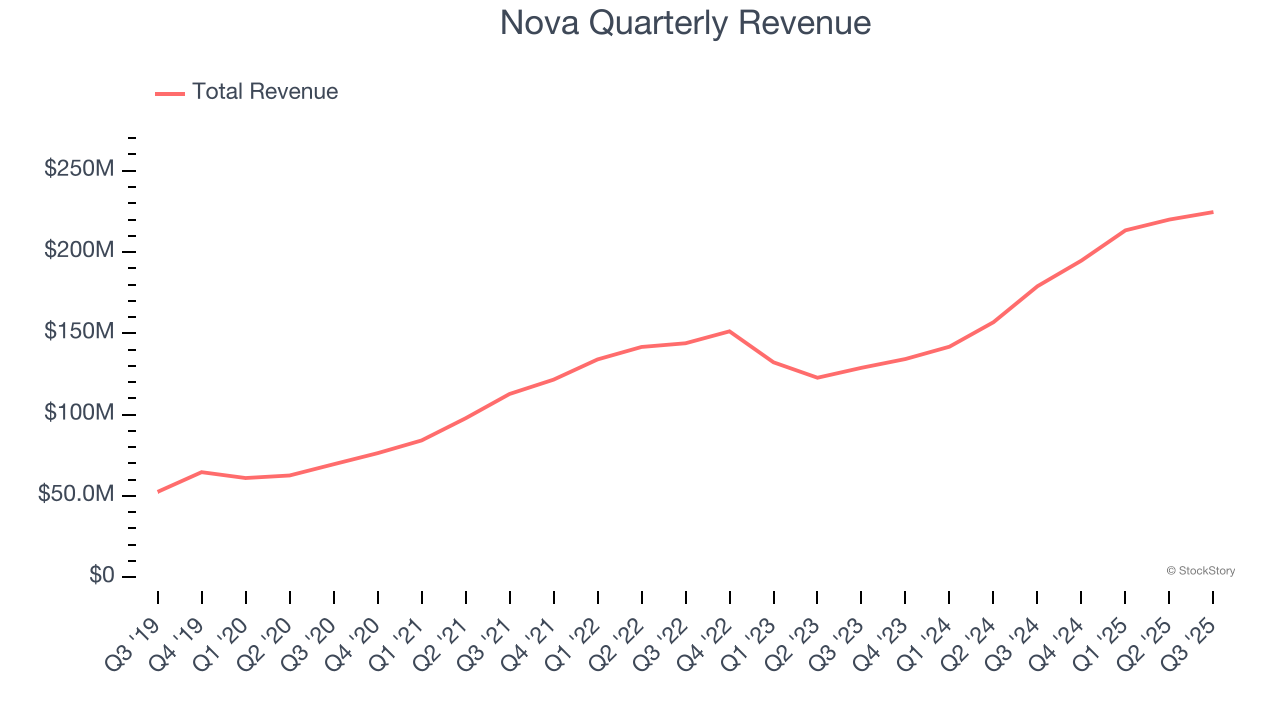

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Nova grew its sales at an incredible 27% compounded annual growth rate. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

