Newmont Mining (NEM)

116.96

+0.67 (0.58%)

NYSE · Last Trade: Mar 9th, 5:48 PM EDT

Detailed Quote

| Previous Close | 116.29 |

|---|---|

| Open | 112.32 |

| Bid | 116.80 |

| Ask | 117.07 |

| Day's Range | 109.30 - 117.09 |

| 52 Week Range | 42.03 - 134.88 |

| Volume | 9,442,541 |

| Market Cap | 92.75B |

| PE Ratio (TTM) | 18.30 |

| EPS (TTM) | 6.4 |

| Dividend & Yield | 1.000 (0.85%) |

| 1 Month Average Volume | 9,292,807 |

Chart

About Newmont Mining (NEM)

Newmont Mining is a leading global gold mining company that specializes in the exploration, extraction, and production of gold and other precious metals. With operations spanning multiple continents, Newmont focuses on sustainable mining practices while actively pursuing opportunities to enhance its operational efficiency and reduce environmental impacts. The company is committed to responsible resource management, community engagement, and the advancement of safety standards in the mining sector. Through its diverse portfolio of mines and projects, Newmont continues to play a significant role in the gold industry, catering to the demand for this vital resource. Read More

News & Press Releases

March 9, 2026 — The global financial landscape has been fundamentally reshaped in the opening months of 2026, as a historic surge in precious metals prices sends shockwaves through international markets. Driven by a catastrophic escalation of geopolitical conflict in the Middle East, gold and silver have transcended their traditional roles

Via MarketMinute · March 9, 2026

The opening quarter of 2026 has ushered in a dramatic transformation across the U.S. equity landscape, as the multi-year dominance of mega-cap technology gives way to a broad-based "Great Rotation." Investors are aggressively reallocating capital out of the high-flying artificial intelligence (AI) and software sectors, pivoting instead toward the

Via MarketMinute · March 9, 2026

Applying Peter Lynch's GARP Strategy to Newmont Corp (NYSE:NEM)chartmill.com

Via Chartmill · March 5, 2026

Gold rose along with geopolitical tensions, and Newmont delivered an earnings beat.

Via The Motley Fool · March 9, 2026

Two macroeconomic factors are affecting Newmont stock today.

Via The Motley Fool · March 9, 2026

By: MarketMinute

In a startling divergence from historical market behavior, precious metals saw a significant sell-off on March 9, 2026, even as energy markets braced for an inflationary shock. Gold futures fell 1.24% to settle at $5,107 per ounce, while silver dropped 1.32% to $83.33 per

Via MarketMinute · March 9, 2026

As of March 9, 2026, the global gold market is witnessing an unprecedented regional decoupling that has left analysts and bullion traders stunned. While the yellow metal has surged to historic highs—trading in a volatile range between $5,100 and $5,400 per ounce—the two largest physical consumers,

Via MarketMinute · March 9, 2026

The United States economy was sent into a tailspin this past week following the release of a devastating February jobs report that has shattered the prevailing "soft landing" narrative. On March 6, 2026, the Bureau of Labor Statistics revealed an unexpected contraction of 92,000 jobs, a stark reversal from

Via MarketMinute · March 9, 2026

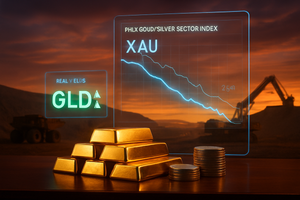

The traditional status of gold as a "safe haven" faced its most severe test in a decade last week as institutional investors executed a historic retreat from precious metals. On March 4, 2026, the SPDR Gold Trust (NYSE Arca: GLD) recorded a staggering net cash outflow of $2.91 billion

Via MarketMinute · March 9, 2026

The global financial landscape has been thrust into a state of high-intensity volatility as of March 9, 2026. Following a series of precision strikes by U.S. and Israeli forces on critical Iranian oil facilities—part of the escalating "Operation Epic Fury"—Brent crude oil prices have skyrocketed past the

Via MarketMinute · March 9, 2026

Precious metals experienced a sharp correction on Monday, March 9, 2026, as a resurgent U.S. dollar and climbing Treasury yields forced investors to lock in profits following a historic multi-month rally. Spot gold fell 2.5% to settle at $5,041.89 per ounce, while silver took a more

Via MarketMinute · March 9, 2026

Which S&P500 stocks are moving before the opening bell on Monday?chartmill.com

Via Chartmill · March 9, 2026

Investors in the gold stock have more than doubled their money in one year. What's next?

