Boeing Co (BA)

248.43

-3.72 (-1.48%)

NYSE · Last Trade: Jan 26th, 9:10 PM EST

Detailed Quote

| Previous Close | 252.15 |

|---|---|

| Open | 251.49 |

| Bid | 248.52 |

| Ask | 248.87 |

| Day's Range | 247.41 - 251.59 |

| 52 Week Range | 128.88 - 254.14 |

| Volume | 8,469,164 |

| Market Cap | 145.62B |

| PE Ratio (TTM) | -15.06 |

| EPS (TTM) | -16.5 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 8,037,499 |

Chart

About Boeing Co (BA)

Boeing Co is a leading aerospace company that designs, manufactures, and sells airplanes, rotorcraft, rockets, satellites, and telecommunications equipment worldwide. The company serves a wide range of customers, including commercial airlines, government agencies, and defense organizations, providing innovative solutions for air travel and space exploration. Through its diverse portfolio, Boeing is involved in both commercial and military aircraft production, as well as technologies related to space and satellite operations, aiming to enhance global connectivity and advance aerospace technology. Additionally, Boeing engages in maintenance, repair, and logistics services to support its products throughout their lifecycle. Read More

News & Press Releases

Boeing is expected to report results for its fiscal fourth quarter on Tuesday, January 27, with a conference call scheduled for 10:30 am EDT.

Via Talk Markets · January 26, 2026

As the opening bell rang on January 26, 2026, the equity markets found themselves at a historic crossroads. J.P. Morgan Global Research has issued a stark warning regarding the unprecedented concentration of the S&P 500, revealing that the top 20 stocks now command a staggering 50.8% of

Via MarketMinute · January 26, 2026

The American manufacturing sector started 2026 on a tentative note, as the S&P Global US Manufacturing PMI for January posted a reading of 51.9. While any number above 50 indicates expansion, the marginal increase from December’s 51.8 masked a deepening divide within the industrial economy. Despite

Via MarketMinute · January 26, 2026

Boeing is ramping up deliveries after delays, production caps in 2025. Shares of the Dow Jones plane maker trade above a buy point.

Via Investor's Business Daily · January 26, 2026

RTX (RTX) Q3 2024 Earnings Call Transcript

Via The Motley Fool · January 26, 2026

Boeing (BA: NYSE) shares surged to a fresh 52-week high of $254.14 in mid-January, marking a significant psychological and financial milestone for the aerospace giant as it prepares to report its fourth-quarter and full-year 2025 earnings. This rally, which has seen the stock climb over 40% from its 12-month

Via MarketMinute · January 26, 2026

As the financial markets open on January 26, 2026, The Boeing Company (NYSE: BA) finds itself at the center of a high-stakes "Reconstruction Era." After years of crisis management, the aerospace giant is finally shifting its focus back to industrial execution and quality stabilization. With a stock price hovering around

Via MarketMinute · January 26, 2026

As of January 26, 2026, Southwest Airlines (NYSE: LUV) stands at the most significant crossroads in its 55-year history. Known for decades as the "Maverick" of the skies—a carrier that defied industry norms with open seating, a point-to-point network, and a refusal to charge for checked bags—Southwest is currently in the midst of a radical [...]

Via Finterra · January 26, 2026

As of January 26, 2026, American Airlines Group Inc. (NASDAQ: AAL) stands at a critical juncture in its post-pandemic evolution. Once characterized by the industry’s heaviest debt load and a series of strategic pivots that alienated corporate travel partners, the Fort Worth-based carrier has spent the last 24 months in a state of "operational righting." [...]

Via Finterra · January 26, 2026

As of January 26, 2026, the global aviation industry is navigating a paradoxical landscape of record-breaking revenues and intensified operational volatility. At the center of this narrative is United Airlines Holdings, Inc. (Nasdaq: UAL), a carrier that has spent the last five years undergoing perhaps the most ambitious transformation in its century-long history. United is [...]

