Aerospace and defense company Boeing (NYSE:BA) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 34.9% year on year to $22.75 billion. Its non-GAAP loss of $1.24 per share was 5.5% above analysts’ consensus estimates.

Is now the time to buy Boeing? Find out by accessing our full research report, it’s free.

Boeing (BA) Q2 CY2025 Highlights:

- Revenue: $22.75 billion vs analyst estimates of $21.67 billion (34.9% year-on-year growth, 5% beat)

- Adjusted EPS: -$1.24 vs analyst estimates of -$1.31 (5.5% beat)

- "As we look to the second half of the year, we remain focused on restoring trust and making continued progress in our recovery while operating in a dynamic global environment." - CEO

- Operating Margin: -0.8%, up from -6.5% in the same quarter last year

- Free Cash Flow was -$200 million compared to -$4.33 billion in the same quarter last year

- Backlog: $618.5 billion at quarter end

- Sales Volumes rose 63% year on year (-32.4% in the same quarter last year)

- Market Capitalization: $178.3 billion

"Our fundamental changes to strengthen safety and quality are producing improved results as we stabilize our operations and deliver higher quality airplanes, products and services to our customers," said Kelly Ortberg, Boeing president and chief executive officer.

Company Overview

One of the companies that forms a duopoly in the commercial aircraft market, Boeing (NYSE:BA) develops, manufactures, and services commercial airplanes, defense products, and space systems.

