Latest News

The relationship between the Federal Reserve and the U.S. bond market has reached a state of "stabilized weakness" as of January 22, 2026. Despite the Federal Open Market Committee (FOMC) delivering three consecutive quarter-point interest rate cuts in the final months of 2025, the benchmark 10-year Treasury yield remains

Via MarketMinute · January 22, 2026

The Charles Schwab Corporation (NYSE:SCHW) reported its fourth-quarter and full-year 2025 earnings on January 21, 2026, revealing a complex portrait of the modern retail investor. While the brokerage giant achieved a staggering record of $11.90 trillion in total client assets, the market's response was notably muted. The core

Via MarketMinute · January 22, 2026

PLUG Shares Soar Over 10% Ahead Of CEO’s Reddit AMA On Upcoming Share Count Votestocktwits.com

Via Stocktwits · January 22, 2026

In a move that signals a profound shift in the global semiconductor hierarchy, Alibaba Group Holding Limited (NYSE: BABA) has reportedly initiated plans to list its specialized chipmaking subsidiary, T-Head (also known as Pingtouge). As of January 22, 2026, the tech giant is moving to restructure the unit into a

Via MarketMinute · January 22, 2026

This warehouse club retailer hasn't split its stock since 2000, and its shares were recently priced at $960 apiece.

Via The Motley Fool · January 22, 2026

In a move that has sent tremors through both Silicon Valley and Wall Street, OpenAI is reportedly in the final stages of a historic funding round that could value the artificial intelligence pioneer at a staggering $830 billion. Led by CEO Sam Altman, the fundraising effort aims to secure between

Via MarketMinute · January 22, 2026

Nvidia partner Vertiv flirted with a buy point in Thursday's stock market with substantial earnings growth expected.

Via Investor's Business Daily · January 22, 2026

TMC wants to mine the Pacific Ocean for metals. NOAA may let them do it.

Via The Motley Fool · January 22, 2026

Via MarketBeat · January 22, 2026

Horizon Bancorp (HBNC) Q3 2025 Earnings Transcript

Via The Motley Fool · January 22, 2026

Horizon Bancorp HBNC Earnings Call Transcript

Via The Motley Fool · January 22, 2026

The global elite gathered for the World Economic Forum in Davos, Switzerland, with a singular realization: the era of the "AI buildout" has moved from a speculative software trend to the largest physical infrastructure project in human history. Nvidia Corp. (NASDAQ: NVDA) CEO Jensen Huang, speaking on January 21, 2026,

Via MarketMinute · January 22, 2026

As the morning bell rang on Wall Street this Thursday, January 22, 2026, the Department of Labor released a set of figures that have sent economists back to their spreadsheets. Initial jobless claims for the week ending January 17 rose slightly to 200,000, up from a revised 199,000

Via MarketMinute · January 22, 2026

Horizon Bancorp (HBNC) Q4 2024 Earnings Transcript

Via The Motley Fool · January 22, 2026

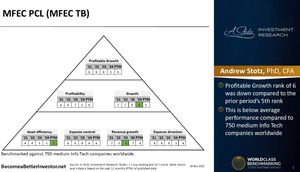

MFEC Public Company Limited is a leading Thai technology and digital transformation company offering IT consulting and system integration.

Via Talk Markets · January 22, 2026

Horizon Bancorp (HBNC) Q3 2024 Earnings Transcript

Via The Motley Fool · January 22, 2026

NEW YORK — As the sun rose over Wall Street on January 22, 2026, investors were greeted by one of the most anticipated and unusual economic reports in recent memory. The Bureau of Economic Analysis (BEA) released a combined Personal Consumption Expenditures (PCE) report covering both October and November 2025—a

Via MarketMinute · January 22, 2026

WASHINGTON, D.C. — The United States economy continues to defy gravity, showcasing a resilience that has caught both domestic and international observers by surprise. On Thursday, January 22, 2026, the Bureau of Economic Analysis (BEA) released its final estimate for the third-quarter 2025 Gross Domestic Product (GDP), revealing an annualized

Via MarketMinute · January 22, 2026

This stock presents tons of opportunities with lower risk.