Via Finterra · January 26, 2026

As of January 26, 2026, the aviation industry finds itself at a critical juncture, caught between the soaring highs of record-breaking premium travel demand and the brutal operational realities of an increasingly volatile climate. At the center of this narrative is Delta Air Lines (NYSE: DAL), a carrier that has spent the last decade reinventing [...]

Via Finterra · January 26, 2026

As the calendar turns to late January 2026, the American corporate landscape is undergoing its most significant fiscal transformation in nearly a decade. The 'One Big Beautiful Bill Act' (OBBBA), signed into law in mid-2025, has officially moved from legislative text to market-moving reality. With a staggering $285 billion stimulus

Via MarketMinute · January 26, 2026

Via Benzinga · January 26, 2026

The stocks in this article are all trading near their 52-week highs.

This strength often reflects positive developments such as new product launches, favorable industry trends, or improved financial performance.

Via StockStory · January 25, 2026

Aerospace and defense company Boeing (NYSE:BA)

will be reporting results this Tuesday before market hours. Here’s what you need to know.

Via StockStory · January 25, 2026

Markets face one of the most consequential weeks of 2026 with an extraordinary convergence of events including Wednesday's Federal Reserve meeting at 2:00pm, multiple speeches by President Trump on Tuesday and Wednesday, and a blockbuster earnings li...

Via Barchart.com · January 25, 2026

Two recent deals with Palantir and GE Aerospace are transforming this growth stock's growth prospects.

Via The Motley Fool · January 24, 2026

The week in tech and autos featured Tesla hiking FSD prices and releasing Q4 estimates, GM reshaping production amid an NHTSA probe, and Boeing securing a surge in foreign government contracts.

Via Benzinga · January 24, 2026

If Trump follows through on his dividend ban threat, two (or three) defense stocks could be at particular risk.

Via The Motley Fool · January 24, 2026

These two stocks are highly complementary and help diversify an investor's portfolio.

Via The Motley Fool · January 23, 2026

On January 22, 2026, GE Aerospace (NYSE:GE) delivered a fourth-quarter earnings report that, by almost any traditional metric, signaled a company operating at the peak of its powers. The industrial giant posted record orders of $27 billion and raised its future profit targets, yet the market’s response was

Via MarketMinute · January 23, 2026

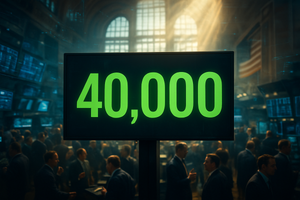

In May 2024, the financial world witnessed a historic realignment of market expectations as the Dow Jones Industrial Average (DJI) breached the 40,000-point threshold for the first time in its 128-year history. This milestone, achieved during the third week of May, was far more than a numerical curiosity; it

Via MarketMinute · January 23, 2026

As the 2025 fiscal year concludes, the aviation industry is witnessing a profound transformation in how profits are generated, with United Airlines (NASDAQ:UAL) standing at the epicenter of this shift. On January 23, 2026, the Chicago-based carrier reported fourth-quarter results that not only shattered revenue records but also highlighted

Via MarketMinute · January 23, 2026

On January 22, 2026, GE Aerospace (NYSE: GE) delivered what many analysts would consider a textbook "beat and raise" performance for its fourth quarter and full-year 2025. The results showcased a company at the peak of its powers, commanding a historic $190 billion backlog and riding an unprecedented "super-cycle" in

Via MarketMinute · January 23, 2026

As of January 23, 2026, Carrier Global Corporation (NYSE: CARR) stands at a pivotal crossroads. Over the last 24 months, the Florida-based climate giant has executed one of the most aggressive portfolio overhauls in the industrial sector, shedding its legacy conglomerate skin to emerge as a streamlined, "pure-play" leader in sustainable climate and energy solutions. [...]

Via Finterra · January 23, 2026