Interactive Brokers Group, Inc. - Class A Common Stock (IBKR)

76.66

-0.54 (-0.70%)

NASDAQ · Last Trade: Feb 11th, 9:54 AM EST

Detailed Quote

| Previous Close | 77.20 |

|---|---|

| Open | 77.63 |

| Bid | 76.61 |

| Ask | 76.77 |

| Day's Range | 76.60 - 77.85 |

| 52 Week Range | 32.82 - 79.18 |

| Volume | 165,730 |

| Market Cap | 4.91B |

| PE Ratio (TTM) | 8.781 |

| EPS (TTM) | 8.7 |

| Dividend & Yield | 0.3200 (0.42%) |

| 1 Month Average Volume | 5,875,453 |

Chart

About Interactive Brokers Group, Inc. - Class A Common Stock (IBKR)

Interactive Brokers is a global brokerage firm that provides a wide range of financial services primarily to individual and institutional investors. The company offers a robust trading platform that facilitates the buying and selling of various financial instruments, including stocks, options, futures, and forex, across multiple markets. With a strong emphasis on technology and low-cost trading, Interactive Brokers aims to empower its clients with advanced tools and research capabilities, enabling them to make informed investment decisions. Additionally, the firm provides comprehensive investment management services and educational resources to enhance clients' trading experiences. Read More

News & Press Releases

Interactive Brokers (NASDAQ:IBKR) on Tuesday launched Coinbase

Via Benzinga · February 10, 2026

Date: February 10, 2026 Introduction In the volatile tapestry of American fintech, few names evoke as much passion and controversy as Robinhood Markets, Inc. (NASDAQ: HOOD). Once the poster child for the "meme stock" revolution and a lightning rod for regulatory scrutiny, Robinhood has undergone a metamorphosis that few analysts predicted five years ago. As [...]

Via Finterra · February 10, 2026

Interactive Brokers (Nasdaq: IBKR), an automated global electronic broker, today announced the launch of Coinbase Derivatives, LLC nano Bitcoin and nano Ether futures contracts for trading on the IBKR platform. These new products are available with monthly expirations or as perpetual-style contracts, offering eligible clients a cost-effective way to gain exposure to cryptocurrency and manage risk within a regulated framework, with trading available 24/7.

By Interactive Brokers · Via Business Wire · February 10, 2026

Why Interactive Brokers Group Stock Crept Higher on Mondayfool.com

The company continues to reap the benefits of robust securities trading on U.S. markets.

Via The Motley Fool · February 2, 2026

CNBC's Halftime Report featured stock picks from Bryn Talkington, Stephen Weiss, Jim Lebenthal, and Joe Terranova, including INFL, AMZN, RIG, and IBKR.

Via Benzinga · February 10, 2026

Market volatility has dropped since the recent correction, but with plenty of items on the news front, we could see a volatility spike at any point. That could mean it’s a good time to look for stock with a low implied volatility percentile.

Via Barchart.com · February 10, 2026

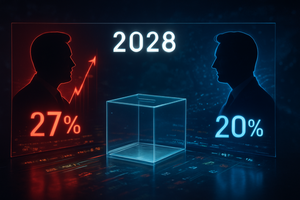

As the United States settles into the second year of the second Trump administration, the political world is already looking toward the horizon. While the 2026 midterms are the immediate hurdle, prediction markets are buzzing with high-stakes activity surrounding the 2028 Presidential Election. The early favorites have emerged with startling clarity: Vice President JD Vance [...]

Via PredictStreet · February 9, 2026

As the countdown to the end of Jerome Powell’s tenure at the Federal Reserve begins, prediction markets have reached a state of near-unanimity. Kevin Warsh, the former Fed Governor and long-time favorite of the Republican establishment, has emerged as the overwhelming frontrunner to be the next Chair of the Federal Reserve. According to data from [...]

Via PredictStreet · February 9, 2026

March S&P 500 E-Mini futures (ESH26) are down -0.25%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.46% this morning, pointing to a lower open on Wall Street as rising Treasury yields curbed investors’ risk appetite.

Via Barchart.com · February 9, 2026

As the prediction market industry enters its most volatile and high-stakes year to date, the internal rivalry between the sector’s two largest titans has spilled over into the markets themselves. On Manifold Markets, a high-liquidity "meta-market" titled "Top 1 prediction market by volume in 2026?" has become the primary scoreboard for what insiders are calling [...]