Via The Motley Fool · January 22, 2026

In a move that signals a seismic shift in the American regional banking landscape, Fifth Third Bancorp (Nasdaq: FITB) has announced it is in the final stages of closing its acquisition of Comerica Inc. (NYSE: CMA). The $10.9 billion all-stock transaction, which received its final regulatory blessings just last

Via MarketMinute · January 22, 2026

NEW BRUNSWICK, N.J. – Johnson & Johnson (NYSE: JNJ) has signaled a definitive turning point in its corporate evolution, issuing a robust 2026 financial outlook that defies the gravity of the pharmaceutical industry’s most feared obstacle: the "patent cliff." Following a "catapult year" in 2025, the healthcare giant is projecting

Via MarketMinute · January 22, 2026

As of January 22, 2026, the global financial landscape is undergoing a fundamental transformation. What was once a niche corner of the internet for political junkies and hobbyist forecasters has evolved into a powerhouse of the modern economy. Prediction markets—increasingly rebranded by Wall Street as "event trading"—are no longer just a curiosity; they are becoming [...]

Via PredictStreet · January 22, 2026

The pillars of the global financial system trembled this week as the U.S. Supreme Court (SCOTUS) took up the case of Trump v. Cook, a high-stakes legal battle that could redefine the executive branch’s authority over the Federal Reserve. At the heart of the dispute is President Donald

Via MarketMinute · January 22, 2026

As the Federal Reserve prepares for its first policy meeting of 2026 on January 28, a quiet revolution is taking place on the trading floors of Manhattan and Chicago. While traditional bond traders scramble to interpret yield curve shifts, a growing cohort of institutional and retail investors is turning to Kalshi to buy direct protection [...]

Via PredictStreet · January 22, 2026

UK stocks enjoyed a broad-based initial upswing on Thursday as investor sentiment improved following U.S. President Donald Trump's decision to step back from tariff threats linked to Greenland.

Via Talk Markets · January 22, 2026

In the wake of the high-stakes 2024 election cycle, many analysts expected a "prediction market hangover"—a period of cooling interest and declining volumes as the political fever broke. Instead, as of January 22, 2026, the opposite has occurred. Prediction markets have evolved from election-centric novelties into high-velocity "truth engines" for every corner of culture and [...]

Via PredictStreet · January 22, 2026

As the financial world turns its gaze toward January 28, 2026, Microsoft Corp. (NASDAQ: MSFT) finds itself at a pivotal crossroads. After two years of aggressive capital investment in artificial intelligence, the software giant is set to report its second-quarter fiscal 2026 results. For shareholders, the upcoming earnings call is

Via MarketMinute · January 22, 2026

Netflix, Inc. (NASDAQ:NFLX) reported its fourth-quarter 2025 earnings on January 20, 2026, delivering a set of results that comfortably met Wall Street's headline expectations but failed to ignite investor enthusiasm. While the streaming giant continues to dominate the global landscape with a record subscriber count and surging advertising revenue,

Via MarketMinute · January 22, 2026

As of January 22, 2026, the landscape of American finance is undergoing its most radical transformation in decades, driven not by a new asset class, but by the systematic dismantling of the guardrails that once hemmed it in. The Commodity Futures Trading Commission (CFTC), once the primary antagonist of event-based wagering, has been effectively reshaped [...]

Via PredictStreet · January 22, 2026

As the calendar turned to January 2026, a familiar script in the financial markets began to flip. For much of the previous two years, the narrative was dominated by the relentless ascent of artificial intelligence and the "Magnificent Seven." However, the first three weeks of 2026 have signaled a profound

Via MarketMinute · January 22, 2026

Shares have lost more than a third of their value since hitting all-time highs in July.

Via The Motley Fool · January 22, 2026

Coinbase (COIN) continues its bearish trend, approaching a key earnings-gap support zone that may signal near-term stabilization.

Via Talk Markets · January 22, 2026

As we cross into 2026, the global information landscape has undergone a radical transformation. The era of relying solely on traditional polling—often criticized for its slow response times and methodological lag—is being eclipsed by the rise of prediction markets. Following their standout performance during the 2024 US Presidential Election, these platforms are no longer viewed [...]

Via PredictStreet · January 22, 2026

Freeport-McMoRan (FCX) Q4 2025 Earnings Transcript

Via The Motley Fool · January 22, 2026

When leading meetings, Fred Ramsdell set a ground rule: Anyone who pulled out their phone to glance at it must pay $10.

