Rio Tinto Plc Common Stock (RIO)

93.32

+0.41 (0.44%)

NYSE · Last Trade: Jan 28th, 3:53 PM EST

As of January 2026, the European aluminum market is grappling with a structural "supply-side squeeze" that has pushed the recycling sector to the brink of a historic transformation. A severe shortage of aluminum scrap across the continent has decoupled secondary metal prices from global primary benchmarks, driving secondary ingot prices

Via MarketMinute · January 28, 2026

In a definitive signal of its operational recovery, Vale S.A. (NYSE: VALE) has announced that its 2025 iron ore production exceeded the upper limit of its annual guidance, effectively reclaiming its title as the world’s largest iron ore producer. The Brazilian mining giant reported a total output of

Via MarketMinute · January 28, 2026

Industrial markets reached a major inflection point this week as aluminum prices surged to a fresh multi-year peak, driven by a perfect storm of tightening global supply and a plummeting U.S. currency. On January 28, 2026, the light metal hit $3,289.55 per tonne on the London Metal

Via MarketMinute · January 28, 2026

As of January 1, 2026, the European Union has officially entered the "definitive phase" of its Carbon Border Adjustment Mechanism (CBAM), ending the era of carbon-free imports for energy-intensive commodities. For the first time, importers of steel, aluminium, cement, electricity, fertilizers, and hydrogen must account for the carbon footprint of

Via MarketMinute · January 27, 2026

As of January 27, 2026, the European aluminum market has entered a period of intense volatility, with prices for aluminum scrap and secondary ingots surging to multi-year highs. This "supply-side squeeze" is being driven by a perfect storm of factors: a structural shortage of domestic scrap generation, an industrial downturn

Via MarketMinute · January 27, 2026

The global copper market has entered a transformative era, driven by a "perfect storm" of surging demand from artificial intelligence (AI) data centers and a series of catastrophic supply shocks at major traditional mines. As of late January 2026, copper prices have stabilized near a historic $5.91 per pound,

Via MarketMinute · January 27, 2026

The global financial landscape has been sent into a tailspin following a series of high-stakes diplomatic confrontations at the World Economic Forum in Davos, Switzerland. As of today, January 26, 2026, investors are grappling with the potential for a total economic decoupling between the United States and its northern neighbor

Via MarketMinute · January 26, 2026

January 26, 2026 — What once seemed like a fringe diplomatic curiosity or a social media provocation has transformed into a high-stakes geopolitical reality. Prediction markets are currently pricing in a significant probability that the United States will secure a formal stake in Greenland before the end of the decade. On Polymarket, a leading decentralized [...]

Via PredictStreet · January 26, 2026

As the first month of 2026 unfolds, a dramatic shift in market leadership is reshaping investor portfolios. For years, the dominant narrative was the unstoppable ascent of mega-cap technology, but by January 23, 2026, that story has encountered a significant rewrite. Investors are aggressively rotating out of high-flying AI and

Via MarketMinute · January 23, 2026

On January 22, 2026, Freeport-McMoRan (NYSE: FCX) reported fourth-quarter 2025 financial results that topped Wall Street estimates on both the top and bottom lines. Despite delivering a significant earnings beat fueled by record-high metal prices, shares of the Phoenix-based mining giant tumbled in early trading, eventually closing down nearly 2%

Via MarketMinute · January 22, 2026

The global economic landscape is entering a period of significant deflationary pressure for raw materials. According to the latest Commodity Markets Outlook from the World Bank, aggregate commodity prices are projected to decline by 7% in 2026. This downward trend, marking the fourth consecutive year of cooling prices, is expected

Via MarketMinute · January 22, 2026

DAVOS, Switzerland — In a move that has sent shockwaves of relief through global financial markets, President Donald Trump used his keynote address at the World Economic Forum in Davos on January 21, 2026, to announce a "framework deal" for the strategic integration of Greenland into a joint U.S.-NATO

Via MarketMinute · January 22, 2026

Date: January 22, 2026 Introduction As the world’s appetite for electricity reaches a fever pitch, one company stands at the epicenter of the global energy transition: Freeport-McMoRan (NYSE: FCX). On this day, January 22, 2026, the Phoenix-based mining giant finds itself in a paradoxical position. While copper prices have shattered historical records—trading above $6.00 per [...]

Via Finterra · January 22, 2026

Cosmic rays from supernovas will help secure the supply of crucial minerals.

Via The Motley Fool · January 22, 2026

Unusually heavy trading in this global iron ore and nickel producer spotlights shifting sentiment in miners, today, Jan. 21, 2026.

Via The Motley Fool · January 21, 2026

Rio Tinto (NYSE: RIO) sees increase in iron ore production and shipments, as well as strong performance in copper and lithium operations.

Via Benzinga · January 21, 2026

The global commodities market has entered 2026 with a startling reversal of fortune for the materials powering the green revolution. After nearly three years of price stagnation and oversupply, battery metals have come roaring back, with Cobalt prices surging by 120% and Lithium recovering 58% from their cyclical lows. This

Via MarketMinute · January 20, 2026

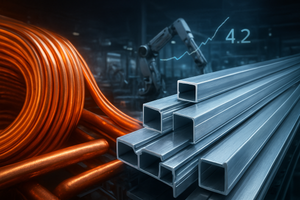

The global commodities market has reached a historic inflection point as of January 2026, with industrial manufacturers aggressively pivoting from copper to aluminum. This shift is no longer a matter of marginal cost-saving; it has become a structural necessity as the copper-to-aluminum price ratio has surged past 4.2, a

Via MarketMinute · January 20, 2026

As of mid-January 2026, the global aluminum market is witnessing a profound transformation in South America, driven by the near-total operational collapse of Venezuela’s state-owned smelting sector. Following the dramatic geopolitical shift on January 3, 2026, which saw the capture of Nicolás Maduro by U.S. forces, the Venezuelan

Via MarketMinute · January 16, 2026

As of mid-January 2026, the global commodities market is witnessing a seismic shift as the Middle East transitions from a fossil-fuel giant to a critical minerals powerhouse. Recent data released at the 2026 Future Minerals Forum in Riyadh indicates that copper demand across the region is projected to surge by

Via MarketMinute · January 16, 2026

The global push for electrification and the surging energy demands of artificial intelligence have placed copper at the center of the modern industrial map. Standing at the forefront of this movement is Freeport-McMoRan (NYSE: FCX), the world’s largest publicly traded copper miner. As of January 16, 2026, the company finds itself navigating a "copper crunch" [...]

Via Finterra · January 16, 2026

ANN ARBOR, MI — On January 15, 2026, the global automotive industry finds itself at a crossroads that many experts warn is paved with a metal the world simply does not have. As copper prices hover near record highs of $13,000 per metric ton following a volatile 2025 "super-squeeze," a

Via MarketMinute · January 15, 2026

As of mid-January 2026, the global commodities market is grappling with a stark reality that researchers warned of years ago: the world is running out of the "red metal" just as it needs it most. Copper prices, which famously breached the $11,000 per tonne mark in a chaotic 2024

Via MarketMinute · January 15, 2026

The "lithium winter" that chilled the clean energy sector for nearly two years has officially thawed. As of mid-January 2026, the lithium market is signaling a decisive V-shaped recovery, marked by a dramatic rebound in prices and a shift from a global surplus to a looming structural deficit. The catalyst

Via MarketMinute · January 14, 2026