Salesforce (CRM)

228.53

-0.87 (-0.38%)

NYSE · Last Trade: Jan 27th, 6:51 PM EST

Detailed Quote

| Previous Close | 229.40 |

|---|---|

| Open | 231.94 |

| Bid | 228.00 |

| Ask | 228.47 |

| Day's Range | 226.27 - 235.74 |

| 52 Week Range | 218.96 - 367.09 |

| Volume | 9,833,815 |

| Market Cap | 214.13B |

| PE Ratio (TTM) | 30.47 |

| EPS (TTM) | 7.5 |

| Dividend & Yield | 1.664 (0.73%) |

| 1 Month Average Volume | 8,294,700 |

Chart

About Salesforce (CRM)

Salesforce is a leading cloud-based software company that specializes in customer relationship management (CRM) solutions. It provides a comprehensive suite of applications designed to help businesses manage their sales, marketing, customer service, and analytics more effectively. By leveraging innovative technologies such as artificial intelligence and automation, Salesforce enables organizations to streamline their processes, enhance customer engagement, and drive growth. The company is committed to delivering a robust platform that allows businesses of all sizes to connect with their customers and gain valuable insights from data, ultimately fostering lasting relationships and improving overall business performance. Read More

News & Press Releases

Salesforce (NYSE: CRM), the #1 AI CRM, today announced it has granted equity awards under its 2014 Inducement Equity Incentive Plan (the "Plan") to new employees who joined Salesforce in connection with the acquisitions of Apromore, Spindle AI, and Informatica. The Plan was adopted by the Salesforce Board of Directors in July 2014, in accordance with New York Stock Exchange Rule 303A.08.

By Salesforce · Via Business Wire · January 27, 2026

In a move that signals a tectonic shift in the enterprise software landscape, ServiceNow (NYSE: NOW) has announced its definitive agreement to acquire Armis, a leader in cyber exposure management, for approximately $7.75 billion in an all-cash transaction. This acquisition, the largest in ServiceNow's history, marks a bold departure

Via MarketMinute · January 27, 2026

As the world grapples with a lengthening and more intense wildfire season, a transformative technological leap has reached orbit. FireSat, the ambitious satellite constellation powered by advanced artificial intelligence and specialized infrared sensors, has officially transitioned from a promising prototype to a critical pillar of global disaster management. Following the successful deployment of its first [...]

Via TokenRing AI · January 27, 2026

Why Did CRM Stock Rise Over 1% After Hours?stocktwits.com

Via Stocktwits · January 26, 2026

As of January 2026, the artificial intelligence landscape has undergone a seismic shift from passive assistants to proactive, autonomous "execution engines." This transition is best exemplified by the intensifying competition between Manus AI, the breakout independent success recently integrated into the Meta Platforms (NASDAQ: META) ecosystem, and Microsoft’s (NASDAQ: MSFT) massively expanded Copilot agent platform. [...]

Via TokenRing AI · January 27, 2026

In a landmark report released today, January 27, 2026, data and AI powerhouse Databricks has detailed a tectonic shift in the enterprise landscape: the rapid transition from simple generative chatbots to fully autonomous "agentic" systems. The company’s "2026 State of AI Agents" report highlights a staggering 327% increase in multi-agent workflow adoption over the latter [...]

Via TokenRing AI · January 27, 2026

Salesforce Inc shares have slipped into the red after giving up earlier gains. The company had announced a major government contract win.

Via Benzinga · January 27, 2026

Salesforce (NYSE: CRM) has officially ushered in a new era for enterprise finance and sales operations with the launch of its "Agentforce Revenue Management" suite. Moving beyond traditional, rule-based automation, the company has integrated its autonomous AI agent framework, Agentforce, directly into the heart of its Revenue Cloud. This development signals a fundamental shift in [...]

