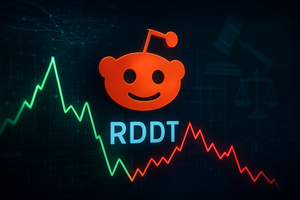

Reddit, Inc. (RDDT)

139.29

-10.69 (-7.13%)

NYSE · Last Trade: Feb 11th, 10:06 PM EST

Detailed Quote

| Previous Close | 149.98 |

|---|---|

| Open | 148.86 |

| Bid | 139.20 |

| Ask | 139.42 |

| Day's Range | 137.25 - 152.44 |

| 52 Week Range | 79.75 - 282.95 |

| Volume | 8,409,724 |

| Market Cap | 18.05B |

| PE Ratio (TTM) | 53.16 |

| EPS (TTM) | 2.6 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 6,546,682 |

Chart

News & Press Releases

Today’s date is February 11, 2026. Introduction AppLovin Corporation (NASDAQ: APP) stands at a critical crossroads as it prepares to report its fourth-quarter and full-year 2025 earnings results today. Once viewed as a niche player in the mobile gaming space, the company has undergone one of the most aggressive and successful corporate transformations in recent [...]

Via Finterra · February 11, 2026

The stock market can act irrationally in the short term.

Via The Motley Fool · February 11, 2026

Date: February 10, 2026 Introduction For years, Gilead Sciences, Inc. (Nasdaq: GILD) was characterized by investors as a "value trap"—a cash-rich biopharma giant that had lost its way after the historic, yet short-lived, success of its Hepatitis C cures. However, as of early 2026, that narrative has shifted dramatically. Gilead has successfully executed a "second [...]

Via Finterra · February 10, 2026

Reddit Inc. (NYSE:RDDT) Soars on Strong Q4 Earnings Beat and $1 Billion Buyback Announcementchartmill.com

Via Chartmill · February 5, 2026

Today is February 10, 2026. The telehealth landscape stands at a historic inflection point, and no company better embodies this volatility than Hims & Hers Health, Inc. (NYSE: HIMS). After a meteoric rise in 2024 and early 2025, the company is currently navigating a "regulatory double whammy" that has sent its stock price tumbling and [...]

Via Finterra · February 10, 2026

As of February 10, 2026, the landscape of work has fundamentally shifted. The "gig economy," once a buzzword for side hustles, has matured into a sophisticated global marketplace for high-end digital talent. At the epicenter of this transformation is Upwork Inc. (NASDAQ: UPWK). Once viewed as a simple platform for connecting small businesses with freelance [...]

Via Finterra · February 10, 2026

The stocks in this article have caught Wall Street’s attention in a big way, with price targets implying returns above 20%.

But investors should take these forecasts with a grain of salt because analysts typically say nice things about companies so their firms can win business in other product lines like M&A advisory.

Via StockStory · February 9, 2026

Reddit Shares Are Rallying Today – Here’s Whystocktwits.com

Via Stocktwits · February 5, 2026

People don't trust AI, but they do trust Reddit.

Via The Motley Fool · February 9, 2026

As of February 9, 2026, the medtech landscape is witnessing a pivotal shift centered around the long-awaited return of robotics to the heart of the operating room. Intuitive Surgical, Inc. (NASDAQ: ISRG), the undisputed pioneer of robotic-assisted surgery (RAS), recently secured a landmark FDA clearance for its next-generation da Vinci 5 platform, specifically for use [...]

Via Finterra · February 9, 2026

Today, February 9, 2026, marks a pivotal moment for Monday.com (NASDAQ: MNDY) as the company released its fiscal 2026 revenue guidance. Once the darling of the "Work OS" and software-as-a-service (SaaS) sector, the company is navigating a complex transition from high-velocity growth to mature, multi-product enterprise scaling. While Monday.com remains a powerhouse in organizational efficiency, [...]

Via Finterra · February 9, 2026

The paradox of the "front page of the internet" was on full display this week as Reddit, Inc. (NYSE: RDDT) reported fourth-quarter 2025 financial results that, on paper, should have sent shares soaring. The company delivered a significant beat on both top and bottom lines, fueled by a surge in

Via MarketMinute · February 6, 2026

Baird lowered its price target on Reddit to $200 from $240, and maintained a ‘Neutral’ rating on the shares, saying it updated its model after its quarterly results and outlook.

Via Stocktwits · February 6, 2026

Reddit, Inc. (NASDAQ: RDDT) reports strong Q4 and full-year 2025 results, with 70% revenue growth, $1B buyback and positive market sentiment.

Via Benzinga · February 6, 2026

Check out the companies making headlines this week:

Via StockStory · February 6, 2026

Online community and discussion platform Reddit (NYSE:RDDT) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 69.7% year on year to $725.6 million. On top of that, next quarter’s revenue guidance ($600 million at the midpoint) was surprisingly good and 4.3% above what analysts were expecting. Its GAAP profit of $1.24 per share was 33.1% above analysts’ consensus estimates.

Via StockStory · February 6, 2026

Reddit (RDDT) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 5, 2026

Online community and discussion platform Reddit (NYSE:RDDT) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 69.7% year on year to $725.6 million. On top of that, next quarter’s revenue guidance ($600 million at the midpoint) was surprisingly good and 4.3% above what analysts were expecting. Its GAAP profit of $1.24 per share was 33.1% above analysts’ consensus estimates.

Via StockStory · February 5, 2026

Reddit, Inc. (NYSE: RDDT) today announced financial results for the quarter and full year ended December 31, 2025. Reddit’s complete financial results and management commentary can be found in its shareholder letter on Reddit’s Investor Relations website at https://investor.redditinc.com.

By Reddit, Inc. · Via Business Wire · February 5, 2026

The artificial intelligence industry is bracing for what could be the most significant financial event in tech history. Rumors are intensifying that OpenAI, the creator of ChatGPT, is preparing for an initial public offering (IPO) in late 2026 with a target valuation of $1 trillion. Following a series of massive private funding rounds that most [...]

Via TokenRing AI · February 5, 2026

Reddit Inc (NYSE:RDDT) shares are trading marginally lower on Thursday. The company is set to release its fourth‑quarter earnings report after the market close today.

Via Benzinga · February 5, 2026

Check out the companies making headlines yesterday:

Via StockStory · February 5, 2026

Reddit heads into Q4 earnings with its RSI near 21 and shares down 29% over the past year.

Via Stocktwits · February 5, 2026

Nasdaq, S&P 500 Futures Subdued Ahead Of Amazon Earnings: Why GOOGL, AVGO, MSFT, HOOD Are On Traders' Radar Todaystocktwits.com

Via Stocktwits · February 5, 2026

Shares of online community and discussion platform Reddit (NYSE:RDDT) fell 6.9% in the afternoon session after software stocks continued to pull back as investors assessed the potential for new AI automation tools to compete with established software platforms.

Via StockStory · February 4, 2026