Via The Motley Fool · March 9, 2026

Should you buy the dip in the gold stock?

Via The Motley Fool · March 6, 2026

The global financial landscape has shifted dramatically as the first quarter of 2026 draws to a close. After years of relentless strength that pressured global trade and emerging markets, the U.S. Dollar Index (DXY) has finally begun a sustained retreat, falling from its 2025 peaks to stabilize in the

Via MarketMinute · March 6, 2026

March 6, 2026 — Global financial markets are reeling as gold futures successfully breached the unprecedented $5,300 per troy ounce milestone this week, cementing the precious metal's status as the ultimate hedge in an era of systemic instability. The rally, which saw spot prices peak as high as $5,594

Via MarketMinute · March 6, 2026

As of March 5, 2026, the global financial landscape is grappling with a tectonic shift in capital flows as China’s major financial institutions continue a systematic retreat from the U.S. Treasury market. Recent data confirms that China’s holdings of American sovereign debt have plummeted to levels not

Via MarketMinute · March 5, 2026

On March 5, 2026, the global financial landscape is witnessing a historic fracture in the traditional relationship between geopolitical risk and safe-haven assets. US Treasury yields have surged to multi-month highs, with the benchmark 10-year Treasury note climbing to 4.14%, as investors find themselves trapped in a violent "tug-of-war.

Via MarketMinute · March 5, 2026

The precious metals sector has staged a remarkable rally in early March 2026, as the PHLX Gold/Silver Sector Index (XAU) tests historic highs amid a massive influx of institutional capital. Driven by a significant decline in inflation-adjusted "real" yields, investors have aggressively rotated into gold-backed assets, resulting in over

Via MarketMinute · March 5, 2026

As the first quarter of 2026 unfolds, the gold mining sector has transformed from a traditional defensive harbor into a high-octane engine for portfolio growth. With spot gold prices surging toward the $6,300 per ounce mark, the industry’s heavyweights are witnessing a fundamental re-rating. Recent research notes from

Via MarketMinute · March 5, 2026

As of March 5, 2026, the global financial landscape is still reeling from the most significant constitutional and economic collision in decades. Following the February 20 decision by the U.S. Supreme Court to strike down President Trump’s sweeping "Liberation Day" tariffs, a vacuum of fiscal uncertainty has pulled

Via MarketMinute · March 5, 2026

The global financial landscape has been thrown into a state of high-intensity volatility following the commencement of a massive, coordinated military campaign by the United States and Israel against Iranian strategic targets. As of today, March 5, 2026, the geopolitical landscape has shifted fundamentally, sending shockwaves through commodity pits and

Via MarketMinute · March 5, 2026

March 4, 2026 — The global financial landscape has been fundamentally altered this week as precious metals prices hit levels once considered the realm of speculative fiction. Gold has stabilized at a staggering $5,133.40 per ounce, while silver prices recorded a violent 11% surge in just five trading days,

Via MarketMinute · March 4, 2026

The global financial landscape was jolted this week as gold prices surged to a historic all-time high of $4,380 per ounce on Monday, March 2, 2026. The move, driven by a dramatic military escalation in the Middle East and the sudden death of Iran’s Supreme Leader, represented a

Via MarketMinute · March 4, 2026

As of March 4, 2026, the global mining landscape has shifted into an unprecedented phase of profitability that analysts are now calling the “Era of Super-Margins.” With spot gold prices having recently consolidated above the psychological and financial milestone of $5,000 per ounce, the world’s largest miners are

Via MarketMinute · March 4, 2026