Trilogy Metals Inc. Common Stock (TMQ)

3.6900

+0.00 (0.00%)

NYSE · Last Trade: Feb 18th, 8:12 AM EST

Detailed Quote

| Previous Close | 3.690 |

|---|---|

| Open | - |

| Bid | 3.730 |

| Ask | 3.750 |

| Day's Range | N/A - N/A |

| 52 Week Range | 1.125 - 11.29 |

| Volume | 2,952 |

| Market Cap | 592.44M |

| PE Ratio (TTM) | -73.80 |

| EPS (TTM) | -0.1 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 6,706,404 |

Chart

About Trilogy Metals Inc. Common Stock (TMQ)

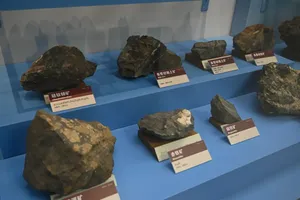

Trilogy Metals Inc. is a mineral exploration and development company focused on advancing projects in the prolific mining district of Alaska, specifically targeting high-grade copper, zinc, gold, and silver deposits. The company undertakes comprehensive exploration activities to assess the resource potential of its properties, notably the Upper Kobuk Mineral Projects, which include the Arctic and Bornite deposits. With a commitment to environmentally responsible practices, Trilogy Metals aims to deliver sustainable mineral resources while engaging with local communities and stakeholders throughout the development process. Read More

News & Press Releases

The Canada-based company saw significant erosion in key fundamentals last year.

Via The Motley Fool · February 17, 2026

BillionDollarBreaks – Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Reports Fiscal 2025 Results and Advances Upper Kobuk Projects

This article has been disseminated on behalf of Trilogy Metals Inc. and may include paid advertising.

Via Investor Brand Network · February 17, 2026

RockBreaks – Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Positioned to Unlock Alaska’s Mineral Resources

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · February 13, 2026

InvestorNewsBreaks – Trilogy Metals Inc.’s (NYSE American: TMQ) (TSX: TMQ) Key Role in Emerging Critical Minerals Hub

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · February 6, 2026

Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Strengthens Position amid US Push to Secure Domestic Critical Mineral Supply

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · February 6, 2026

Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Expands Advisory and Leadership Teams, and Releases Corporate Budget for 2026

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · February 4, 2026

A key part of the USA Rare Earth buy-thesis just blew up.

Via The Motley Fool · January 29, 2026

Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Expands Advisory and Leadership Teams, and Releases Corporate Budget for 2026

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · January 29, 2026

As the Genesis Mission accelerates, robotics is emerging as the keystone industry in America's next moonshot.

Via InvestorPlace · January 28, 2026

InvestorNewsBreaks – Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Expands Advisory and Leadership Teams Following US Investment Support

Disseminated on behalf of Trilogy Metals Inc. and may include paid advertising.

Via Investor Brand Network · January 20, 2026

Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Advances Critical Mineral Development in Alaska, Positioned for a Strong 2026

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · January 15, 2026

MissionIRNewsBreaks – Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Advancing Arctic and Bornite Projects

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · January 13, 2026

Permitting Advances at Trilogy Metals Inc.’s (NYSE American: TMQ) (TSX: TMQ) Arctic Project in Alaska’s Ambler Mining District as 2026 Budget Targets Critical Milestone Year

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · January 9, 2026

Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Positioned to Benefit from Updated Critical Minerals List with Progress on Ambler Road in Alaska

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · January 8, 2026

RockBreaks – Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Leveraging District-Scale Upside in Alaska’s Ambler Mining District

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · January 2, 2026

Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Committed to Responsible Development as Momentum Builds in the Ambler Mining District

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · December 31, 2025

Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Preps High-Grade Alaskan Projects for Rising Mineral Demand

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · December 30, 2025

RockBreaks – Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Advances Path to Unlock Alaska’s Copper and Critical Minerals Potential

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · December 24, 2025

2025 Metals Rally Highlights Structural Demand Drivers For MiningNewsWire Clients

According to a recent Yahoo Finance report by breaking business news reporter Jake Conley, gold and silver reached record highs in 2025, capping one of their strongest years on record, while industrial metals such as copper, aluminum, steel and lithium also posted substantial gains. The article highlights that, unlike precious metals benefiting primarily from safe-haven demand, much of the strength in industrial and battery metals is being driven by the global AI build-out and the accelerating energy transition.

Via Investor Brand Network · December 23, 2025

Geopolitical tensions lifted critical metal stocks as U.S. reshoring efforts, government backing, and supply fears drove gains.

Via Stocktwits · December 19, 2025

RockBreaks – Surging Demand Propels Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) in America’s Last Frontier

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · December 15, 2025

The deal gives Critical Metals the long-term rights to 50% of all Tanbreez rare earth concentrate.

Via Stocktwits · December 9, 2025

InvestorNewsBreaks – Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) CEO Shines Spotlight on Ambler Road

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · December 4, 2025

NetworkNewsBreaks – Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Accelerates Upper Kobuk Exploration with Federal Capital Injection

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · November 28, 2025

Building the Future of U.S. Mineral Independence: Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) Highlights Vast Resource Potential at Alaska’s Ambler Mining District

Disseminated on behalf of Trilogy Metals Inc. (NYSE American: TMQ) (TSX: TMQ) and may include paid advertising.

Via Investor Brand Network · November 26, 2025