Via PredictStreet · February 8, 2026

The high-stakes world of prediction markets is currently facing its most existential threat since the landmark 2024 election cycle. As of February 8, 2026, Kalshi—the first federally regulated prediction market—is locked in what legal scholars are calling a "guerrilla war" with state gaming regulators in Massachusetts, Nevada, and Connecticut. At the heart of the conflict [...]

Via PredictStreet · February 8, 2026

While the dust of the 2024 election has long since settled, the gaze of the political and financial worlds has already shifted toward the next horizon. As of February 7, 2026, prediction markets for the 2028 Democratic Nominee have reached an unprecedented level of early activity. On Kalshi, the premier regulated event contract exchange, the [...]

Via PredictStreet · February 7, 2026

The race to lead the world’s most powerful financial institution has moved from the boardrooms of Washington to the high-stakes arena of prediction markets. As of February 7, 2026, Kevin Warsh has emerged as the overwhelming favorite to succeed Jerome Powell as Chair of the Federal Reserve, commanding a staggering 94% probability on the prediction [...]

Via PredictStreet · February 7, 2026

Robinhood advanced with crypto as volatility and trading engagement shaped positioning ahead of the company’s earnings report.

Via The Motley Fool · February 6, 2026

In the world of retail finance, the "meme stock" era has officially been replaced by the "event contract" era. Leading this charge is Robinhood (NASDAQ: HOOD), which has successfully pivoted its massive user base from speculative equity trading toward the rapidly expanding frontier of prediction markets. As of early February 2026, the platform has moved [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the traditional landscape of geopolitical analysis is undergoing a radical transformation. While cable news pundits and academic experts grapple with the nuances of diplomatic cables and legislative posturing, a more precise—and often more brutal—barometer has emerged: the prediction market. In the first week of February, these markets have become the [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the prediction market industry is no longer just a niche playground for political junkies; it is the front line of a massive constitutional and regulatory war. At the center of this storm is Kalshi, the federally regulated exchange that has spent the last year oscillating between landmark legal victories and [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the global financial landscape is characterized by a "new normal" of elevated volatility and a pervasive "options-ification" of retail and institutional portfolios. Standing at the epicenter of this transformation is Cboe Global Markets, Inc. (CBOE: CBOE), an exchange operator that has evolved from a niche Chicago-based floor for options into [...]

Via Finterra · February 6, 2026

The legal boundary between a "hedge" and a "bet" has reached a breaking point. As of February 5, 2026, the prediction market industry is locked in what experts are calling a "jurisdictional civil war," pitting the federally regulated exchange Kalshi against a phalanx of state regulators. At the heart of the storm is a question [...]

Via PredictStreet · February 5, 2026

While the dust of the 2024 election cycle has barely settled, the financial world is already placing its bets on the next battle for the White House. As of February 2026, prediction markets—the once-niche platforms that successfully forecasted the 2024 outcome with surgical precision—are signaling a clear trajectory for the 2028 U.S. Presidential Election. Vice [...]

Via PredictStreet · February 5, 2026

The global financial landscape has shifted into a new era of "Information Finance," or InfoFi, where the most valuable commodity is not gold or oil, but the "truth." As of February 5, 2026, the battle for dominance in this sector has narrowed down to two titans: Polymarket, the decentralized, crypto-native pioneer, and Kalshi, the regulated, [...]

Via PredictStreet · February 5, 2026

The stock brokerage keeps reporting strong growth and gaining market share.

Via The Motley Fool · February 4, 2026

A number of stocks traded in opposite directions in the afternoon session after the market slid following the release of weaker-than-expected private-sector employment data, fueling concerns about a cooling economy. According to the ADP report, U.S. private employers added only 22,000 jobs in January, falling significantly short of economists' estimates of 45,000. This miss signals that the multi-year cooling in labor demand has continued into the new year. The disappointing data added to existing market pressures, particularly on the tech sector, as investors weigh the implications of a potential economic slowdown on corporate earnings and growth prospects.

Via StockStory · February 4, 2026

Interactive Brokers Group, Inc. (Nasdaq: IBKR) announces that its Chairman Thomas Peterffy will speak at the BofA Securities 2026 Financial Services Conference on Tuesday, February 10th at 1:50 p.m. ET.

By Interactive Brokers Group, Inc. · Via Business Wire · February 3, 2026

The Charles Schwab Corporation (SCHW:NYSE) has officially turned the page on the era of regional banking anxiety and "cash sorting" that defined its recent history. Following its comprehensive earnings summary and a major leadership restructuring announcement on January 30, 2026, the financial services giant demonstrated a robust recovery, posting

Via MarketMinute · February 2, 2026