Via Investor's Business Daily · January 22, 2026

The equity markets have entered uncharted territory as of January 22, 2026, with the S&P 500 reaching a forward price-to-earnings (P/E) ratio of 22x. This valuation level, a rare air historically, places the broad market index in a position it has not occupied since the height of the

Via MarketMinute · January 22, 2026

Investors will gain much more insight into the healthcare company's direction on this date.

Via The Motley Fool · January 22, 2026

As the sun sets over Atlanta, Georgia, 25-year-old Logan Sudeith isn't heading home from an office. Instead, he is likely propped up against his headboard, surrounded by glowing monitors and discarded DoorDash containers, preparing for another marathon shift in the world of "Information Finance." Sudeith is a leading figure in a burgeoning class of professionals [...]

Via PredictStreet · January 22, 2026

Major U.S. equity markets surged on Wednesday after President Donald Trump announced a pivotal shift in his administration's Arctic strategy, backing away from a proposed "Greenland Tax" that had threatened to ignite a trade war with European allies. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite

Via MarketMinute · January 22, 2026

Sangetsu Corp has declared but not paid variable semi-annual dividends since December 2024. The declared, March 2026 SA dividend of $0.49 equates to a forward looking annual dividend amount of $1.02 for the coming year.

Via Talk Markets · January 22, 2026

The retail trading landscape has been fundamentally reshaped. As of January 22, 2026, Robinhood Markets (NASDAQ: HOOD) has officially transitioned from a stock-and-crypto powerhouse into the undisputed leader of the prediction market revolution. Following a record-breaking holiday season and a high-stakes NFL playoff run, the platform announced it has surpassed the staggering milestone of 11 [...]

Via PredictStreet · January 22, 2026

The American consumer has once again proven to be the engine of the domestic economy, as recently released data for November 2025 reveals a retail sector that is far more robust than analysts had initially feared. According to the delayed report from the U.S. Census Bureau, retail sales rose

Via MarketMinute · January 22, 2026

NEW YORK — Polymarket, the world’s largest decentralized prediction platform, has officially begun its long-awaited homecoming. After years of operating in a regulatory exile that forced it to block American IP addresses, the platform is now aggressively onboarding thousands of users from its domestic waitlist. This strategic pivot follows a landmark regulatory shift under the [...]

Via PredictStreet · January 22, 2026

The long-awaited release of the November Producer Price Index (PPI) has finally provided a clear, if delayed, signal that wholesale inflation is continuing its downward trajectory. In a report that market participants have been anticipating for weeks, the Bureau of Labor Statistics revealed that wholesale prices rose by just 0.

Via MarketMinute · January 22, 2026

In the ROSELLA trial, patients receiving relacorilant with nab-paclitaxel saw their risk of death drop by about 35% compared with those given the chemotherapy alone.

Via Stocktwits · January 22, 2026

As of January 22, 2026, the United States is witnessing a historic constitutional collision between federal financial oversight and century-old state police powers. At the center of this storm is KalshiEX LLC, the first federally regulated exchange for "event contracts," which is currently locked in a multi-front legal war with state gaming regulators in Nevada, [...]

Via PredictStreet · January 22, 2026

POET Technologies (POET) stock drops on announcement of $150 million registered direct offering, aimed at acquisitions and R&D.

Via Benzinga · January 22, 2026

In a historic week for commodities, gold and silver have surged to unprecedented record highs, cementing their status as the ultimate safe havens in an increasingly fractured global economy. As of today, January 22, 2026, gold is trading near a staggering $4,822.25 per ounce, while silver has captivated

Via MarketMinute · January 22, 2026

The mid-January earnings season of 2026 has delivered a striking paradox for the American financial sector. While the nation’s largest lenders largely cleared the high bar set by analysts, a wave of selling pressure wiped billions in market capitalization from the commercial banking giants. In a classic "sell the

Via MarketMinute · January 22, 2026

The early morning of January 3, 2026, will be remembered as one of the most significant geopolitical shifts of the decade. As U.S. Army Delta Force commandos descended upon the Fort Tiuna military complex in Caracas to capture Nicolás Maduro, a parallel drama was unfolding in the digital corridors of decentralized finance. While the world [...]

Via PredictStreet · January 22, 2026