Latest News

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

SOUTHWEST AIRLINES CO (NYSE:LUV) Shows Strong Technical Setup for Potential Breakoutchartmill.com

Via Chartmill · January 22, 2026

ONESPAN INC (NASDAQ:OSPN): A Peter Lynch GARP Investment Case Studychartmill.com

Via Chartmill · January 22, 2026

Arista Networks Inc. (NYSE:ANET) Presents a Compelling Mix of Strong Fundamentals and Technical Breakout Potentialchartmill.com

Via Chartmill · January 22, 2026

Selling cash secured puts on stocks an investor is happy to take ownership of is a great way to generate some extra income.

Via Barchart.com · January 22, 2026

DAX rebounds as Trump backs down over Greenland & tariffs. USD/JPY rebounds as the

Via Talk Markets · January 22, 2026

UnitedHealth CEO tells Congress that hospital prices, drug costs, and consolidation—not insurers—are driving U.S. health care spending higher.

Via Benzinga · January 22, 2026

Berkshire Hathaway will release its fourth-quarter earnings soon, and analysts anticipate a double-digit profit dip.

Via Barchart.com · January 22, 2026

ServiceNow Inc (NYSE:NOW) Embodies Quality Investing Principles in Caviar Cruise Screenchartmill.com

Via Chartmill · January 22, 2026

Rollins Inc. (NYSE:ROL) Embodies Quality Investing Principleschartmill.com

Via Chartmill · January 22, 2026

Nvidia is now outspending Apple at TSMC. Intel may benefit the most from the shift.

Via The Motley Fool · January 22, 2026

Industrial conglomerate GE Aerospace (NYSE:GE) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 17.6% year on year to $12.72 billion. Its non-GAAP profit of $1.57 per share was 9.5% above analysts’ consensus estimates.

Via StockStory · January 22, 2026

AES Corporation will release its fourth-quarter earnings soon, and analysts anticipate a double-digit bottom-line growth.

Via Barchart.com · January 22, 2026

Via Benzinga · January 22, 2026

The healthcare giant has had trouble winning over investors in the past year despite an incredibly low valuation.

Via The Motley Fool · January 22, 2026

HP Inc. will release its first-quarter earnings soon, and analysts anticipate a single-digit bottom-line growth.

Via Barchart.com · January 22, 2026

Food flavoring company McCormick (NYSE:MKC) announced better-than-expected revenue in Q4 CY2025, with sales up 2.9% year on year to $1.85 billion. Its non-GAAP profit of $0.86 per share was 1.8% below analysts’ consensus estimates.

Via StockStory · January 22, 2026

Via Benzinga · January 22, 2026

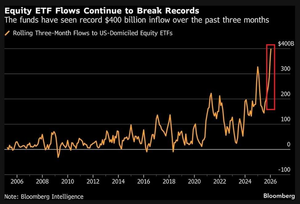

Western investors are not rushing to buy gold, but are mainly focusing on passive investments.

Via Talk Markets · January 22, 2026

The company disclosed that the Food and Drug Administration (FDA) has reviewed and authorized the use of its first commercially produced batch of the GP2 drug product in the ongoing FLAMINGO-01 trial.

Via Stocktwits · January 22, 2026

DoorDash partners with Hibbett to offer footwear, apparel, and accessories from brands like Nike and Adidas across ~1,000 stores.

Via Benzinga · January 22, 2026

The largest cruise line is hot again, and 2026 could be even hotter.

Via The Motley Fool · January 22, 2026

J. M. Smucker will release its third-quarter earnings soon, and analysts anticipate a double-digit profit dip.

Via Barchart.com · January 22, 2026

Socially responsible bank Amalgamated Financial (NASDAQ:AMAL) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.2% year on year to $85.2 million. Its non-GAAP profit of $0.99 per share was 9.4% above analysts’ consensus estimates.

Via StockStory · January 22, 2026

Via Benzinga · January 22, 2026

Alphabet's stock crushed the market in 2026.

Via The Motley Fool · January 22, 2026

Last week, during its Investor Day, Ondas raised its 2026 revenue outlook to a range of $170 million to $180 million, 25% above its previous $140 million target.

Via Stocktwits · January 22, 2026

Viatris is set to report its fourth-quarter earnings soon, with analysts forecasting a slight decline in profits.

Via Barchart.com · January 22, 2026

Corvus increased its public stock offering to $175 million from $150 million, making 7.9 million shares of its common stock available for purchase at Wednesday’s closing price of $22.15.

Via Stocktwits · January 22, 2026

Vistra is preparing to unveil its fourth-quarter earnings in the near term, and analysts are projecting a triple-digit jump in the company’s bottom-line results.

Via Barchart.com · January 22, 2026

Alibaba and Chinese tech giants are pushing for IPOs for their chip businesses amid global supply restrictions.

Via Benzinga · January 22, 2026

Global stock markets appeared poised to extend their recent rally after President Donald Trump softened his stance on imposing tariffs on Europe.

Via Talk Markets · January 22, 2026

Apple stated that being forced to comply with the Competition Commission of India’s demands for its financial records would defeat the company’s primary challenge against the penalty rules.

Via Stocktwits · January 22, 2026

Autodesk will release its fourth-quarter earnings soon, and analysts anticipate a double-digit bottom-line growth.

Via Barchart.com · January 22, 2026

Via Benzinga · January 22, 2026

NetApp is preparing to release its fiscal third-quarter earnings shortly, and analysts are forecasting low single-digit growth in profits.

Via Barchart.com · January 22, 2026

Bitcoin failed to reclaim the $90,000 level even after President Trump paused proposed tariffs as heavy institutional outflows continued to weigh on the market. Bitcoin ETFs saw $708.7 million in net outflows on Thursday, while Ethereum ETFs reported $287 million in net outflows. Trader Commentary

Via Benzinga · January 22, 2026

Goldman Sachs raises end-2026 gold price forecast to $5,400/oz from $4,900, citing strong structural demand.

Via Benzinga · January 22, 2026

Hormel Foods is expected to report its first-quarter results soon, and analysts are projecting a single-digit year-over-year drop in earnings.

Via Barchart.com · January 22, 2026

You won't have to wait too much longer.

Via The Motley Fool · January 22, 2026

March S&P 500 E-Mini futures (ESH26) are up +0.66%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.89% this morning, pointing to further gains on Wall Street after U.S. President Donald Trump walked back his threats to impose tariffs on a grou...

Via Barchart.com · January 22, 2026

Regional banking company Commerce Bancshares (NASDAQ:CBSH) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 5.9% year on year to $449.4 million. Its GAAP profit of $1.01 per share was 1.9% above analysts’ consensus estimates.

Via StockStory · January 22, 2026

Strategic decisions require human judgment on capital-labor tradeoffs, future flexibility, and safety standards—areas where AI provides data but humans drive choices.

Via Talk Markets · January 22, 2026

Regional banking firm Texas Capital Bancshares (NASDAQ:TCBI) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 15.4% year on year to $327.5 million. Its non-GAAP profit of $2.08 per share was 17.8% above analysts’ consensus estimates.

Via StockStory · January 22, 2026