Revenue Growth

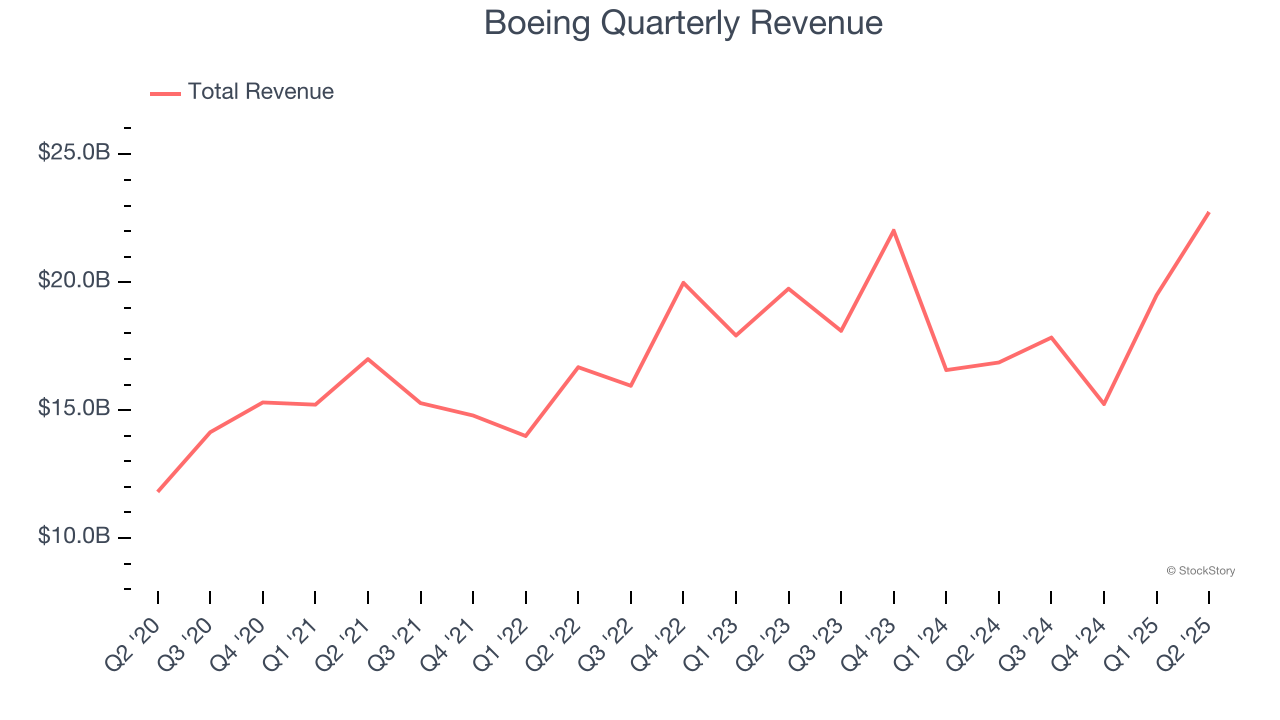

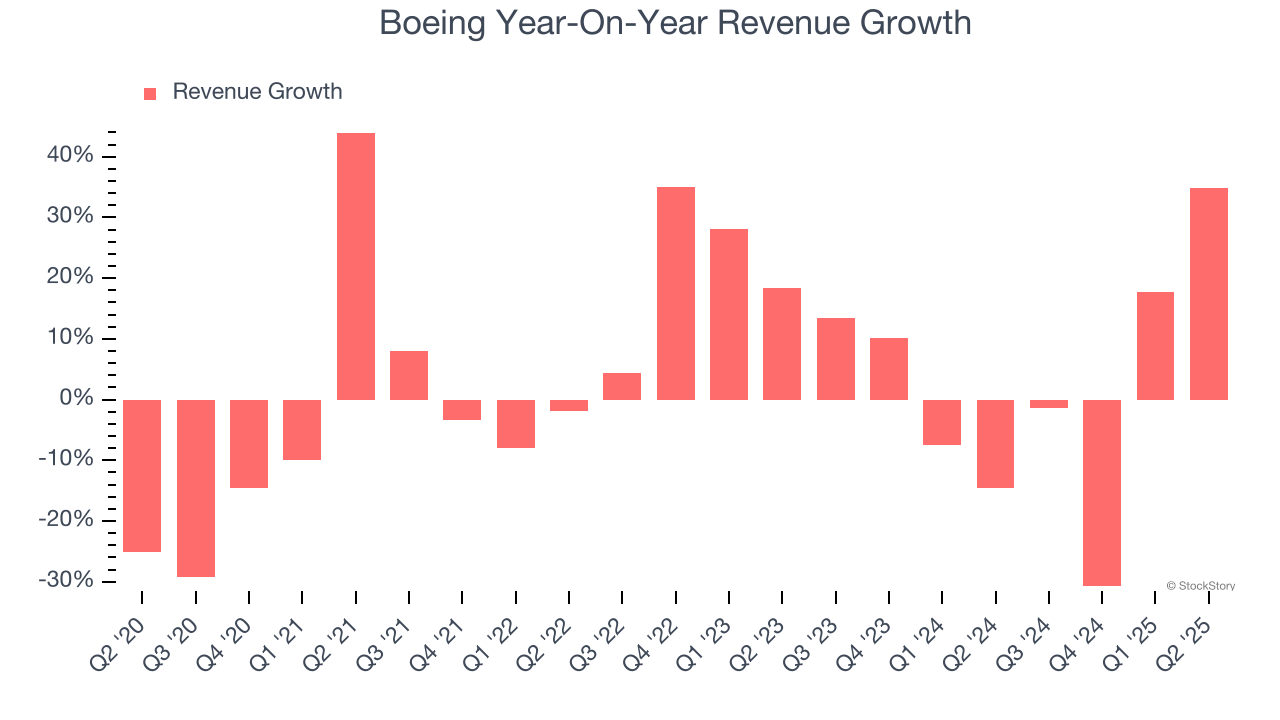

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Boeing’s sales grew at a sluggish 2.5% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Boeing’s recent performance shows its demand has slowed as its annualized revenue growth of 1.2% over the last two years was below its five-year trend.

