Latest News

The dividend yield now stands at 7.3%, and we expect it to be the primary driver of BTB’s total return prospects in the coming years.

Via Talk Markets · January 22, 2026

Coller Capital will become part of private equity firm EQT's global platform, offering its secondaries platform to clients.

Via Benzinga · January 22, 2026

This under-the-radar artificial intelligence stock might be poised for a recovery in 2026.

Via The Motley Fool · January 22, 2026

Ripple CEO Brad Garlinghouse on Thursday commented on the CLARITY Act, saying ” “we’re so close we can’t give up now” with regards to delayed crypto bill after Coinbase Global Inc.

Via Benzinga · January 22, 2026

Heritage Financial HFWA Earnings Call Transcript

Via The Motley Fool · January 22, 2026

BlackRock Exec Rieder’s Odds To Become Next Fed Chair Jumps After Trump’s Latest Praisestocktwits.com

Via Stocktwits · January 22, 2026

Which S&P500 stocks have an unusual volume on Thursday?chartmill.com

Via Chartmill · January 22, 2026

Earlier this month, Altimmune said the U.S. Food and Drug Administration (FDA) has granted Breakthrough Therapy Designation (BTD) for pemvidutide for the treatment of patients with metabolic dysfunction-associated steatohepatitis.

Via Stocktwits · January 22, 2026

Heritage Financial (HFWA) Earnings Transcript

Via The Motley Fool · January 22, 2026

There were 1,425 unusually active options on Wednesday, a day that included several ups and downs resulting from Davos. Ultimately, the S&P 500 closed up over 1%. Three stocks and their options stood out. Here’s why.

Via Barchart.com · January 22, 2026

Arm bounced back after a long sell-off late last year.

Via The Motley Fool · January 22, 2026

Don't wait too long to press the buy button on these comeback stories.

Via The Motley Fool · January 22, 2026

Lean hog futures are up 20 to 70 cents across the front months on Thursday, with some contracts heading to contract highs. USDA’s national base hog price was not reported on Thursday morning due to light volume. The CME Lean Hog Index was up another...

Via Barchart.com · January 22, 2026

Cotton futures are trading with 35 to 40 point losses at midday. Crude oil futures are down $1.43 per barrel at $60.67. The US dollar index is down $0.418 to $98.145. The Tuesday online auction from The Seam showed sales of 59.15 cents/lb on 17,692...

Via Barchart.com · January 22, 2026

The wheat complex are trading with gains across the three exchanges on Thursday. Chicago SRW futures are 7 to 8 cents in the green at midday. KC HRW futures are 4 to 5 cents higher on Thursday. MPLS spring wheat is showing 6 to 7 cent higher trade at...

Via Barchart.com · January 22, 2026

Via Benzinga · January 22, 2026

Corn futures are up 1 to 2 cents across most contracts on Thursday. The CmdtyView national average Cash Corn price is up 1 1/2 cents at $3.86. Weekly EIA data showed a total of 1.119 million barrels per day of ethanol production in the week ending o...

Via Barchart.com · January 22, 2026

Live cattle futures are mixed, with contracts down 65 cents to 25 cents higher. Cash trade saw a few cattle exchange hands at $232 so far this week on thin volume. The Wednesday Fed Cattle Exchange online auction showed no sales on the 1,228 head, wi...

Via Barchart.com · January 22, 2026

Shares of Rigetti Computing, Inc. (NASDAQ: RGTI) are rising Thursday after B. Riley Securities upgraded the stock from a neutral to a buy.

Via Benzinga · January 22, 2026

The world's largest Bitcoin hoarder could have a bright future.

Via The Motley Fool · January 22, 2026

Via Benzinga · January 22, 2026

Via MarketBeat · January 22, 2026

The analyst has a ‘Buy’ rating on the company with a target price of $910, representing an upside of over 40% from current levels.

Via Stocktwits · January 22, 2026

It's important to know what to do with the money you've saved.

Via The Motley Fool · January 22, 2026

The nation’s largest realtor group reported a massive 9.3% drop in pending home sales for December, biggest monthly decline since 2020.

Via Talk Markets · January 22, 2026

Dogecoin (CRYPTO: DOGE) has taken another step into the financial mainstream with the launch of a spot ETF backed by the

Via Benzinga · January 22, 2026

Plug Power Inc (NASDAQ: PLUG) stock is trading higher Thursday afternoon as investors position ahead of a Q&A with longtime CEO Andy Marsh.

Via Benzinga · January 22, 2026

Pony AI Inc. (NASDAQ: PONY) stock is rising due to strong market trend. It is also included in ARK Invest's Big Ideas 2026 report.

Via Benzinga · January 22, 2026

Gradient Investments launches its private wealth series, a new suite of actively managed private market portfolios.

Via Benzinga · January 22, 2026

Tradr launches four inverse ETFs tied to Lucid, Iren, Nebius and Applied Digital, as Trump tariff talks fuel volatility in the EV and AI stocks.

Via Benzinga · January 22, 2026

Target Corp. appointed former Nike and HanesBrands executives to its board in line with its strategy for innovation and value creation.

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Via Benzinga · January 22, 2026

Shares of cloud monitoring platform Datadog (NASDAQ:DDOG) jumped 7.3% in the afternoon session after Stifel upgraded the stock from a "Hold" to a "Buy," citing expectations for a strong fourth-quarter performance.

Via StockStory · January 22, 2026

Shares of social network operator Meta Platforms (NASDAQ:META)

jumped 4.7% in the afternoon session after investor optimism grew following positive analyst commentary and the company's announcement that it would begin showing ads on its Threads platform.

Via StockStory · January 22, 2026

GE (GE) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 22, 2026

Via Benzinga · January 22, 2026

The trading volume of these stocks is deviating from the norm in today's session.chartmill.com

Via Chartmill · January 22, 2026

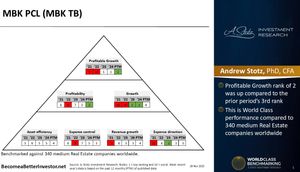

MBK Public Company Limited engages in diverse businesses related to tourism, including the well-known Bangkok shopping mall with the same name, hotels, golf tours, real estate, and food solution business.

Via Talk Markets · January 22, 2026

BofA keeps Buy rating on GE Aerospace after Q4 results top consensus estimates, fueled by higher margins and strong 2026 outlook.

Via Benzinga · January 22, 2026

Shares of enterprise technology company Hewlett Packard Enterprise (NYSE:HPE) jumped 4.1% in the afternoon session after DB Life Insurance selected the company to build a scalable, sovereign AI foundation for future innovation.

Via StockStory · January 22, 2026

Shares of puerto Rican financial services company OFG Bancorp (NYSE:OFG) fell 8.9% in the afternoon session after the company reported mixed fourth-quarter 2025 results, where a beat on earnings per share was overshadowed by misses on key profitability and efficiency metrics.

Via StockStory · January 22, 2026

Shares of satellite communications provider jumped 6% in the afternoon session after the company announced successful on-air testing of its new direct-to-device (D2D) satellite service, a key milestone as it prepared for a commercial launch in 2026.

Via StockStory · January 22, 2026