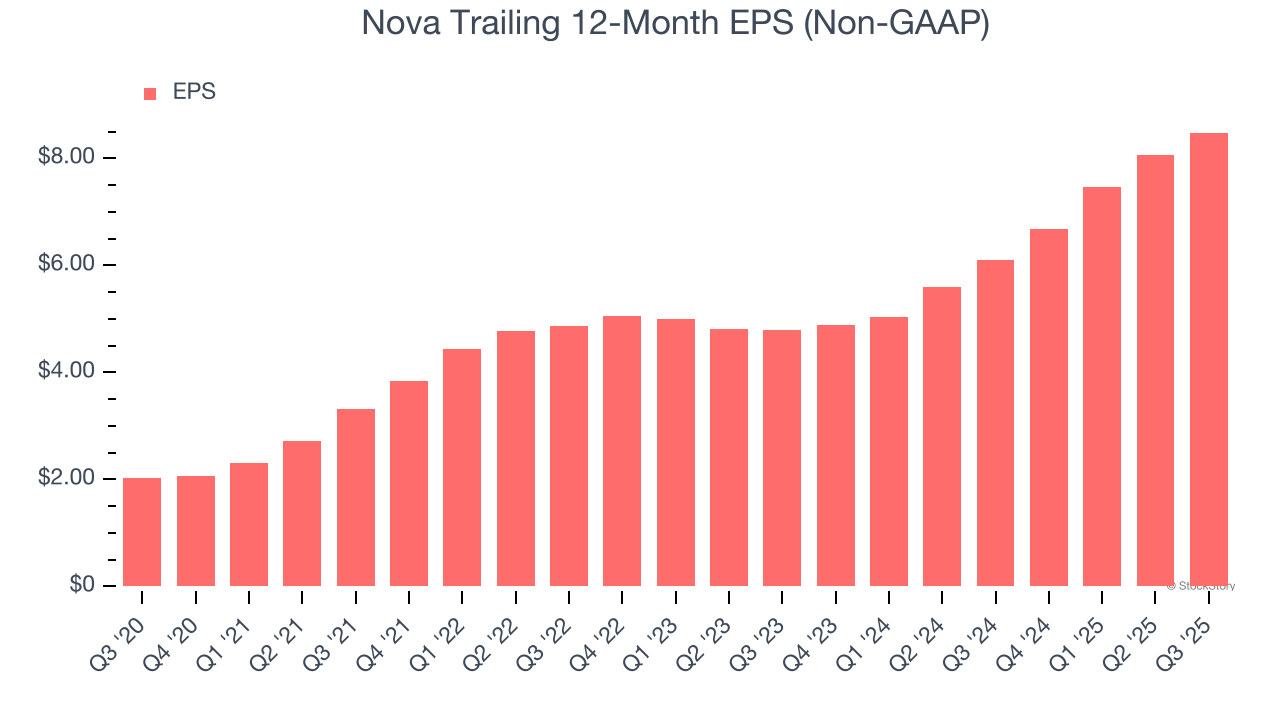

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Nova’s EPS grew at an astounding 33.1% compounded annual growth rate over the last five years, higher than its 27% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

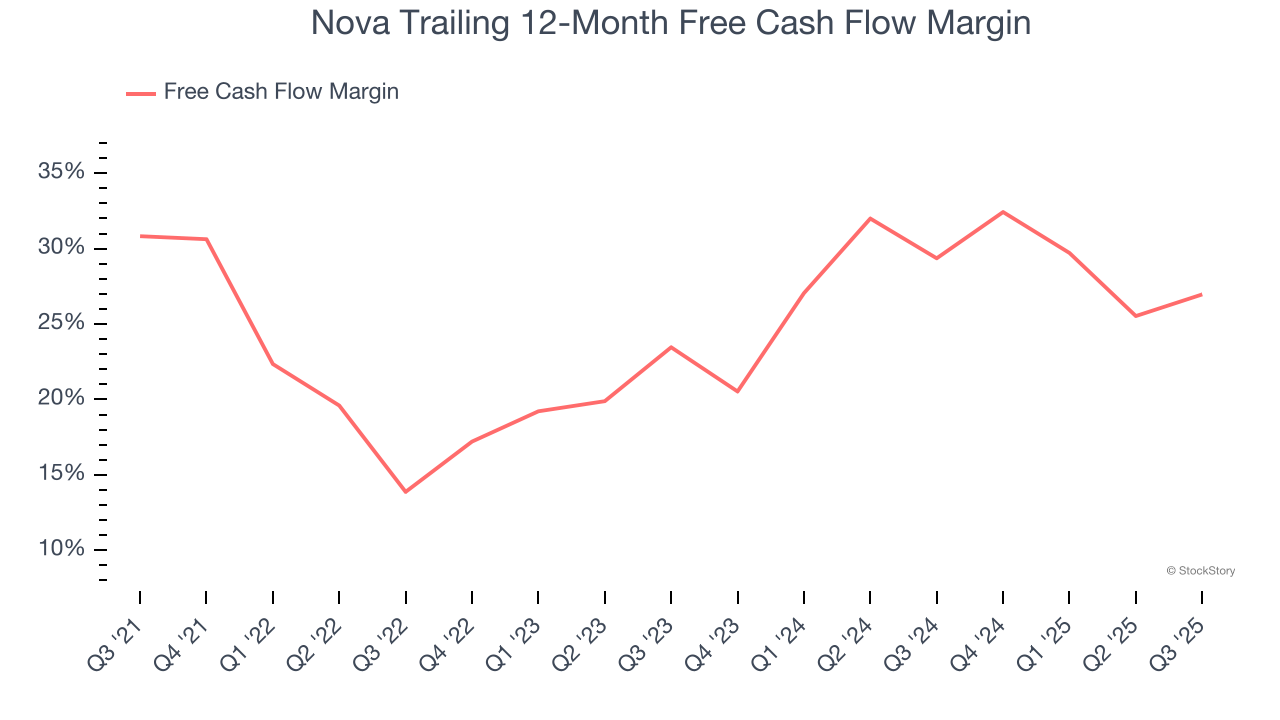

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Nova has shown robust cash profitability, and if it can maintain this level of cash generation, will be in a fine position to ride out cyclical downturns while investing in plenty of new products and returning capital to investors. The company’s free cash flow margin averaged 28% over the last two years, quite impressive for a semiconductor business.

Final Judgment

These are just a few reasons Nova is a rock-solid business worth owning, and after the recent rally, the stock trades at 44.8× forward P/E (or $404.50 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Nova

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.