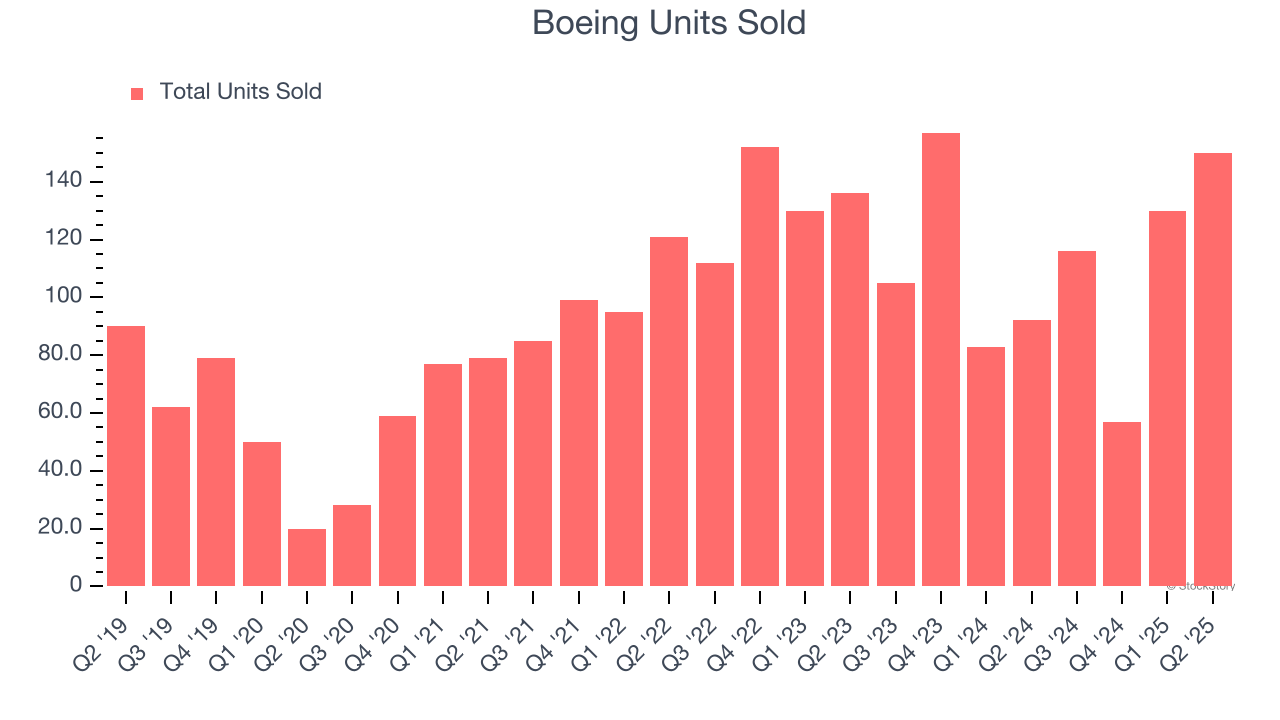

We can better understand the company’s revenue dynamics by analyzing its number of units sold, which reached 150 in the latest quarter. Over the last two years, Boeing’s units sold were flat. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Boeing reported wonderful year-on-year revenue growth of 34.9%, and its $22.75 billion of revenue exceeded Wall Street’s estimates by 5.3%.

Looking ahead, sell-side analysts expect revenue to grow 19.8% over the next 12 months, an improvement versus the last two years. This projection is eye-popping for a company of its scale and implies its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