Via TokenRing AI · January 27, 2026

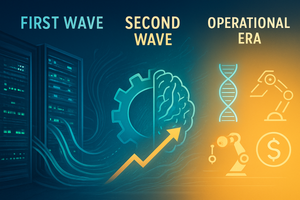

As of January 27, 2026, the global financial markets are witnessing a profound transformation in the artificial intelligence narrative. While 2023 and 2024 were defined by a "land grab" for semiconductor chips and massive data center construction, the narrative in early 2026 has shifted toward the "Second Wave": a period

Via MarketMinute · January 27, 2026

As the tech world braces for Microsoft’s (NASDAQ: MSFT) Q2 fiscal year 2026 earnings report scheduled for tomorrow, January 28, the company finds itself at a pivotal crossroads. Once the undisputed darling of the artificial intelligence (AI) gold rush, the Redmond giant is now entering a "valuation reset" phase

Via MarketMinute · January 27, 2026

As of January 27, 2026, Salesforce (NYSE: CRM) finds itself at a pivotal crossroads. Once the disruptor that pioneered the Software-as-a-Service (SaaS) movement at the turn of the millennium, the company is now navigating the most significant shift in its history: the transition from assistive artificial intelligence to autonomous agentic systems. Under the unwavering, if [...]

Via Finterra · January 27, 2026

As of January 27, 2026, Microsoft Corporation (NASDAQ: MSFT) stands not merely as a software giant, but as the foundational utility for the burgeoning intelligence economy. On the eve of its fiscal second-quarter 2026 earnings report, the company finds itself at a pivotal juncture. Having successfully transitioned from the "Cloud First" era of the 2010s [...]

Via Finterra · January 27, 2026

As of January 27, 2026, Zoom Video Communications (NASDAQ:ZM) has defyed the "post-pandemic slump" narrative that once haunted its stock. Once dismissed as a temporary beneficiary of the 2020 lockdowns, Zoom has successfully reinvented itself into an AI-first "Work Platform" that competes head-to-head with legacy tech giants. The company is currently in focus following a [...]

Via Finterra · January 27, 2026

Salesforce (NYSE: CRM) secures $5.6B contract from U.S. Army to modernize systems and improve efficiency. Stock gains premarket.

Via Benzinga · January 27, 2026

Salesforce (NYSE: CRM), the world’s #1 AI CRM, today announced that the U.S. Army has awarded the company a $5.6 billion, 10-year* Indefinite Delivery Indefinite Quantity (IDIQ) contract. The landmark agreement is executed through Computable Insights LLC.**, a wholly owned subsidiary dedicated to Salesforce’s national security operations. Through Missionforce National Security, Salesforce will bring the best of private sector innovation to support the Department of War (DOW), enabling a more efficient and effective force.

By Salesforce · Via Business Wire · January 26, 2026

MercadoLibre operates a leading e-commerce and fintech platform serving merchants and consumers across Latin America.

Via The Motley Fool · January 26, 2026

The era of "prompt-and-wait" is over. As of January 2026, the artificial intelligence landscape has undergone its most profound transformation since the release of ChatGPT, moving away from reactive chatbots toward "Agentic AI"—autonomous digital entities capable of independent reasoning, multi-step planning, and direct interaction with software ecosystems. While 2023 and 2024 were defined by Large [...]

Via TokenRing AI · January 26, 2026

AI has weighed on this sector, but it could be a major growth catalyst.

Via The Motley Fool · January 24, 2026

SoundHound and Salesforce are betting big on agentic AI.

Via The Motley Fool · January 24, 2026

In May 2024, the financial world witnessed a historic realignment of market expectations as the Dow Jones Industrial Average (DJI) breached the 40,000-point threshold for the first time in its 128-year history. This milestone, achieved during the third week of May, was far more than a numerical curiosity; it

Via MarketMinute · January 23, 2026

Date: January 23, 2026 Introduction As the global economy navigates the "Era of Agents," few companies have positioned themselves as centrally as ServiceNow (NYSE: NOW). Once viewed primarily as a tool for IT ticketing, ServiceNow has evolved into what CEO Bill McDermott describes as the "AI platform for business transformation." Following its most recent subscription [...]

Via Finterra · January 23, 2026

As the first month of 2026 draws to a close, the narrative that dominated Wall Street for the better part of three years—the undisputed reign of mega-cap technology—is rapidly fracturing. In its place, a massive "sector rotation" is taking hold, fundamentally altering the landscape for institutional and retail

Via MarketMinute · January 22, 2026

There are still solid bargains to be found in the tech sector.

Via The Motley Fool · January 22, 2026

Salesforce Inc (NYSE:CRM) shares are trading higher on Thursday, lifted by a broad market rally.

Via Benzinga · January 22, 2026

The world's largest Bitcoin hoarder could have a bright future.

Via The Motley Fool · January 22, 2026