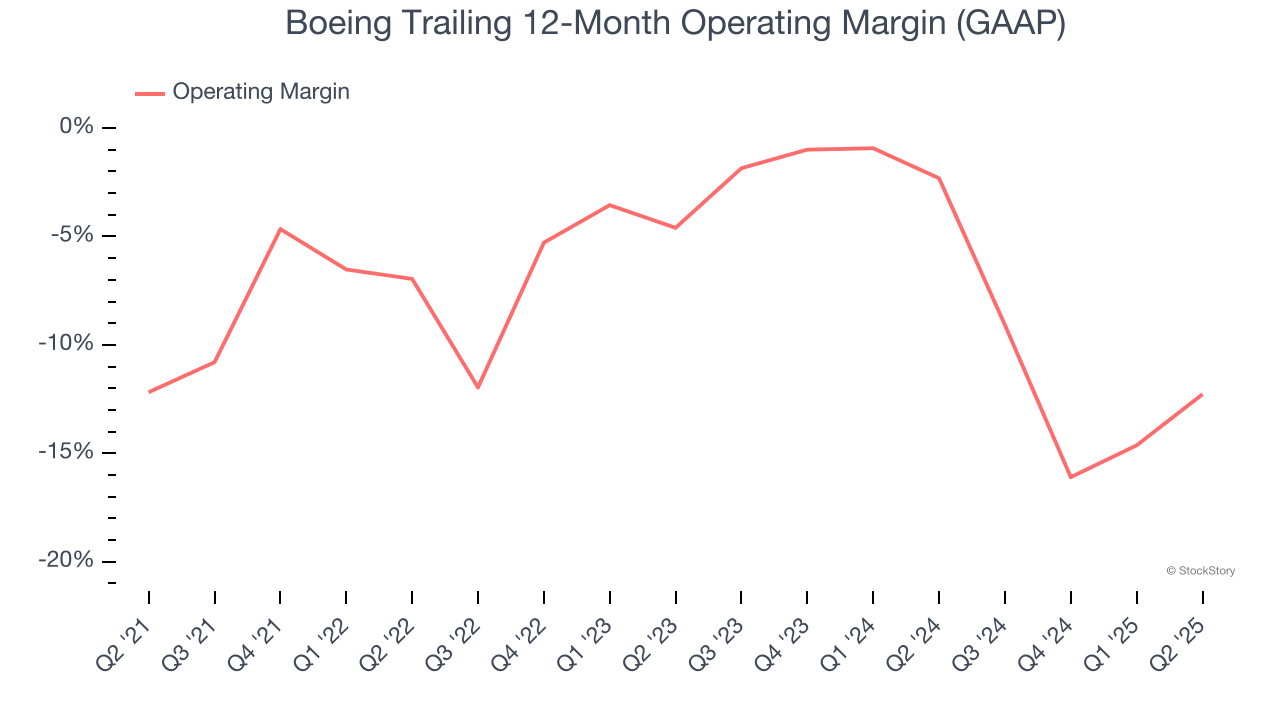

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Boeing’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging negative 7.6% over the last five years. Unprofitable industrials companies that fail to improve their losses or grow sales rapidly deserve extra scrutiny. For the time being, it’s unclear if Boeing’s business model is sustainable.

Analyzing the trend in its profitability, Boeing’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Boeing generated a negative 0.8% operating margin. The company's consistent lack of profits raise a flag.

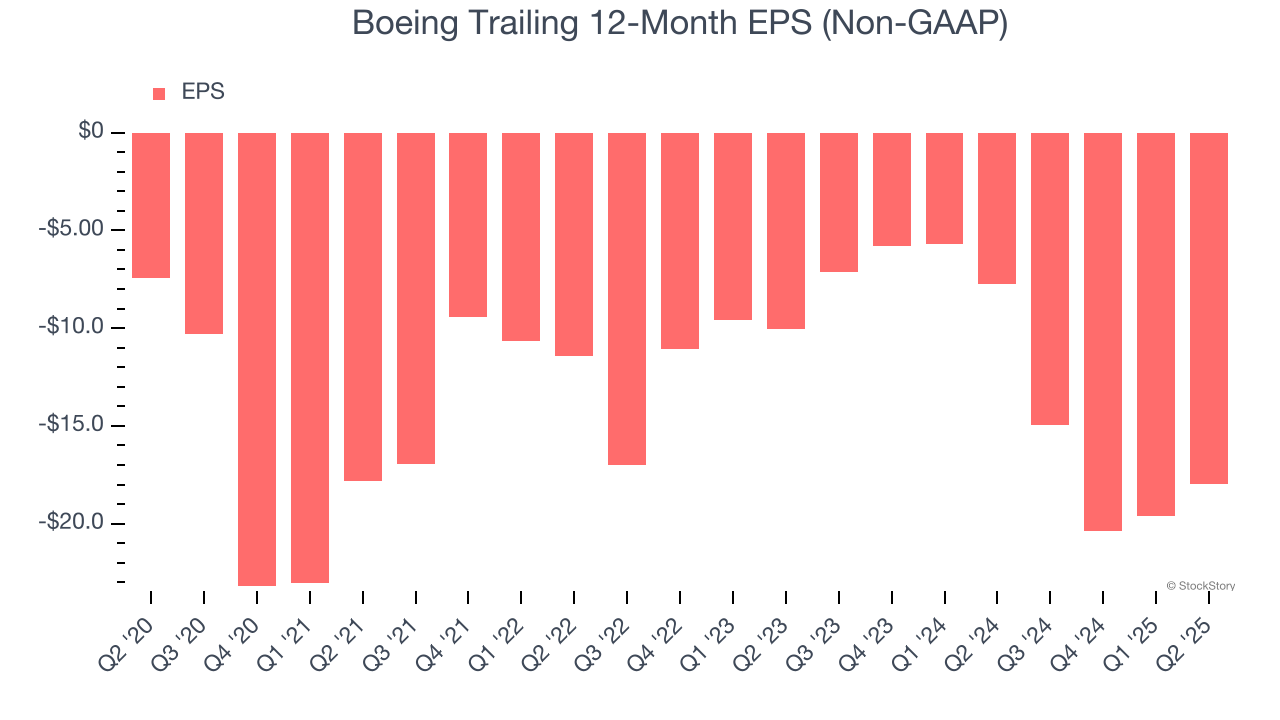

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Boeing’s earnings losses deepened over the last five years as its EPS dropped 19.3% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Boeing’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Boeing, its two-year annual EPS declines of 33.8% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q2, Boeing reported EPS at negative $1.24, up from negative $2.90 in the same quarter last year. This print beat analysts’ estimates by 5.5%. Over the next 12 months, Wall Street is optimistic. Analysts forecast Boeing’s full-year EPS of negative $17.95 will flip to positive $1.34.

Key Takeaways from Boeing’s Q2 Results

We were impressed by how significantly Boeing blew past analysts’ sales volume expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Lastly, its operating loss narrowed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 2.2% to $241.50 immediately after reporting.

Indeed, Boeing had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.